Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

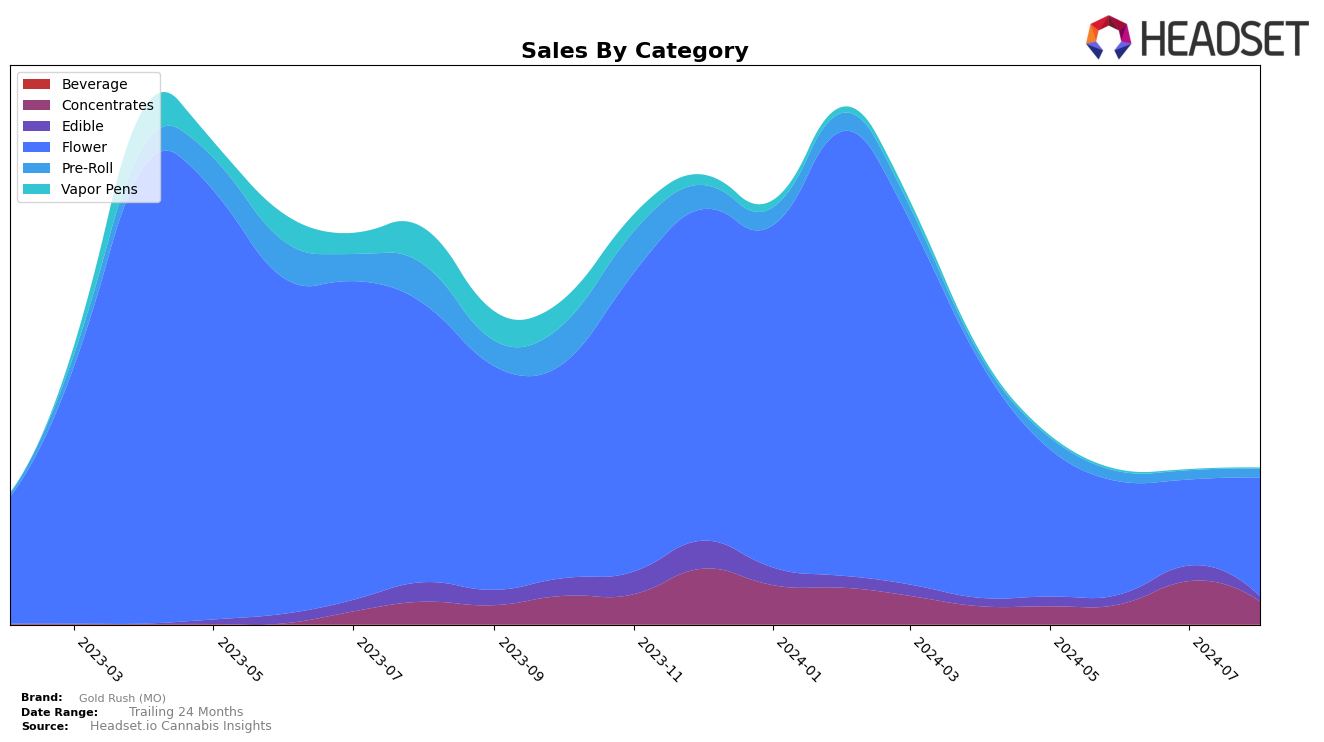

Gold Rush (MO) has shown a varied performance across different categories in Missouri. In the Concentrates category, the brand experienced a notable fluctuation, starting at rank 28 in May 2024, dropping to rank 30 in June, then rising significantly to rank 21 in July before falling back to rank 26 in August. Despite this volatility, the sales figures indicate a substantial increase in July, reaching $99,197, which suggests a peak in consumer interest or a successful marketing campaign during that month. However, the subsequent drop in rank and sales in August indicates that maintaining this momentum may be a challenge.

In the Edible category, Gold Rush (MO) struggled to break into the top 30, with rankings consistently below this threshold, peaking at rank 40 in July before falling to rank 52 in August. This indicates a weaker market presence in this segment compared to Concentrates. The Flower category showed more stability, with rankings fluctuating between 29 and 40, and sales showing a recovery in August to $274,137 after a dip in June and July. This indicates a resilient performance in Flower, suggesting a loyal customer base or effective product offerings. On the other hand, the Pre-Roll category saw consistently low rankings, never breaking into the top 30, with a slight improvement from rank 57 in May to rank 46 in August, signifying a need for strategic improvements in this area.

Competitive Landscape

In the highly competitive Missouri Flower category, Gold Rush (MO) has experienced notable fluctuations in its ranking over the past few months. Starting at rank 37 in May 2024, Gold Rush (MO) saw a slight improvement to rank 35 in June, but then dropped to rank 40 in July before making a significant recovery to rank 29 in August. This volatility contrasts with the more stable performance of competitors like Willie's Reserve, which maintained a relatively consistent ranking around the high 30s, and Cookies, which showed a slight decline but remained in the high 20s. Notably, Pinchy's has consistently outperformed Gold Rush (MO), holding ranks in the low 20s to high 20s. The sales trends reflect these rankings, with Gold Rush (MO) experiencing a dip in July but rebounding in August, while CuCo (Culture Collective) showed a significant rise from being outside the top 20 in May and June to rank 30 in August. These dynamics suggest that while Gold Rush (MO) is capable of recovery, it faces stiff competition from both established and emerging brands in the Missouri market.

Notable Products

In August 2024, the top-performing products for Gold Rush (MO) were Raspberry Diesel (3.5g) and Valley Girl OG (3.5g), both securing the first rank with notable sales figures of $1,632 each. Royal Slippers (3.5g) maintained its consistent performance, holding the second rank for four consecutive months. Dragon Fruit Pre-Roll (1g) made a significant leap to the third position from its previous fifth rank in May 2024. Hybrid RSO Syringe (1g) entered the top rankings for the first time, securing the fourth position. Overall, the product rankings show a dynamic shift, especially with the rise of Dragon Fruit Pre-Roll (1g) and the new entry of Hybrid RSO Syringe (1g).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.