Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

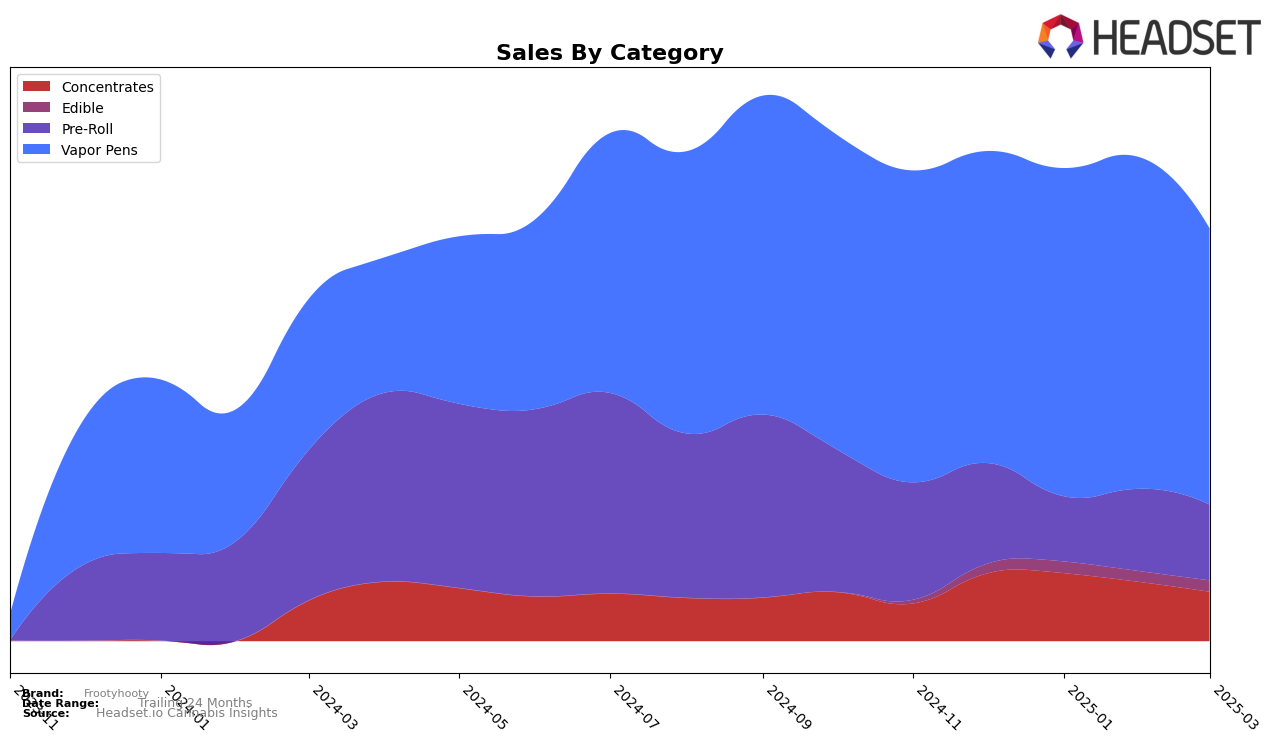

Frootyhooty's performance in the category of Vapor Pens in Alberta has shown notable fluctuations over recent months. Starting with a rank of 24 in December 2024, they improved to 21 in January 2025 and further to 20 in February, before slightly declining back to 21 in March. This indicates a relatively stable presence in the top 30, though the sales figures reveal a peak in February with a subsequent decline in March. In contrast, their performance in the Concentrates category in Ontario saw them consistently outside the top 30, highlighting a potential area for growth or reevaluation.

In Saskatchewan, Frootyhooty's entry into the Vapor Pens market was marked by an initial absence from the top 30 in December 2024, but they managed to secure the 30th position by January 2025, maintaining it in February before slipping to 36th in March. This trajectory suggests a challenging market environment or increased competition. Meanwhile, in the Edible category in Alberta, Frootyhooty consistently hovered around the 26th to 31st ranks, indicating a steady but modest foothold. These movements across different categories and regions underscore the brand's varied market presence and potential strategic areas for improvement or focus.

Competitive Landscape

In the competitive landscape of Vapor Pens in Alberta, Frootyhooty has shown a dynamic performance over the past few months, with its rank fluctuating from 24th in December 2024 to 21st in March 2025. This improvement is notable when compared to brands like Carmel, which consistently hovered around the 20th position, and Vox, which experienced a decline from 14th to 19th over the same period. Despite Coterie maintaining a stable rank at 22nd, Frootyhooty surpassed it in February 2025, indicating a positive trend in sales momentum. Meanwhile, Tuck Shop made significant strides, moving from 34th to 23rd, showcasing a strong upward trajectory that could pose a future challenge. Frootyhooty's ability to climb the ranks amidst these shifts suggests a competitive edge, likely driven by strategic market positioning and consumer preference in the Alberta Vapor Pens category.

Notable Products

In March 2025, the top-performing product from Frootyhooty was the Wild Watermelon Coconut Live Rosin + Disty Cartridge (1g) from the Vapor Pens category, which climbed to the first rank with sales of 2255 units. The Wild Watermelon Coconut Infused Pre-Roll 3-Pack (1.5g) in the Pre-Roll category maintained a strong presence, ranking second, a slight drop from its leading position in February. The Wild Watermelon Coconut Live Rosin Distillate Disposable (1g), also from the Vapor Pens category, held steady at third place, showing a consistent performance despite a drop in sales. The Poppin Peach Full Spectrum Live Rosin Cartridge (1g) remained in fourth place, indicating stable demand. Lastly, the Poppin Peach Live Rosin Amplified Infused Pre-Roll 3-Pack (1.5g) re-entered the rankings at fifth, highlighting renewed interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.