Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

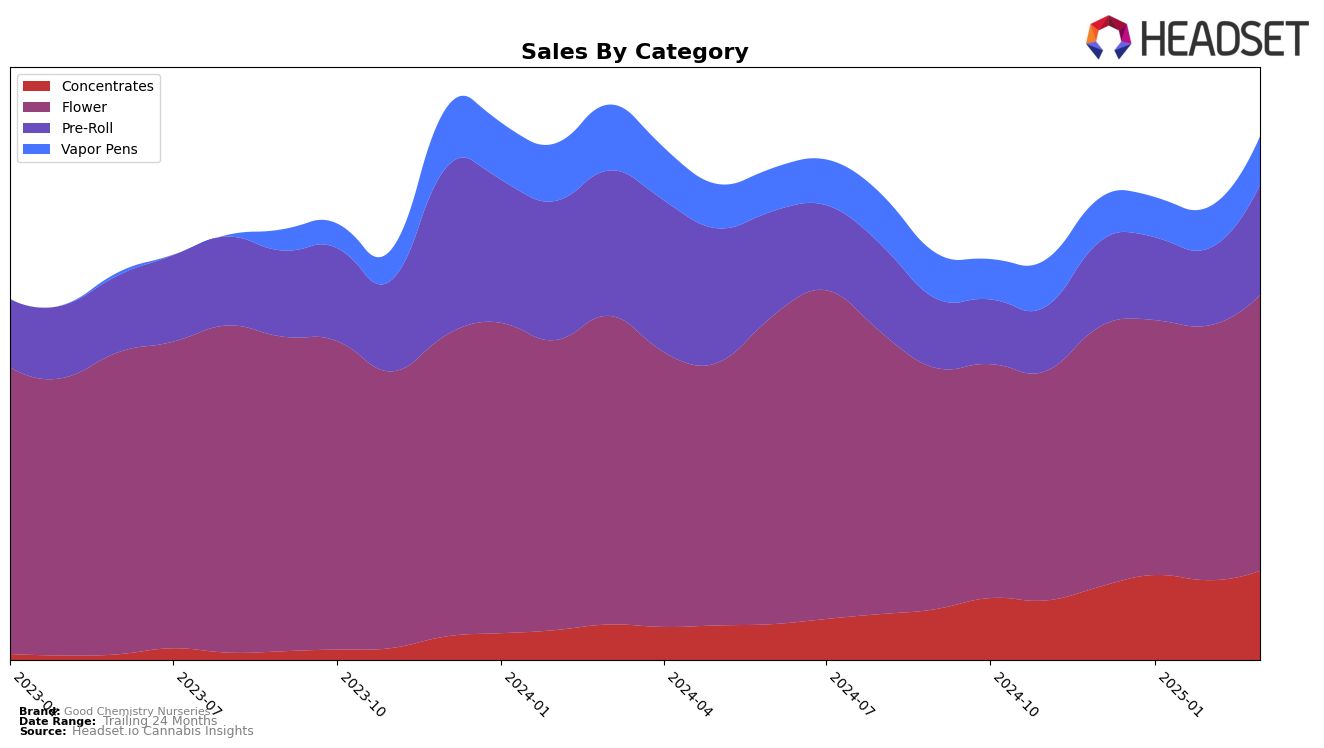

Good Chemistry Nurseries has shown a consistent performance across various categories in both Colorado and Massachusetts. In Colorado, the brand maintained a steady second-place ranking in the Flower category from December 2024 through March 2025, with a notable increase in sales in March. However, their performance in the Pre-Roll category was more volatile, with rankings outside the top 30 for February 2025, which could be a concern regarding their market penetration in this segment. Despite this, they rebounded to achieve a 12th place ranking by March.

In Massachusetts, Good Chemistry Nurseries has dominated the Concentrates category, consistently holding the top spot over the observed months. Their Flower category performance also showed positive momentum, climbing from 7th to 5th place before slightly dropping back to 6th by March. Notably, the Pre-Roll category saw a significant improvement, jumping from 6th to 2nd place by March 2025, indicating a strong growth trajectory. Although their Vapor Pens category rankings fluctuated between 14th and 17th, the consistent sales figures suggest a stable presence in the market.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Good Chemistry Nurseries consistently held the second rank from December 2024 to March 2025, indicating a stable position in the market. Despite a dip in sales from December to February, Good Chemistry Nurseries saw a significant rebound in March 2025, closing the gap with the leading brand, Seed & Strain Cannabis Co., which maintained the top rank throughout the period. Meanwhile, Triple Seven (777) and Classix remained consistently behind Good Chemistry Nurseries, ranked third and fourth respectively, with sales figures notably lower than Good Chemistry Nurseries. This stability in rank and the March sales surge suggest Good Chemistry Nurseries' resilience and potential for further growth in the competitive Colorado market.

Notable Products

In March 2025, the top-performing product for Good Chemistry Nurseries was Cloudy Daze Pre-Roll (1g), which achieved the number one rank with sales of 13,817 units. Sour Amnesia Pre-Roll (1g) maintained its position at rank two from February, with a slight increase in sales. Grape Cream Cake Pre-Roll (1g) entered the rankings at third place, indicating a strong performance for its initial reporting. Chocolate Chem Pre-Roll (1g) dropped from the top position in December 2024 to fourth place in March, showing a decline in sales figures. Completing the top five, 9 LB Hammer Pre-Roll (1g) made its debut in the rankings, suggesting a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.