Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

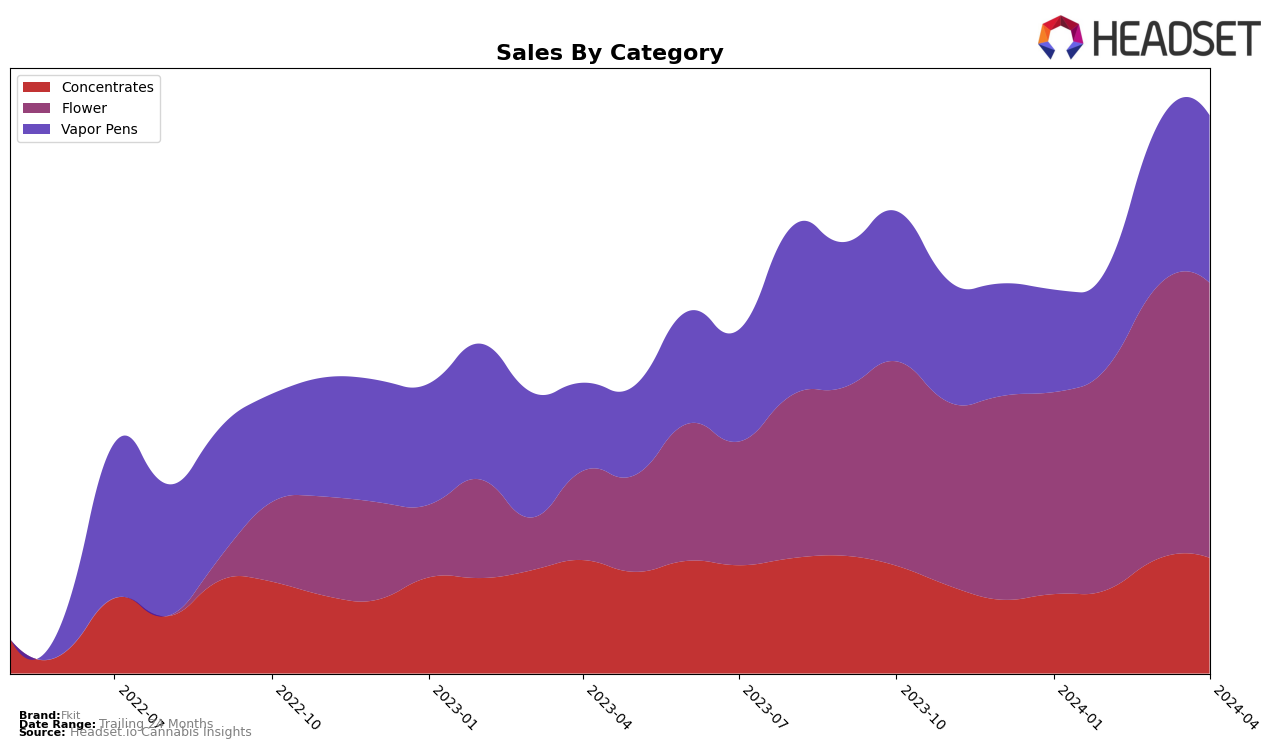

In Washington, the cannabis brand Fkit has shown a notable performance across several categories, with a consistent upward movement in rankings from January to April 2024. Particularly in the Concentrates category, Fkit climbed from a rank of 54 in January to 30 by April, indicating a significant increase in its market share and consumer preference within this category. This upward trajectory is mirrored in their sales figures, with an initial $38,286 in January, culminating to $55,840 by April. However, it's worth noting that despite improvements, Fkit did not break into the top 30 brands in the Flower and Vapor Pens categories until after January, suggesting room for growth and increased market penetration in these segments.

While Fkit's performance in the Concentrates category is commendable, their journey in the Flower and Vapor Pens categories tells a story of gradual but steady improvement. Starting at ranks well outside the top 30 in January 2024, Fkit managed to improve its standings to 75th and 62nd place by April in the Flower and Vapor Pens categories, respectively. This indicates a positive trend in consumer acceptance and brand recognition across different product lines. The sales data, particularly in the Flower category, which saw an increase from $97,547 in January to $132,866 in April, underscores the brand's growing footprint in Washington's cannabis market. However, the initial low rankings highlight the competitive nature of the market and suggest that Fkit may still be in the process of establishing a strong presence in these highly competitive categories.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Washington, Fkit has shown a notable upward trajectory in its market position, moving from a rank of 95th in January 2024 to 75th by April 2024. This improvement in rank is indicative of a positive sales trend, with Fkit experiencing a consistent increase in sales over the same period. Competing brands such as Seattle's Private Reserve and Trail Blazin Productions have seen fluctuations in their rankings and sales, with Seattle's Private Reserve experiencing a decline from 53rd to 81st and Trail Blazin Productions moving from 93rd to 82nd. Another notable competitor, Soulshine Cannabis, entered the rankings in March and improved to 74th by April, while Washington Bud Company maintained a more stable position, moving from 64th to 71st. Fkit's upward movement in both rank and sales suggests a growing consumer preference and market share within the competitive Washington state flower market, positioning it as a brand to watch in the coming months.

Notable Products

In April 2024, Fkit's top-selling product was Runtz Wax (1g) from the Concentrates category, marking a significant rise to the top spot with sales figures reaching 1637 units. Following closely behind, Kush President BHO Wax (1g), also a Concentrate, secured the second rank with a slight decrease in ranking from the previous month. The third place was taken by Jack Herer BHO Wax (1g), maintaining a consistent presence in the top ranks across several months, showing a slight dip to third from its previous second-place standing. Gorilla Glue #4 Wax (1g) ranked fourth, indicating a competitive climb within the Concentrates category, despite not being ranked in the top three in the preceding months. Lastly, making its debut in the top five, Gorilla Glue #4 Distillate Cartridge (1g) from the Vapor Pens category secured the fifth position, highlighting a diversification in Fkit's top-selling products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.