Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

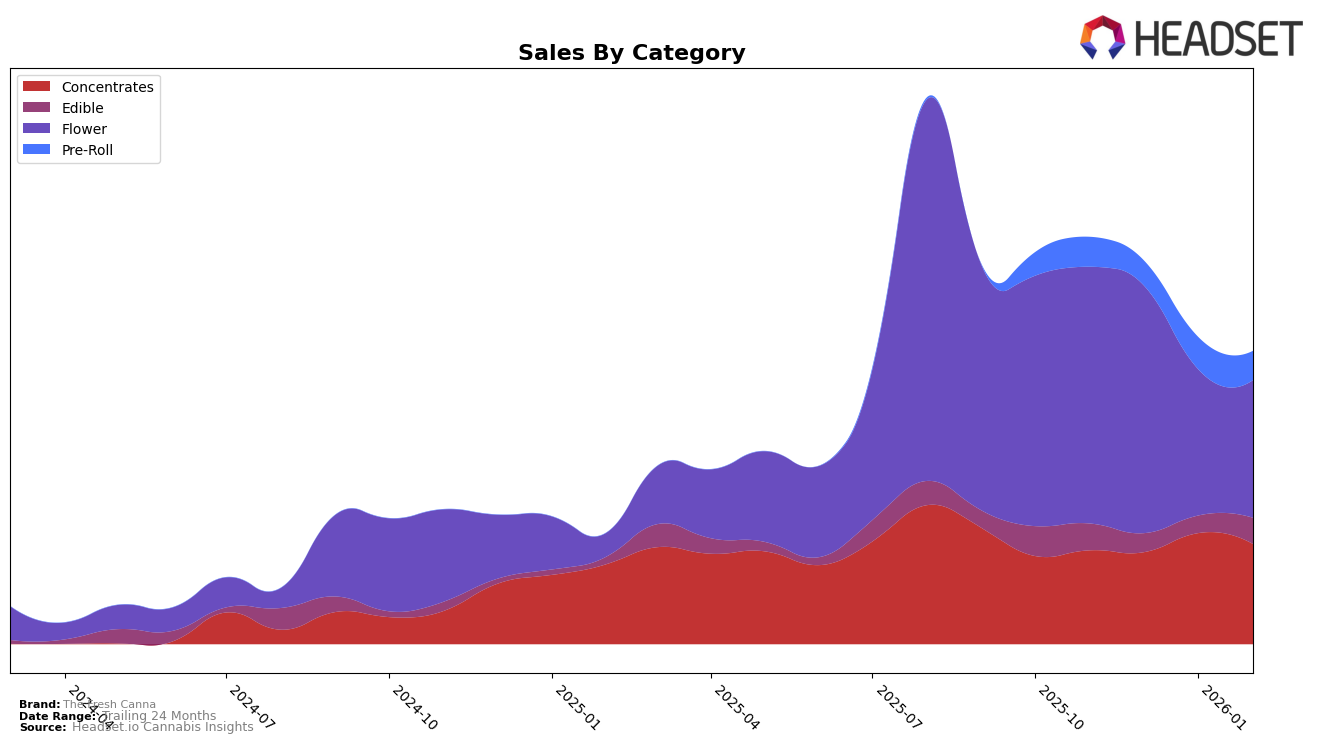

The Fresh Canna has shown a varied performance across different categories in Michigan. In the Concentrates category, the brand maintained a strong presence, consistently ranking within the top 10. Despite a slight dip from 7th to 8th place in February 2026, the brand's sales demonstrated resilience with a notable increase in January 2026. On the other hand, the Edible category has been challenging for The Fresh Canna, as it struggled to break into the top 30, hovering around the 50s for most of the period. However, a positive shift occurred in February 2026 when they moved up to 45th place, indicating a potential upward trend.

In the Flower category, The Fresh Canna experienced a significant drop from 24th place in November 2025 to 40th by January 2026, maintaining that position through February. This decline suggests increased competition or shifts in consumer preferences. Meanwhile, the Pre-Roll category saw some improvement, with the brand climbing from 94th in December 2025 to 69th in January 2026, though it slightly slipped to 72nd in February. The fluctuations in rankings across categories highlight both the challenges and opportunities The Fresh Canna faces in maintaining and improving its market position in Michigan.

Competitive Landscape

In the competitive landscape of Michigan's flower category, The Fresh Canna has experienced notable fluctuations in its ranking and sales performance over recent months. Starting with a strong position at rank 24 in November 2025, The Fresh Canna saw a slight decline to rank 26 in December, followed by a more significant drop to rank 40 in both January and February 2026. This downward trend in rank correlates with a decrease in sales, suggesting increased competition and market pressures. Notably, Dragonfly Cannabis emerged as a formidable competitor, climbing from rank 68 in November to 29 in January, accompanied by a substantial increase in sales. Meanwhile, Carbon maintained a relatively stable presence, consistently ranking within the top 31, although its sales exhibited a downward trend. The competitive dynamics indicate a challenging environment for The Fresh Canna, emphasizing the need for strategic adjustments to regain market share and improve sales performance in the Michigan flower market.

Notable Products

In February 2026, Zkittlez Pre-Roll (1g) emerged as the top-performing product for The Fresh Canna, securing the number one rank with notable sales of 3162 units. Red Raspberry Live Rosin Gummies 5-Pack (200mg) followed closely in second place, while Mimosa Live Resin (1g) took the third spot. Strawberry Cough Live Resin Gummies 5-Pack (200mg) ranked fourth, showcasing strong performance in the edible category. Bubblegum Snow Caps Smalls (Bulk), which previously held the top rank in December 2025 and January 2026, dropped to fifth place in February 2026. This shift highlights a dynamic change in consumer preferences, with a noticeable rise in popularity for pre-rolls and edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.