May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

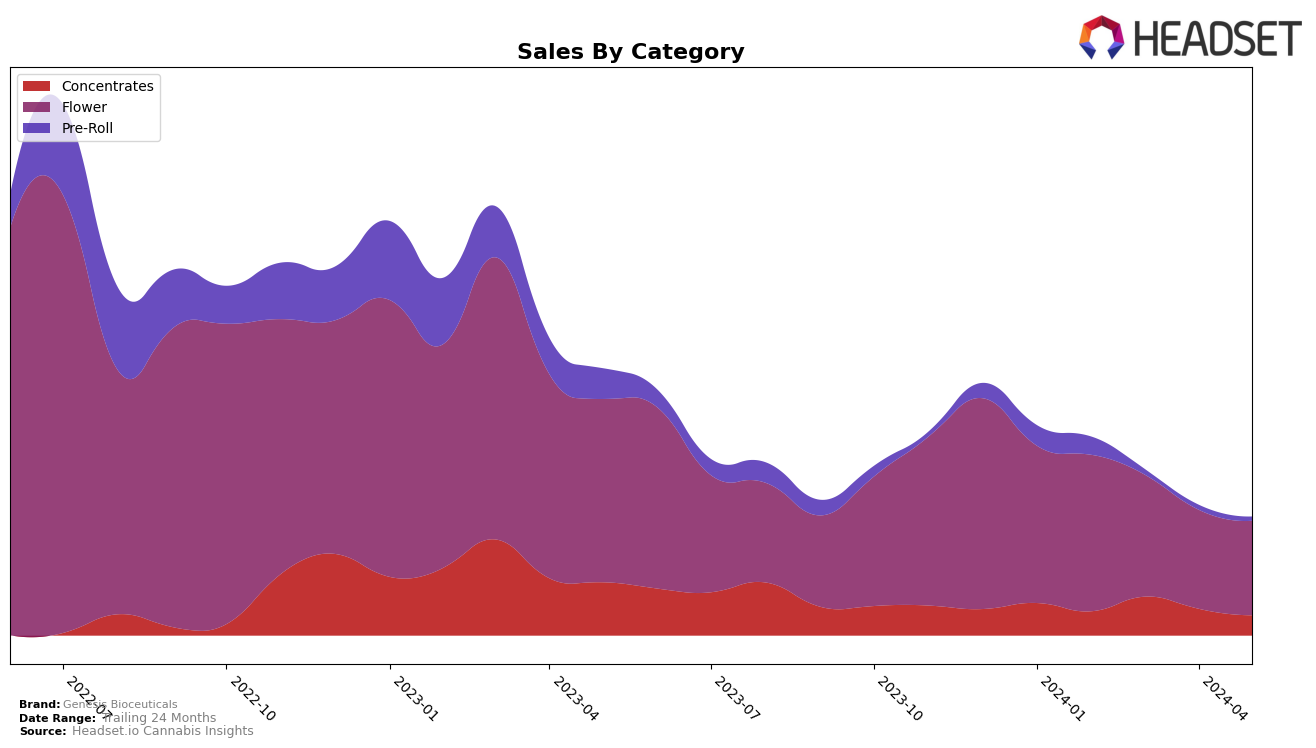

Genesis Bioceuticals has shown varied performance across different product categories in Arizona. In the Concentrates category, the brand experienced a notable improvement in March 2024, moving up to the 21st position from 26th in February. However, this was followed by a decline in the subsequent months, slipping to 29th by May 2024. This fluctuation indicates a volatile market presence, where the brand's sales peaked at $80,803 in March but then dropped to $46,368 by May. Such movements suggest that while there are opportunities for growth, sustaining a higher rank remains a challenge.

In the Flower category, Genesis Bioceuticals did not manage to break into the top 30 rankings at any point between February and May 2024. The brand's position hovered around the mid-30s to 40s, with sales decreasing steadily from $298,226 in February to $183,863 in May. This downward trend highlights a struggle to compete against top brands in this highly competitive category. Similarly, in the Pre-Roll category, Genesis Bioceuticals failed to secure a top 30 spot, with rankings consistently falling from 48th in February to 63rd in May. These patterns suggest that while the brand has a presence, it faces significant competition and market pressures across multiple product categories in Arizona.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Genesis Bioceuticals has experienced fluctuations in its rank and sales over the past few months. Notably, Genesis Bioceuticals ranked 36th in February 2024 but saw a slight decline to 37th in March, dropping further to 40th in April before recovering to 37th in May. This indicates a volatile performance compared to competitors like Daze Off, which improved its rank significantly from 40th in February to 29th in April, before a slight dip to 31st in May. Similarly, FENO showed a steady upward trend, moving from 42nd in February to 32nd in May. Meanwhile, High Variety experienced a sharp decline from 21st in February to 43rd in May, indicating potential market instability. Genesis Bioceuticals' sales have also seen a downward trend, from February's peak to a significant drop by May, which contrasts with the more stable or improving sales figures of its competitors. These dynamics suggest that while Genesis Bioceuticals remains a notable player, it faces stiff competition and market volatility, highlighting the need for strategic adjustments to regain and stabilize its market position.

Notable Products

In May-2024, the top-performing product for Genesis Bioceuticals was Grape Illusion (3.5g) in the Flower category, maintaining its position as the best-seller for four consecutive months with sales of 883 units. Strawberries n Cream XL (4.5g) also in the Flower category, held the second position after rising from fifth place in February and achieving 678 units sold. Tropicana Banana (4.5g) remained steady in third place with sales of 451 units. White 99 XL (4.5g) entered the rankings in May at fourth place with 429 units sold. Notably, Strawberries n' Cream Pre-Roll (1g) debuted in fifth place with 425 units sold, highlighting a new entry in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.