Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

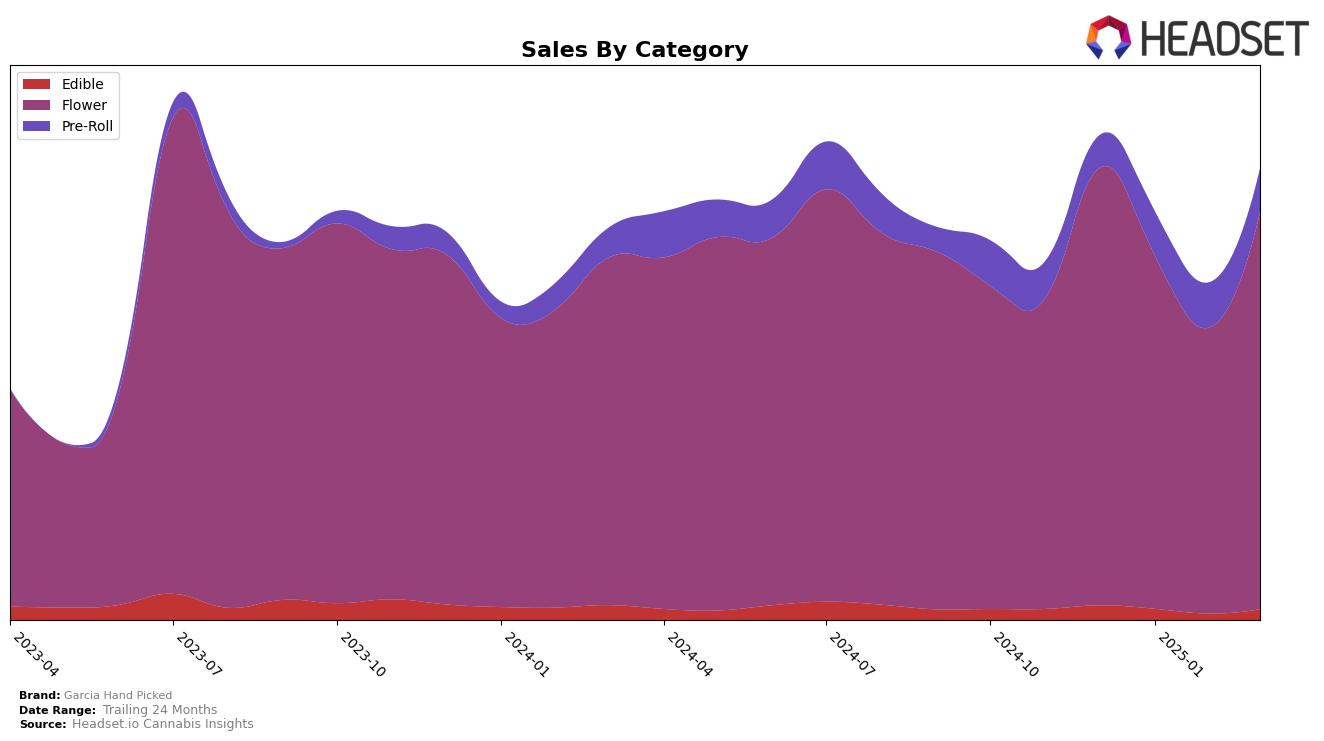

Garcia Hand Picked has shown variable performance across different categories and states, with notable trends in the Massachusetts and Maryland markets. In Massachusetts, the brand's Flower category experienced a decline in rankings, moving from 33rd in January 2025 to 47th by March 2025, indicating a potential challenge in maintaining market presence. Meanwhile, their Pre-Roll category saw an improvement in January but failed to break into the top 30, suggesting competitive pressure in this segment. On the other hand, in Maryland, Garcia Hand Picked maintained a relatively stable performance in the Flower category, consistently ranking within the top 20, although there was a slight dip in February 2025. The Pre-Roll category in Maryland also demonstrated resilience, with rankings fluctuating slightly but remaining within the top 20 throughout the observed period.

In Maryland, the Edible category for Garcia Hand Picked saw a brief absence from the rankings in February 2025, which may indicate a temporary issue or increased competition, though the brand quickly regained its position by March 2025. This fluctuation suggests a need for strategic adjustments to capture a steadier market share. In Michigan, the Flower category showed a promising upward trajectory, with a notable jump from 61st in February 2025 to 43rd in March 2025, reflecting potential growth opportunities in this region. Despite these movements, it's clear that Garcia Hand Picked faces challenges in maintaining consistent rankings across all categories and states, highlighting the competitive and dynamic nature of the cannabis market.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Garcia Hand Picked has experienced fluctuating rankings from December 2024 to March 2025, reflecting a dynamic market environment. Starting at rank 12 in December 2024, Garcia Hand Picked saw a decline to rank 16 in February 2025 before rebounding to rank 13 in March 2025. This volatility in rank is indicative of the competitive pressures from brands such as Kind Tree Cannabis, which consistently outperformed Garcia Hand Picked in January and February 2025, and Grow West Cannabis Company, which maintained a stronger position throughout the period. Notably, Modern Flower also posed significant competition, especially with its strong performance in December 2024. Despite these challenges, Garcia Hand Picked's ability to recover its rank in March 2025 suggests resilience and potential for growth in the Maryland market.

Notable Products

In March 2025, Florida Kush (3.5g) emerged as the top-performing product for Garcia Hand Picked, maintaining its leading position from January and reclaiming the top spot it had in December 2024, with sales reaching 11,887 units. LA Baker (3.5g) followed closely, dropping to the second position after leading in February 2025. Caps Frozen Lemons Pre-Roll 2-Pack (1g) held the third position, showing a decline from its second-place ranking in February. Under the Stars (3.5g) remained consistent, retaining the fourth rank for the second consecutive month. Notably, Swampwater Fumez Pre-Roll 2-Pack (1g) entered the rankings in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.