Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

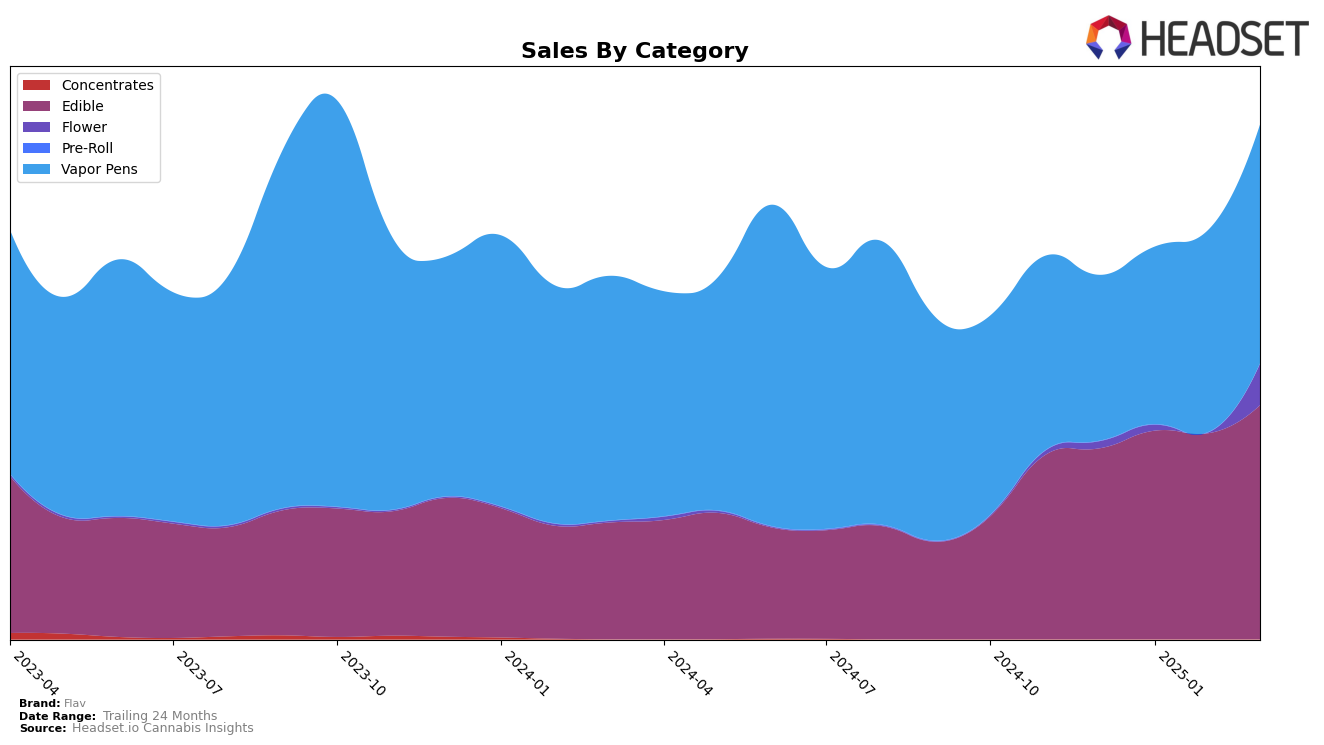

Flav's performance across various states and categories reveals interesting trends and shifts in market presence. In Arizona, the brand has maintained a steady position in the Edible category, consistently ranking 8th from January to March 2025, with a notable increase in sales from December 2024 to March 2025. In the Vapor Pens category, also in Arizona, Flav saw a positive movement, improving its rank from 16th in December 2024 to 12th by February 2025, with sales showing a significant upward trend. Conversely, in California, Flav's presence in the Edible category was minimal, not ranking in the top 30 until March 2025, which could indicate challenges in market penetration or competition in this state.

In Missouri, Flav's performance in the Edible category has been on a positive trajectory, moving from 32nd in December 2024 to 26th by March 2025, reflecting a consistent rise in sales. However, the Vapor Pens category in Missouri presented a different story, with Flav dropping from 52nd in February 2025 to 56th in March 2025. Meanwhile, in New York, Flav maintained a steady 14th position in the Edible category, though sales saw a slight decline. The Vapor Pens category in New York showed a fluctuating yet overall positive trend, with the brand improving its rank to 35th by March 2025. Interestingly, Flav's entry into the Flower category in New York in March 2025 at 54th indicates a potential new area for growth, despite not being in the top 30 in previous months.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Flav has shown a notable upward trajectory in both rank and sales over the first quarter of 2025. Starting at rank 16 in December 2024, Flav maintained its position in January 2025 before climbing to rank 12 by February and March 2025. This improvement in rank coincides with a significant increase in sales, indicating a positive reception in the market. In comparison, IO Extracts consistently held a higher rank, fluctuating between rank 10 and 11, with sales figures notably higher than Flav's, suggesting a strong market presence. Meanwhile, Canamo experienced a slight dip from rank 10 in January to rank 11 by March, with sales peaking in January but declining thereafter. GRAS Cannabis also showed a positive trend, improving from rank 20 in December to rank 13 by March, with fluctuating sales. Sessions Cannabis Extract made a significant leap from rank 25 in December to rank 14 by March, reflecting a strong market entry. These dynamics highlight Flav's competitive positioning and potential for further growth in the Arizona vapor pen market.

Notable Products

In March 2025, Rainbow Sour Live Resin Gummy Belts 10-Pack (100mg) reclaimed its top position in sales for Flav, with a notable sales figure of 7852 units. Sour Blueberry Live Resin Gummy Belts 10-Pack (100mg) slipped to the second rank after leading in January and February. Strawberry Live Resin Gummy Belts 10-Pack (100mg) maintained its third position consistently for the third month in a row. Rainbow Gummy Belts (100mg) held steady at fourth place, showing consistent performance since December. Mega Cherry Rings 10-Pack (100mg) entered the rankings in February at fifth and maintained this position in March, indicating a growing interest among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.