Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

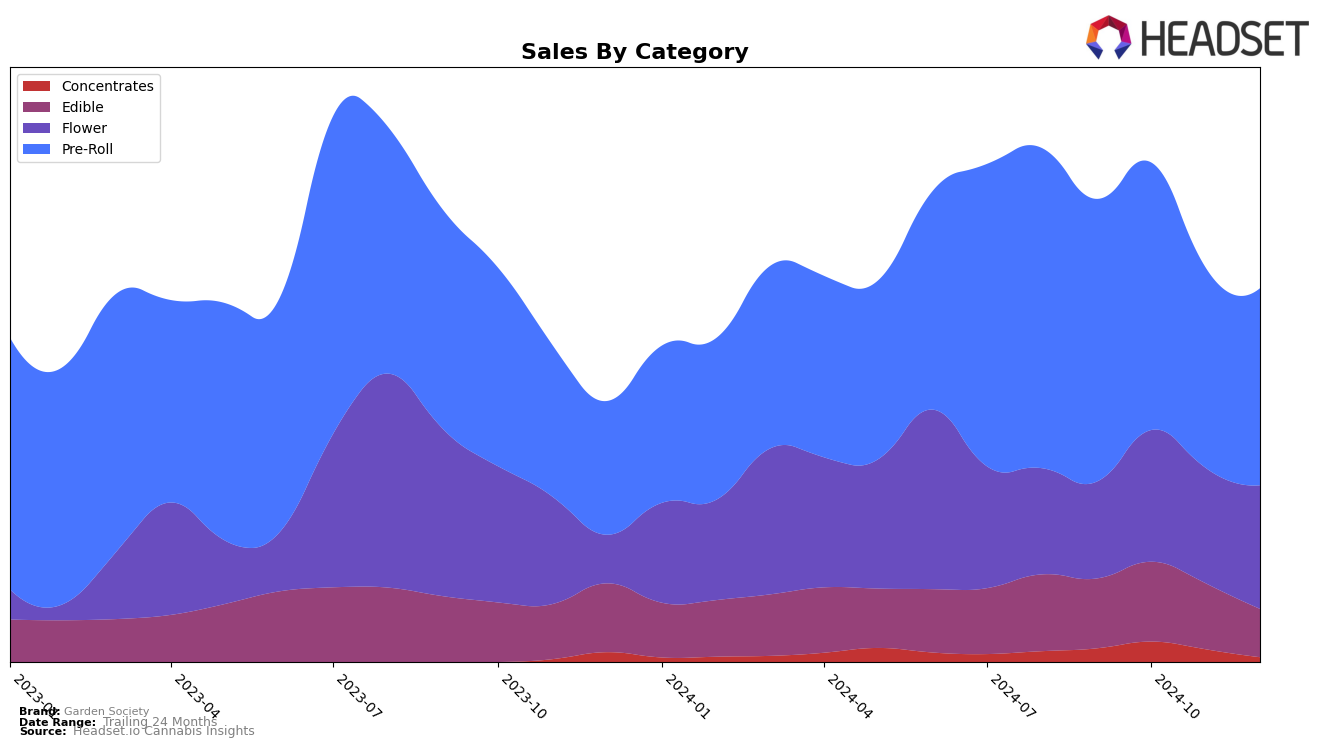

Garden Society has exhibited varied performance across different product categories and states. In California, the brand's presence in the Edible category has seen a gradual decline from September to December 2024, with rankings slipping from 35th to 44th place. Despite an initial increase in sales in October, the subsequent months saw a downturn, highlighting a potential challenge in maintaining consumer interest or market competition. Similarly, in the Pre-Roll category, Garden Society's rank fell from 34th in September to 40th in December, indicating a consistent struggle to maintain a strong foothold in this competitive market. The sales trajectory in this category also mirrored a downward trend, suggesting a need for strategic adjustments to regain market share.

In contrast, the brand's performance in Ohio within the Concentrates category presents a more optimistic picture. Garden Society achieved its highest ranking of 20th place in October 2024, showcasing a positive reception and potential growth opportunity in this market. However, the absence of a ranking in December indicates that the brand did not make it to the top 30, which could be a red flag for sustaining momentum. This fluctuation in rankings and presence across states underscores the dynamic nature of the cannabis market and the importance of strategic positioning and adaptability for brands like Garden Society.

Competitive Landscape

In the competitive landscape of the California Pre-Roll market, Garden Society has experienced a slight decline in its ranking from September to December 2024, moving from 34th to 40th place. This downward trend in rank is mirrored by a decrease in sales, suggesting potential challenges in maintaining market share. In contrast, Blem has shown a positive trajectory, improving its rank from 42nd to 35th, accompanied by a steady increase in sales. Meanwhile, Glass House Farms (CA) has also climbed the ranks, moving from 62nd to 42nd, with a notable rise in sales, indicating growing consumer preference. Dime Industries, although experiencing a drop from 26th to 37th, still maintains higher sales figures compared to Garden Society, highlighting a competitive edge in terms of volume. The fluctuating performance of Revelry Herb Company, which dropped out of the top 20 in November, reflects the volatility within this market segment. These dynamics underscore the importance for Garden Society to innovate and adapt to regain its competitive positioning in the California Pre-Roll market.

Notable Products

In December 2024, the top-performing product from Garden Society was the Brighter Day - Blue Dream Pre-Roll 2-Pack (0.75g), which achieved the number one rank with sales of 1833 units. The Blissful Rest - Indica Rosettes Pre-Roll 10-Pack (3.75g), which had been consistently ranked first from September to November, dropped to the second position. The Sativa Pre-Roll 10-Pack (3.75g) improved its ranking from fourth in November to third in December. Pink Boost Goddess THCV Reserve Rosettes Infused Pre-Roll 10-Pack (3.75g) maintained a strong presence, moving from third to fourth place. Key Lime Jack (14g) saw a decline, falling from second in November to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.