Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

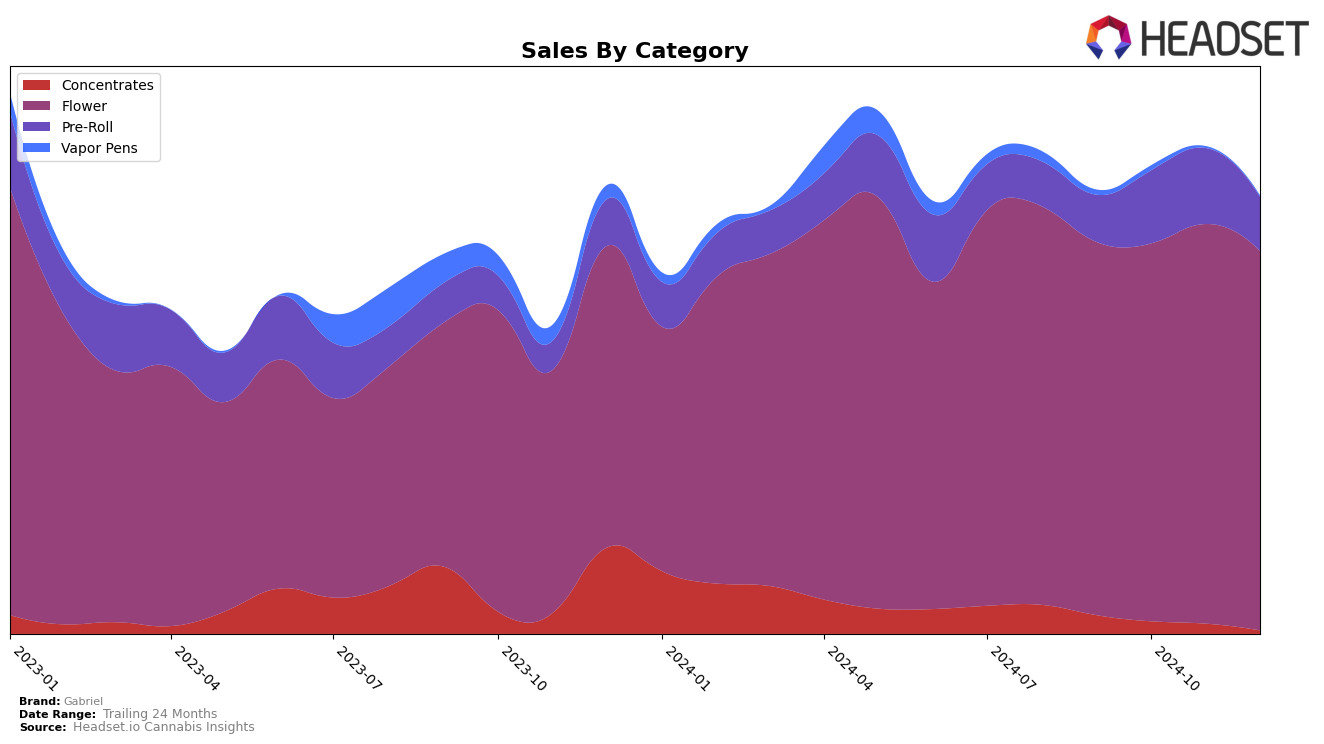

Gabriel's performance in the state of Washington reveals an interesting trajectory across different product categories. In the Flower category, Gabriel maintained a presence within the top 30 brands throughout the last quarter of 2024, peaking at rank 27 in November before slightly dipping to 28 in December. This consistency indicates a stable demand for their Flower products, with sales showing a modest increase from September to November before a slight decline in December. In contrast, Gabriel's performance in the Concentrates category did not make the top 30, which suggests a potential area for improvement or a shift in consumer preference within the state.

For Pre-Rolls, Gabriel exhibited a dynamic movement in rankings, starting at 97 in September and climbing to 70 by November, although it fell back to 86 in December. This fluctuation might point to varying consumer interest or competitive pressures in the market. Despite not breaking into the top 30, the overall upward trend from September to November suggests a growing interest that could be capitalized on with strategic marketing or product development efforts. These insights into Gabriel's performance across categories in Washington offer a glimpse into the brand's current market position and potential areas for growth or recalibration.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Gabriel has experienced some fluctuations in its market positioning over the last few months of 2024. Starting in September, Gabriel was ranked 21st, but saw a decline to 30th in October, before slightly recovering to 27th in November and stabilizing at 28th in December. This movement indicates a competitive pressure from brands like Momma Chan Farms, which showed a significant upward trajectory, climbing from 50th in September to 27th in December. Meanwhile, Bondi Farms also improved its rank from 39th to 30th over the same period, suggesting a strong market presence. Despite these challenges, Gabriel's sales figures remained relatively stable, with a peak in November, indicating a resilient customer base. However, the consistent rankings of Smokey Point Productions (SPP) and Freddy's Fuego (WA) in the top 30 highlight the need for Gabriel to innovate and differentiate to regain its competitive edge in the Washington Flower market.

Notable Products

In December 2024, White Truffle (3.5g) emerged as the top-performing product for Gabriel, climbing from its consistent second-place position in the preceding months to first, with sales reaching 1557 units. Donkey Butter (3.5g) secured the second spot, rebounding from fourth place in November, indicating a strong sales performance with 1403 units sold. Tricho Jordan (3.5g) made a notable entry into the rankings at third place, a significant rise from its absence in the rankings for October and November. The G Stix - Donkey Butter Pre-Roll (1g) dropped to fourth place, after leading the sales in November. Lastly, the G Sticks - White Truffle Pre-Roll (1g) saw a decline in sales rank, moving to fifth place from third in November, reflecting a decrease in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.