Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

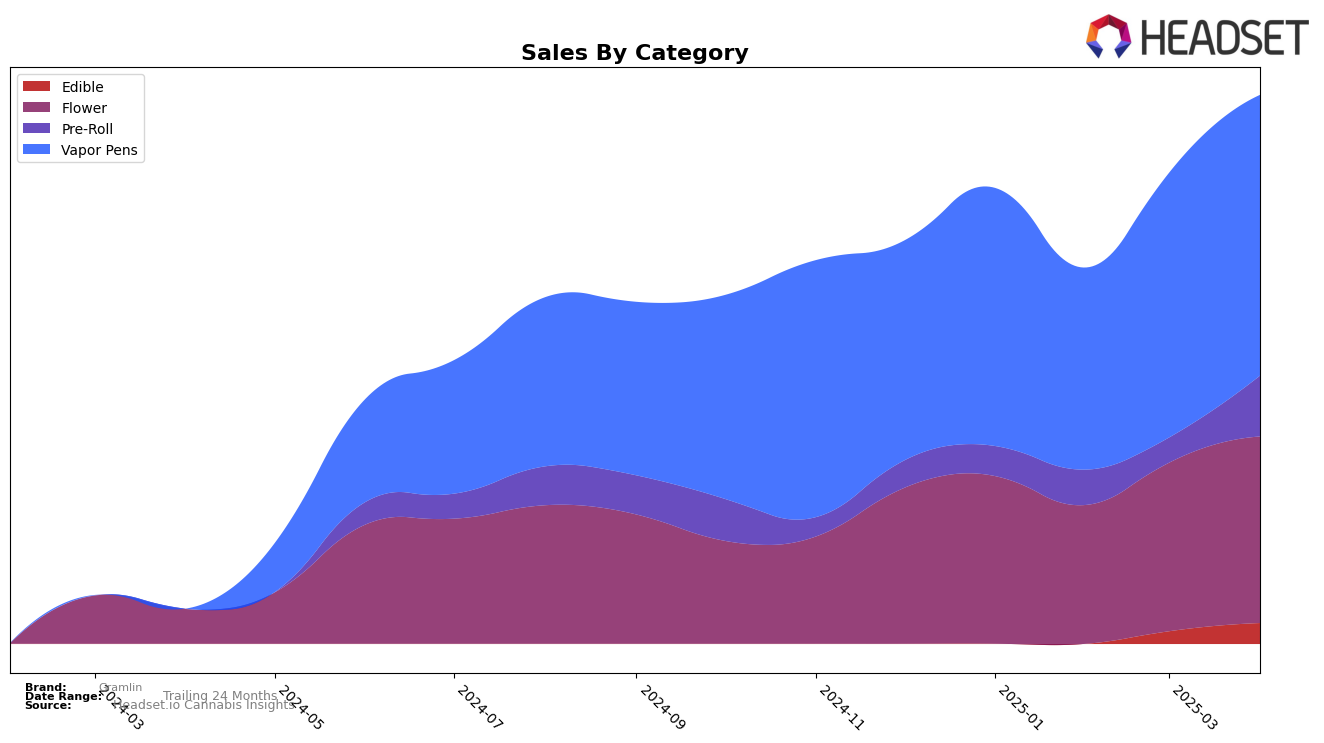

In California, Gramlin has shown notable performance across various cannabis categories. In the Edible category, the brand made a significant leap by entering the top 30 in March 2025, securing the 27th position, and further improving to the 19th rank by April. This upward trajectory suggests a growing consumer preference or successful marketing strategies in this segment. The Flower category has been a consistent stronghold for Gramlin, maintaining an 8th position from January to March 2025, and climbing to the 6th spot by April. This consistency, coupled with a slight upward movement, indicates a robust presence and possibly a loyal customer base in this category.

Meanwhile, in the Pre-Roll category, Gramlin's performance has been more volatile. The brand fluctuated between the 25th and 30th ranks from January to March 2025 but demonstrated a significant improvement by April, jumping to the 15th position. This could be indicative of a strategic change or a response to consumer demand. In the Vapor Pens category, Gramlin has maintained a strong position, consistently ranking within the top 7. Notably, the brand held the 5th rank in January, dropped slightly in February, but regained its position by March and April. This stability in a competitive category highlights Gramlin's effective market penetration and product appeal in California.

Competitive Landscape

In the competitive landscape of vapor pens in California, Gramlin has demonstrated notable resilience and adaptability. Despite a dip in February 2025, where it fell to seventh place, Gramlin quickly rebounded to secure the fourth rank by March and maintained this position in April. This recovery is significant, considering the strong presence of competitors like Raw Garden and Plug Play, which consistently held top positions. Gramlin's ability to climb back up the ranks suggests effective strategic adjustments, possibly in marketing or product offerings, which have positively impacted its sales trajectory. Meanwhile, Jetty Extracts and CAKE she hits different have shown less volatility, maintaining their ranks but not challenging the top three. This dynamic indicates that while Gramlin faces stiff competition, its upward trend in sales and rank positions it as a formidable player in the market.

Notable Products

In April 2025, Gramlin's top-performing product was the Blue Dream Distillate Disposable (1g) in the Vapor Pens category, reclaiming its top position from January after slipping to fifth place in February. The Blueberry Waffles Distillate Disposable (1g) maintained a strong performance, holding the second position for the month, with sales reaching 23,615. Strawberry Cough Distillate Disposable (1g) rose to third place, marking its first appearance in the top rankings since February. Watermelon Lemonade Distillate Disposable (1g) experienced a drop to fourth place after leading in March. Pineapple Express Distillate Disposable (1g) consistently held the fifth spot, showing stable performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.