Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

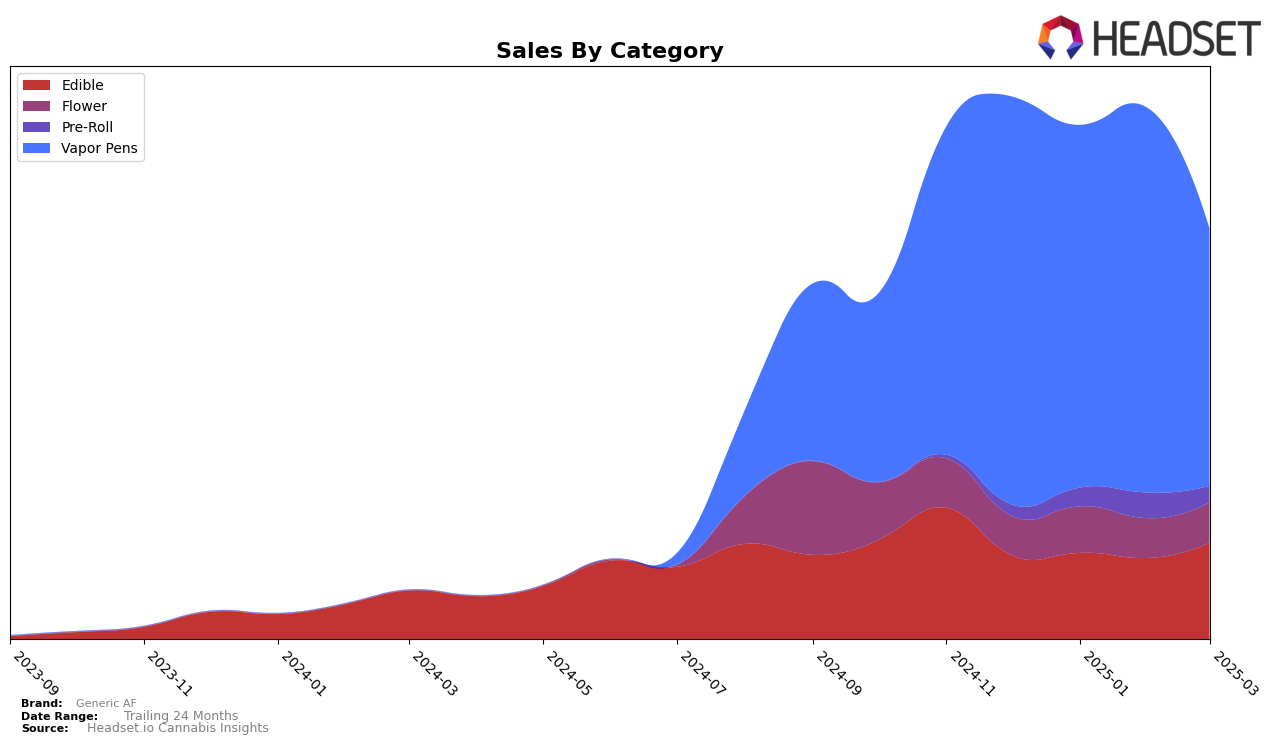

In the Illinois market, Generic AF's performance in the Vapor Pens category has shown a slight decline over the months. Starting at rank 19 in December 2024, the brand slipped to rank 25 by March 2025. This drop in ranking is accompanied by a noticeable decrease in sales, with March figures trailing behind the numbers from December. The downward trend in Illinois could be indicative of increased competition or shifting consumer preferences in the Vapor Pens category.

Meanwhile, in New York, Generic AF's performance across categories presents a mixed picture. In the Edible category, the brand has maintained a steady presence within the top 20, improving slightly from rank 18 in December 2024 to rank 17 in March 2025. However, the Flower and Pre-Roll categories tell a different story, with rankings mostly outside the top 70, suggesting limited market penetration or brand recognition in these segments. The Pre-Roll category, in particular, saw a significant fluctuation, with the brand reaching as high as rank 68 in February 2025 before dropping back to rank 98 in March. This variability highlights potential challenges in maintaining a consistent market position in New York's diverse cannabis landscape.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Generic AF experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 19th in December 2024, Generic AF maintained a stable presence in the top 20 through February 2025, before slipping to 25th in March 2025. This decline in rank coincided with a significant decrease in sales, contrasting with competitors like Revolution Cannabis and Verano, which both showed resilience with stable or improving ranks. In particular, Revolution Cannabis consistently held a rank around 23rd, while Verano improved to 24th in March 2025. Meanwhile, Nuvata maintained a steady position at 26th, suggesting a competitive pressure that may have contributed to Generic AF's decline. These dynamics highlight the importance for Generic AF to reassess its strategies to regain its competitive edge in the Illinois vapor pen market.

Notable Products

In March 2025, the top-performing product for Generic AF was the Blue Dream Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent rank of 1 since December 2024, despite a sales dip to 3316 units. The Alaskan Thunder Full Spectrum CO2 Cartridge (1g) climbed to 2nd place, up from 5th in February, with a notable increase in sales. Skywalker OG Distillate Cartridge (1g) shifted down to 3rd place, continuing its decline from January. The Blue Raspberry Gummies 20-Pack (100mg) entered the rankings at 4th place, marking its first appearance. Maui Waui Distillate Cartridge (1g) dropped to 5th, having been 4th in February, indicating a decrease in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.