Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

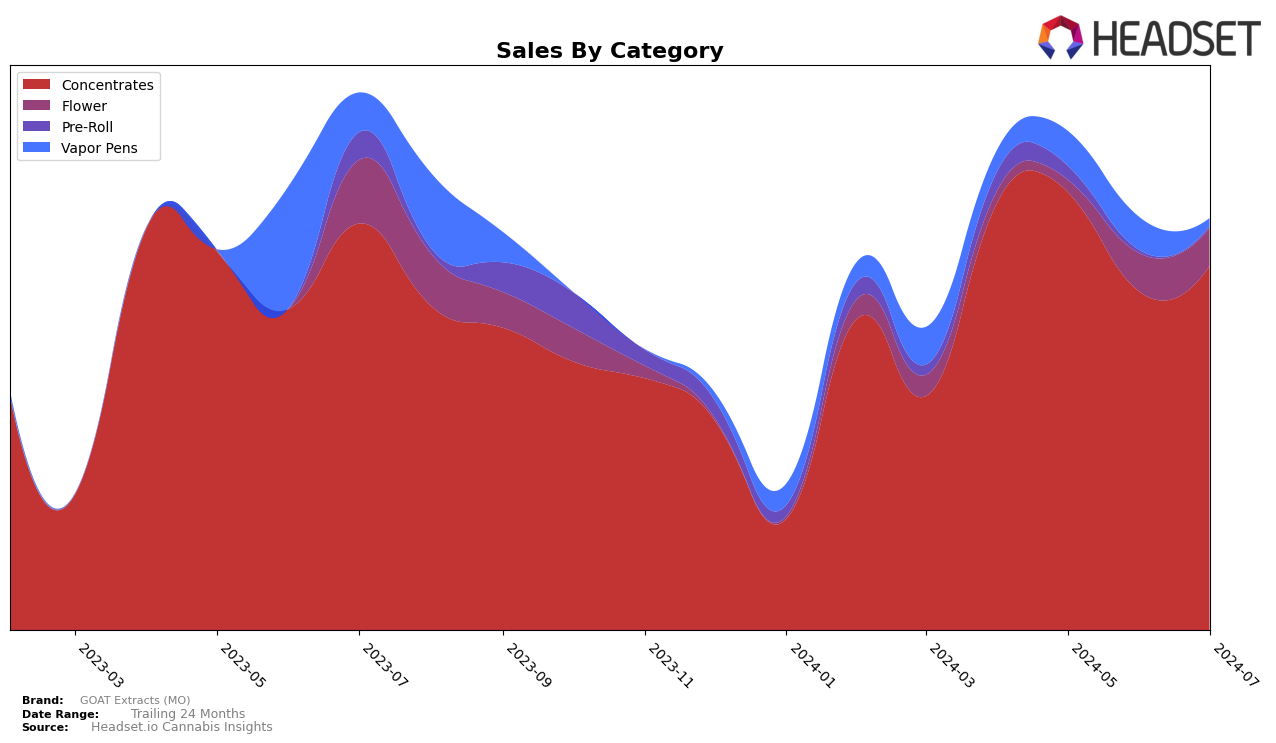

GOAT Extracts (MO) has shown consistent performance in the Concentrates category within Missouri. Their ranking has remained relatively stable, holding the third position in April, May, and July of 2024, with a slight dip to fourth place in June. This stability indicates a strong market presence and consumer preference for their concentrates. The brand's sales in this category saw a notable drop in June, but rebounded in July, suggesting a potential seasonal or supply-related fluctuation.

In contrast, GOAT Extracts (MO) has struggled to break into the top 30 in the Flower and Pre-Roll categories, with rankings mostly outside the top 50. The Flower category saw some improvement, moving from 54th in April to 45th in July, indicating a positive trend that could be worth watching. However, their performance in the Vapor Pens category has been inconsistent, ranking 65th in April and improving slightly to 59th by June, before dropping out of the top 30 in July. This inconsistency highlights potential challenges in maintaining a competitive edge across all product lines.

Competitive Landscape

In the competitive landscape of the Missouri concentrates market, GOAT Extracts (MO) has experienced notable fluctuations in its rank and sales over the past few months. Initially holding a strong position at rank 3 in April and May 2024, GOAT Extracts (MO) saw a dip to rank 4 in June before recovering to rank 3 in July. This oscillation is significant when compared to competitors such as Proper Cannabis, which consistently improved its rank from 4 to 2 over the same period, and Vivid (MO), which maintained the top position. Despite a dip in sales in June, GOAT Extracts (MO) managed to rebound in July, indicating resilience in a competitive market. Meanwhile, Good Day Farm and Heartland Labs showed significant upward trends, with Heartland Labs making a notable leap from rank 10 to 5 between June and July. These dynamics underscore the competitive pressures GOAT Extracts (MO) faces and highlight the importance of strategic adjustments to maintain and improve its market position.

Notable Products

In July 2024, the top-performing product for GOAT Extracts (MO) was Pro Punch THCa Diamonds (1g) in the Concentrates category, achieving the number one rank with notable sales of 1,304 units. Hybrid Moonrocks (1g) from the Flower category followed closely at the second position, although its sales slightly decreased from June. Peach Fuzz Live Diamonds (1g) held the third spot, maintaining its presence in the top ranks despite a minor drop in sales. Girl Scout Cookies Live Diamonds (1g) slipped to fourth place, continuing a downward trend from its peak in May. Biscotti Hash (1g) consistently remained in fifth place, showing stable performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.