Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

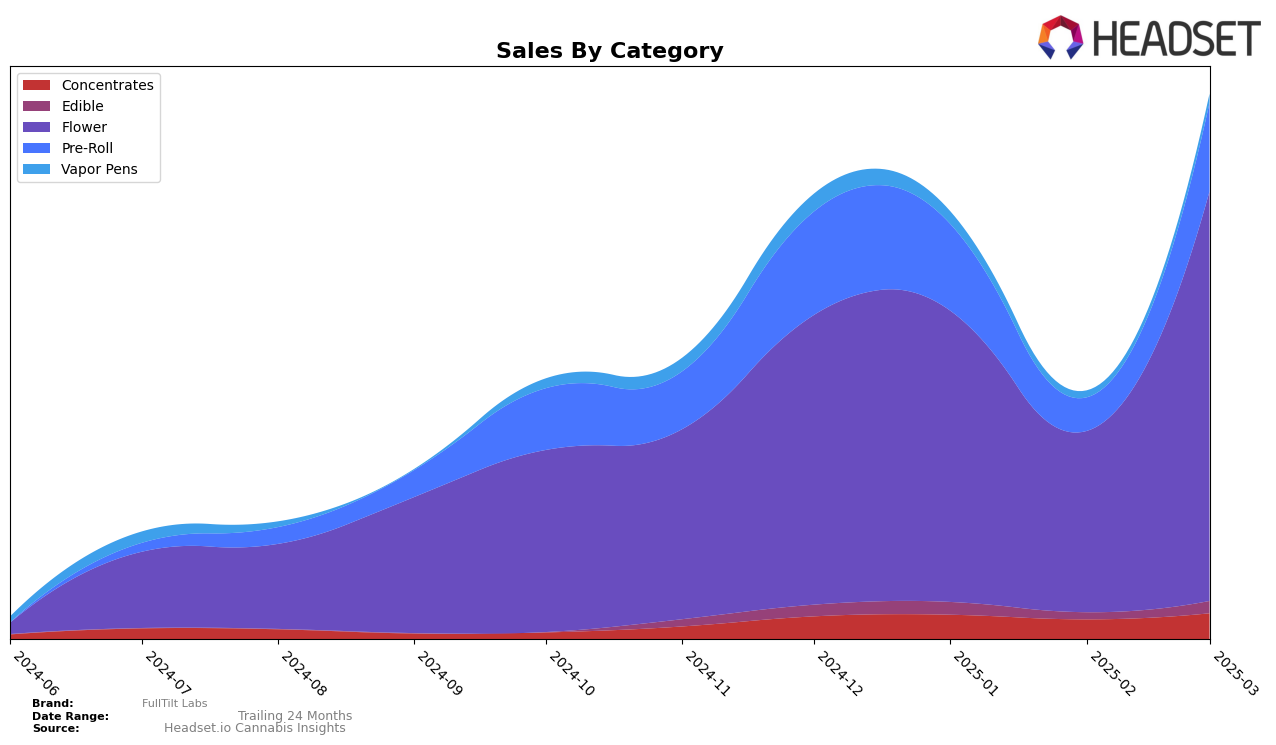

FullTilt Labs has shown a mixed performance across various product categories in New Jersey over the past few months. Concentrates have remained relatively stable, with rankings hovering around the 18th to 20th position, indicating a consistent presence in the market. However, the sales figures have demonstrated some volatility, with a peak in March 2025. In the Flower category, FullTilt Labs experienced significant fluctuations, dropping to 39th place in February 2025 before rebounding to the 29th position in March. This rebound was accompanied by a substantial increase in sales, suggesting a recovery in consumer demand or a successful marketing strategy. The Pre-Roll segment also saw a notable improvement, climbing from 48th in February to 37th in March, reflecting a positive trend in consumer preference or distribution effectiveness.

On the other hand, the Edible and Vapor Pens categories present a more challenging scenario for FullTilt Labs in New Jersey. The brand did not make it into the top 30 for Edibles in December 2024 and February 2025, suggesting a need for strategic adjustments to capture more market share. Despite reappearing in March, the ranking of 39th indicates that there is still significant room for growth. Similarly, Vapor Pens have not ranked since January 2025, highlighting a potential area for concern or an opportunity for re-evaluation of their product offerings in this segment. Overall, while FullTilt Labs has shown resilience in some categories, others require focused attention to enhance their market position.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, FullTilt Labs experienced a dynamic shift in its market positioning from December 2024 to March 2025. Starting at rank 30 in December, FullTilt Labs saw a decline to rank 39 by February, before rebounding to rank 29 in March. This fluctuation suggests a volatile market presence, potentially driven by changes in consumer preferences or competitive pressures. Notably, competitors like &Shine and Fresh Cannabis maintained relatively higher ranks, with &Shine starting at rank 16 and ending at 28, while Fresh Cannabis consistently hovered in the low 20s. Meanwhile, Binske showed a strong upward trend, improving from rank 36 to 30, which may indicate effective marketing strategies or product offerings that resonate well with consumers. The sales data reveal that while FullTilt Labs' sales dipped significantly in February, they managed a strong recovery in March, suggesting potential for growth if the brand can capitalize on its recent momentum.

Notable Products

In March 2025, Crippy Dog (3.5g) emerged as the top-performing product for FullTilt Labs, achieving the number one rank with sales reaching 1070 units. Crippy Dog Pre-Roll (1g) secured the second position, showing a notable entry into the rankings with 884 units sold. Strawberry Cannoli (3.5g) climbed to the third spot, maintaining a strong presence since December 2024 despite not being ranked in January and February. Super Lemon Mac Pre-Roll (1g) was ranked fourth, indicating a stable performance for pre-rolls. Frost Donkey (3.5g), which topped the list in February, fell to fifth place, suggesting a shift in consumer preference towards other flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.