Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

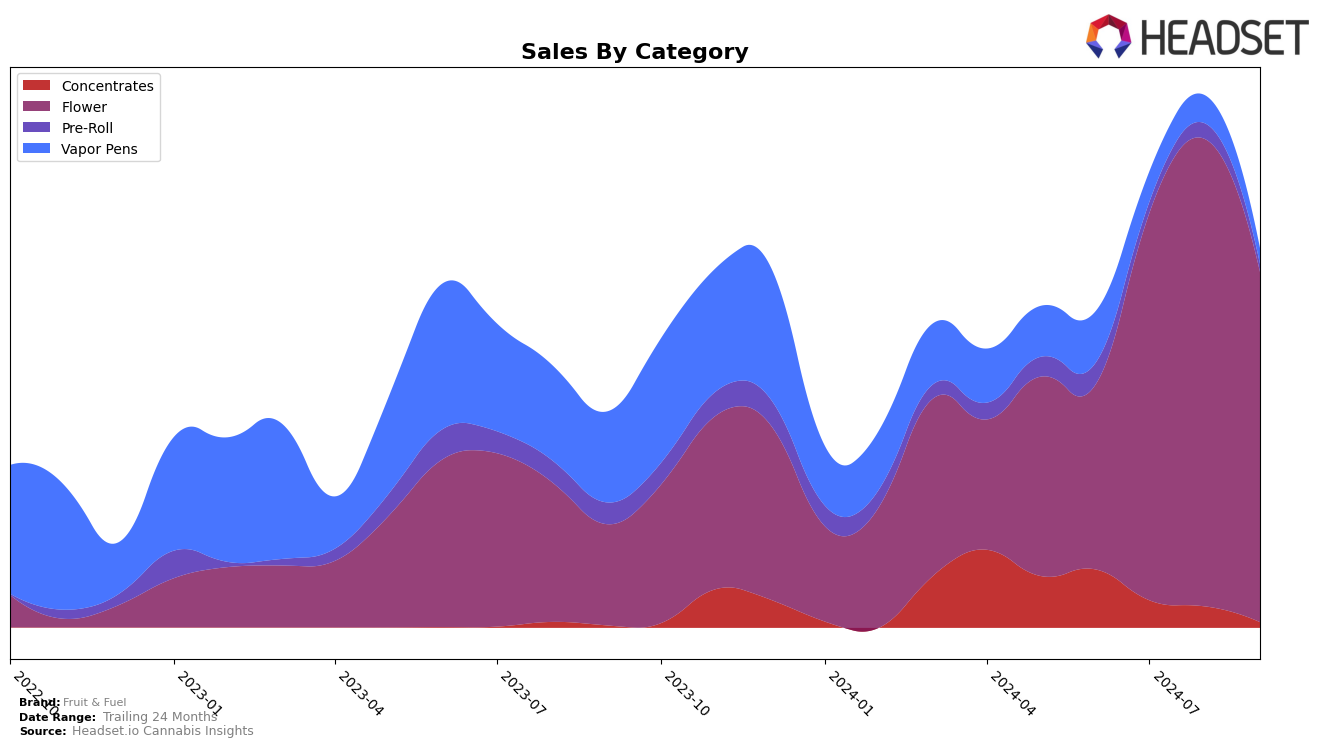

Fruit & Fuel's performance in the Michigan market has exhibited notable fluctuations across different product categories over the past few months. In the Concentrates category, the brand started strong in June 2024 with a rank of 20, but unfortunately, by September 2024, it had fallen out of the top 30 entirely. This decline suggests challenges in maintaining competitiveness in this category. Conversely, the Flower category has been a bright spot for Fruit & Fuel, where the brand improved its ranking from 46 in June to 15 in August, before settling at 19 in September. This upward trajectory highlights a solid performance and suggests a strong consumer preference for their flower products in Michigan.

In the Vapor Pens category, Fruit & Fuel has experienced a steady decline in rankings, moving from 45 in June to 72 in September, indicating potential difficulties in sustaining consumer interest or facing stiff competition. Meanwhile, the Pre-Roll category saw the brand briefly enter the top 90 in June and August but did not maintain a consistent presence in the top rankings, which could imply a need for strategic adjustments in this segment. Overall, while Fruit & Fuel has seen success in certain areas, there are clear opportunities for growth and improvement, particularly in maintaining a stable presence in the competitive Michigan market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Fruit & Fuel has demonstrated notable fluctuations in its rank over the past few months, impacting its sales trajectory. In June 2024, Fruit & Fuel was ranked 46th, but it made a significant leap to 20th in July, further climbing to 15th in August before slightly dropping to 19th in September. This upward trend in July and August was accompanied by a substantial increase in sales, indicating strong market performance. However, the slight dip in September suggests a potential challenge from competitors like Redemption, which improved its rank from 39th in June to 21st in September, and Goldkine, which saw a notable rise from 36th in July to 18th in September. Additionally, Hytek and Pure Options have shown competitive resilience, with both brands consistently improving their ranks, potentially impacting Fruit & Fuel's market share. These dynamics highlight the importance for Fruit & Fuel to strategize effectively to maintain its competitive edge in the Michigan flower market.

Notable Products

In September 2024, the top-performing product from Fruit & Fuel was Jungle Cake (3.5g) in the Flower category, which secured the number one rank with sales of $15,860. Frosted Cherry Cookies (3.5g) maintained its strong performance, holding the second position, though its sales decreased from the previous month. Greasy Runtz (3.5g) emerged as a new entrant in the rankings, achieving third place. Cherry Nerdz (3.5g) dropped to fourth place, continuing a downward trend from its first-place position in June. Lemon Headband (3.5g) made its debut in the rankings at fifth place, showing potential for future growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.