Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

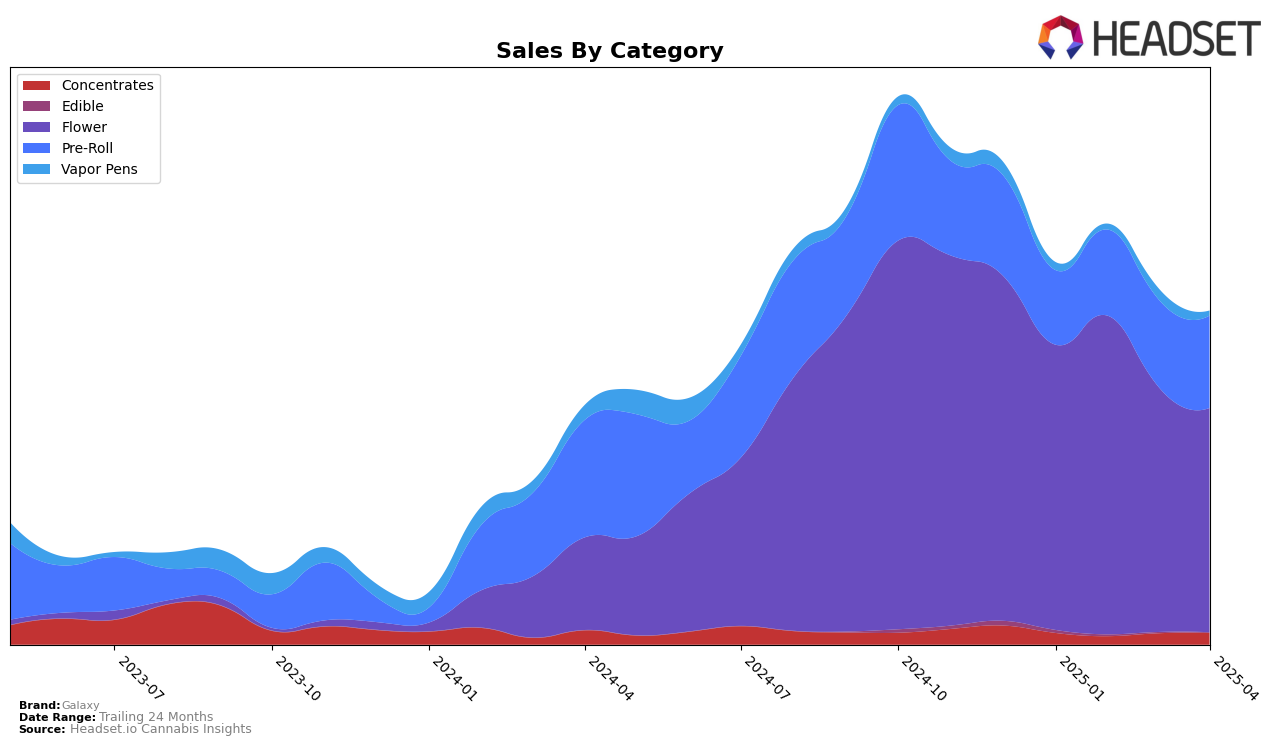

Galaxy's performance in California reveals an interesting trajectory across different categories. In the Concentrates category, Galaxy has shown a positive trend, moving up the ranks from 81st in January 2025 to 71st by April 2025. Despite not breaking into the top 30, this upward movement suggests a growing acceptance and possibly an increase in market share within the state. In the Pre-Roll category, Galaxy has maintained a steady presence, improving its rank from 99th in January to 90th in April. This consistent climb, coupled with an increase in sales from 65,511 in January to 83,080 in April, indicates a strengthening position in the market.

In Illinois, Galaxy's performance in the Flower category has seen a slight decline, with its rank slipping from 26th in January to 30th in April. This drop, accompanied by a decrease in sales from January to April, may suggest challenges in maintaining its competitive edge in this category. Conversely, the Pre-Roll category in Illinois shows a more favorable trend, as Galaxy improved its rank from 29th in January to 26th in April. This improvement, despite not being dramatic, signifies a potential for growth and increased consumer preference in this segment. Overall, while Galaxy faces challenges in certain areas, its ability to improve and maintain ranks in others highlights its dynamic presence in the market.

Competitive Landscape

In the competitive landscape of the flower category in Illinois, Galaxy has experienced notable fluctuations in its rank and sales over the first four months of 2025. Starting the year at rank 26, Galaxy improved to rank 23 in February, but then saw a decline to rank 29 in March and further to rank 30 in April. This downward trend in rank is mirrored by a decrease in sales from February's peak. In contrast, FloraCal Farms showed a consistent improvement, climbing from rank 32 in January to 28 in both March and April, with a significant sales increase in March. Similarly, Find. made a notable leap from rank 39 in January to 27 in March before dropping to 33 in April, indicating a volatile but upward trend. Meanwhile, nuEra steadily improved its rank, reaching 31 in April, and experienced a consistent increase in sales. Legacy Cannabis (IL) also showed fluctuations, with its rank peaking at 23 in January but dropping to 29 by April. These dynamics suggest that while Galaxy faces challenges in maintaining its rank, competitors are either stabilizing or improving, highlighting the need for strategic adjustments to regain competitive ground in the Illinois flower market.

Notable Products

In April 2025, Galaxy's top-performing product was Cap Junky (3.5g) in the Flower category, which climbed to the number one spot with sales reaching 964 units. Following closely, Brioche French Toast Pre-Roll (1g) secured the second position, marking its debut in the rankings with notable sales figures. Pineapple Donut Pre-Roll 5-Pack (2.5g) took the third rank, reflecting strong entry performance. Brioche French Toast (3.5g) experienced a slight dip, moving to fourth place from its previous third position in March. Meanwhile, Garlic Cocktail #7 Pre-Roll (1g), which was consistently ranked first in January and February, fell to fifth place in April, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.