Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

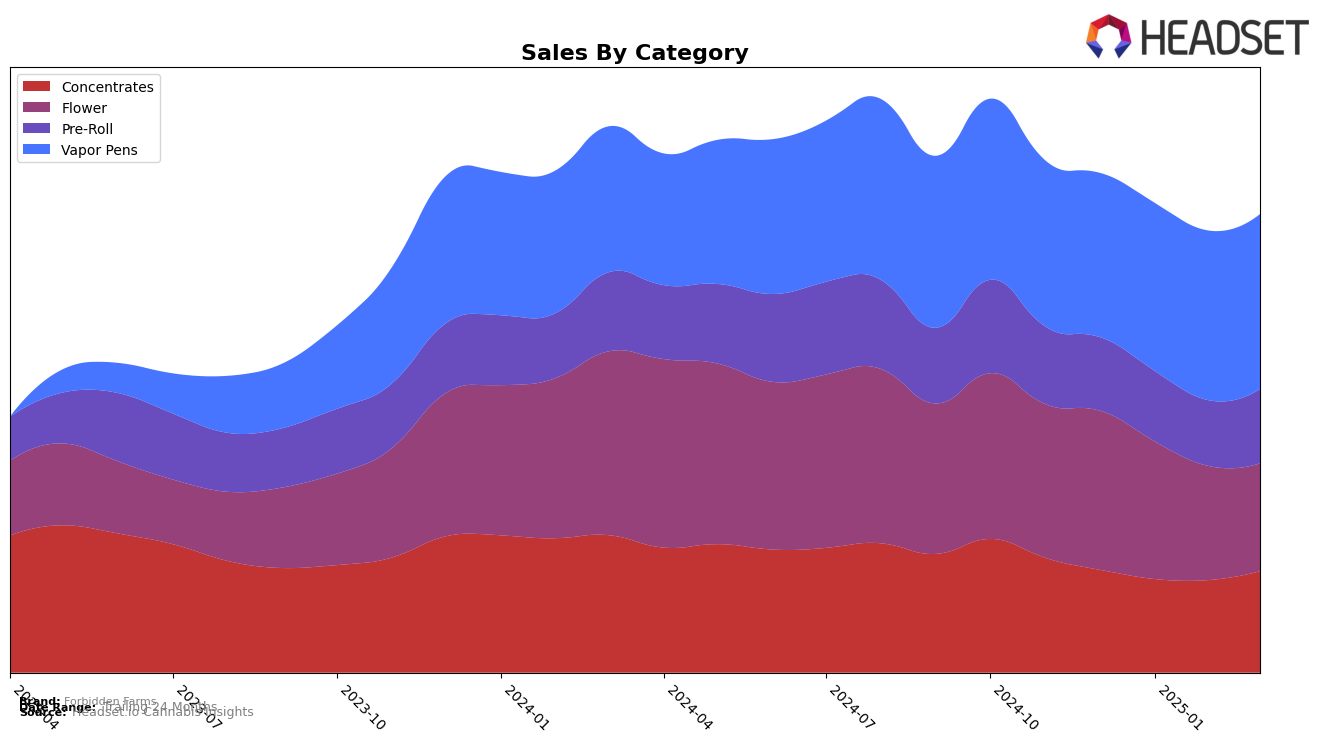

Forbidden Farms has demonstrated a consistent performance in the Washington market, particularly in the Concentrates category where it has maintained a steady rank of 3rd place from December 2024 through March 2025. This stability indicates a strong foothold in this segment, despite fluctuations in sales figures. In contrast, the Flower category has seen a downward trend in rankings, slipping from 9th in December 2024 to 15th by March 2025. This drop suggests increasing competition or shifting consumer preferences that may require strategic adjustments. While the Pre-Roll category has also seen a slight decline in rank from 15th to 16th, it remains within the top 20, indicating a relatively stable position compared to the more dynamic changes seen in Flower.

In the Vapor Pens category, Forbidden Farms has shown a positive trajectory, climbing from 16th place in December 2024 to 13th by March 2025. This upward movement, along with increasing sales, suggests growing consumer interest and market share in this segment. However, outside of these categories, Forbidden Farms does not appear in the top 30 rankings for any other categories or states, which could be seen as a limitation in their market reach or a strategic focus on specific segments within Washington. The absence in other markets might highlight opportunities for expansion or a need to diversify their product offerings to capture a broader audience. Overall, while Forbidden Farms maintains a strong presence in certain categories, there are clear areas for potential growth and market penetration.

Competitive Landscape

In the Washington vapor pen market, Forbidden Farms has shown a consistent upward trend in its rankings, moving from 16th place in December 2024 to 13th place by March 2025. This positive trajectory is supported by steady sales growth, with March 2025 sales figures surpassing those from December 2024. In contrast, Buddies experienced a decline, starting at 15th place in December 2024 and dropping to 16th in February 2025, before slightly recovering to 15th in March 2025. Their sales also reflect a downward trend. Meanwhile, Flipside and Regulator have maintained stronger positions, with Flipside consistently ranking higher than Forbidden Farms, despite a dip in sales. Slusheez remained stable in 14th place throughout the period, with fluctuating sales. Forbidden Farms' consistent improvement in rank and sales suggests a growing market presence and potential to challenge higher-ranked competitors in the Washington vapor pen category.

Notable Products

In March 2025, the top-performing product for Forbidden Farms was Blazed - Indica Infused Pre-Roll (1g) in the Pre-Roll category, reclaiming its number one rank with notable sales of 5558 units. Candy Cone - Hybrid Infused Pre-Roll (1g) climbed to the second position from third place in February, showing a positive trend with increased sales figures. Purple Punch Live Resin Cartridge (1g) in the Vapor Pens category dropped to third place after leading in February, indicating a slight decline in preference. Lodi Dodi Pre-Roll (1g) maintained its position at fourth, consistent with its February ranking. Notably, Jungle Cake Wax (1g) entered the top five for the first time, highlighting its emergence in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.