Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

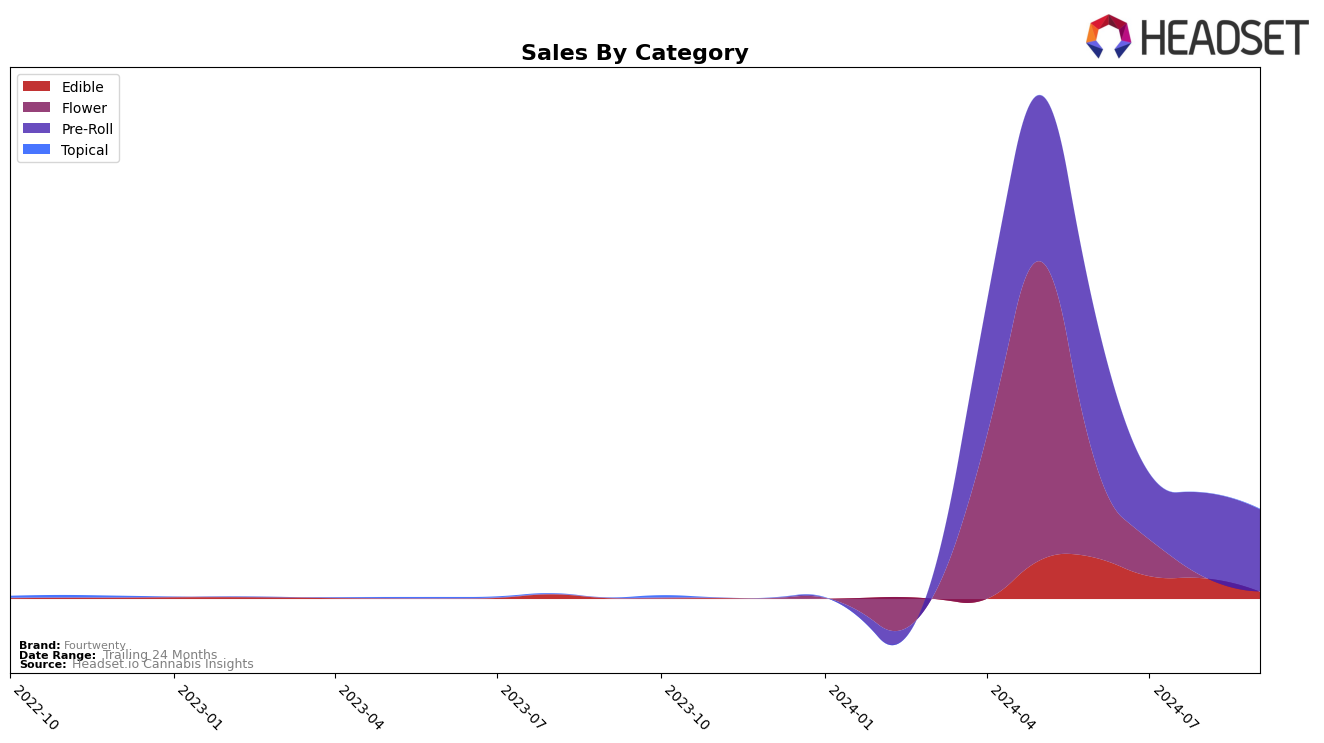

Fourtwenty's performance across various categories in Arizona shows a dynamic landscape with notable shifts in rankings. In the Pre-Roll category, Fourtwenty has been consistently present within the top 50, with its rank fluctuating from 40th in June 2024 to 50th by September 2024. Despite this slight decline, the brand remains a significant player in this category. In contrast, Fourtwenty's presence in the Edible category is less prominent, as it did not make it into the top 30 rankings from July to September 2024, indicating a potential area for growth or a need for strategic adjustments. The Flower category also reflects a challenging market position, as Fourtwenty did not appear in the top 30 for the months of August and September 2024, suggesting competitive pressure or market saturation in this segment.

Overall, Fourtwenty's performance in Arizona highlights both strengths and opportunities for improvement. The brand's consistent ranking in the Pre-Roll category suggests a strong foothold, even though the slight drop in rank might warrant attention. However, the absence of top 30 rankings in the Edible and Flower categories during the latter half of 2024 could signal either a strategic shift in focus or a need to bolster efforts in these segments. The sales data across categories, while not fully detailed here, offer insights into market dynamics and consumer preferences, which could guide Fourtwenty's future strategies in the state.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, Fourtwenty has experienced notable fluctuations in its market position from June to September 2024. Initially ranked 40th in June, Fourtwenty saw a decline to 56th in July, followed by a slight recovery to 49th in August and stabilizing at 50th in September. This trend indicates a volatile market presence compared to competitors like Pressd, which maintained a stronger position, ranking as high as 22nd in June before dropping to 40th by September. Meanwhile, Miss Grass consistently outperformed Fourtwenty, despite its own declining sales, maintaining a rank between 39th and 46th. The emerging presence of Abundant Organics and Big Bud Farms, which entered the rankings in August and September respectively, indicates increasing competition. This dynamic suggests that while Fourtwenty faces challenges in maintaining its rank, there is potential for strategic adjustments to regain market share amidst a shifting competitive environment.

Notable Products

In September 2024, Kush Mints Pre-Roll (0.9g) maintained its position as the top-performing product for Fourtwenty, with sales reaching 1,954 units. Lemon Cherry Sherbert Pre-Roll (0.9g) held steady at second place, following its consistent ranking since July. Headhunter Pre-Roll (0.9g) ranked third, showing a slight decline from its peak position in July. The Soap Pre-Roll (0.9g) made its debut in the rankings, securing the fourth spot. Wildberry Lemonade Gummies 10-Pack (100mg) entered the list at fifth place, marking a notable addition to the Edible category for the brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.