Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

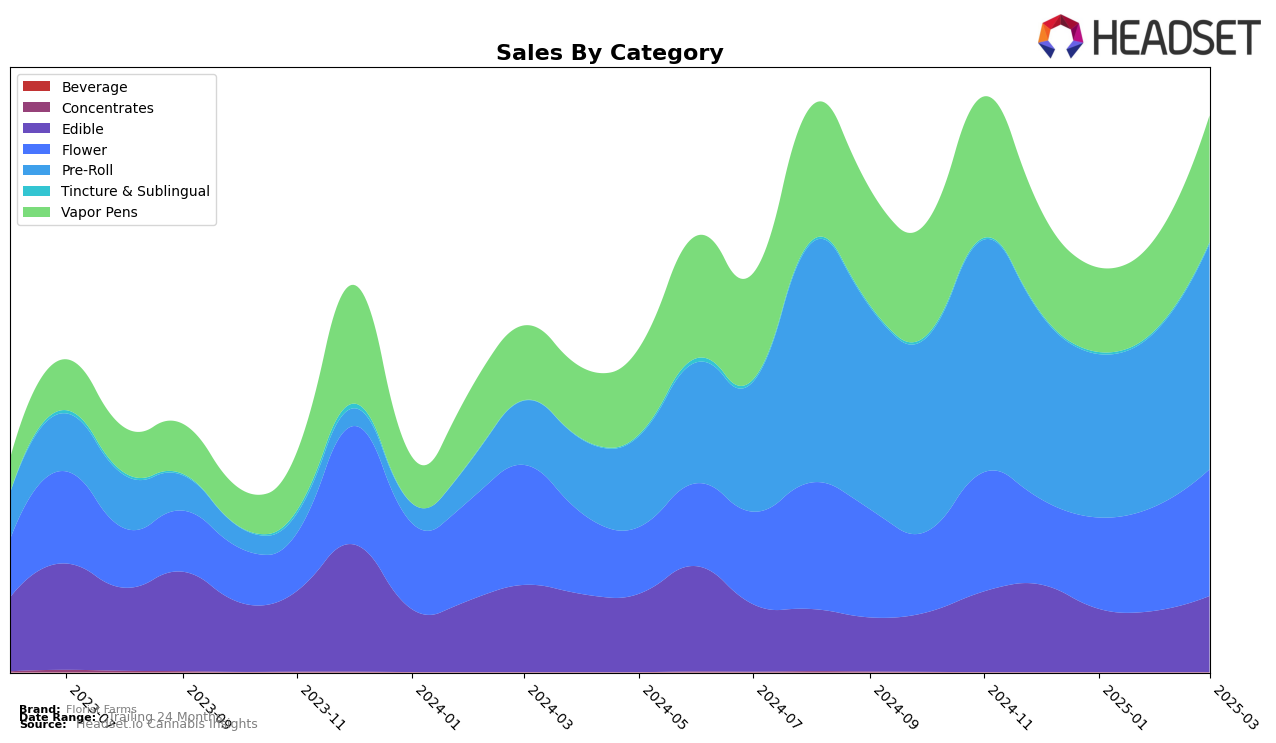

Florist Farms has shown a varied performance across different product categories in New York. In the Edible category, the brand maintained a consistent rank of 13 from January to March 2025, after a slight drop from 10 in December 2024. This indicates a stable position in the market, though not within the top 10. Their Flower category exhibited a positive trend, climbing from 24 in January to 20 by March 2025, suggesting an increasing consumer preference or effective marketing strategies in this segment. Notably, Florist Farms consistently held the third position in the Pre-Roll category, showcasing a strong foothold and possibly a loyal customer base for this product type.

In the Vapor Pens category, Florist Farms improved its rank from 21 in January to 17 by March 2025, reflecting a potential increase in demand or strategic enhancements in product offerings. This upward movement is significant, as it indicates progress toward breaking into more competitive positions. However, the brand did not make it into the top 30 rankings in any other states or categories, which could be an area of concern or an opportunity for growth. Overall, while Florist Farms exhibits strengths in specific categories like Pre-Rolls and is gaining ground in others, there remains potential for expansion and improvement in broader markets.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Florist Farms consistently held the third rank from December 2024 through March 2025. Despite steady rankings, its sales figures reveal a dynamic market position. While Florist Farms maintained its rank, it faced stiff competition from top brands like Ruby Farms and Dank. By Definition, which consistently occupied the first and second positions, respectively. Notably, Leal demonstrated a significant upward trend, climbing from the twelfth to the fifth rank over the same period, indicating a potential future threat. Meanwhile, Jetpacks maintained a stable fourth position, suggesting a solid foothold just below Florist Farms. These dynamics suggest that while Florist Farms is currently secure in its position, the brand must remain vigilant and innovative to defend against rising competitors like Leal and to close the sales gap with the leading brands.

Notable Products

In March 2025, the top-performing product for Florist Farms was the Witches Brew Live Resin Infused Pre-Roll 5-Pack (2.5g), maintaining its leading position from February with sales reaching 6173. The Dutch Hawaiian Infused Pre-Roll 5-Pack (2.5g) climbed back to the second spot, showing a notable increase from its third-place ranking in February. Candy Jack Live Resin Infused Pre-Roll 5-Pack (2.5g) slipped to third place, closely following Dutch Hawaiian with a sales figure of 4747. The Sleep - THC/CBN 1:1 Bedtime Blueberry Gummies 10-Pack (100mg THC, 100mg CBN) improved its position to fourth, up from fifth in February, indicating a positive trend in the Edible category. Ice Cream Gelato Live Resin Infused Pre-Roll 5-Pack (2.5g) held steady at fifth place, showing consistent performance since its debut in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.