Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

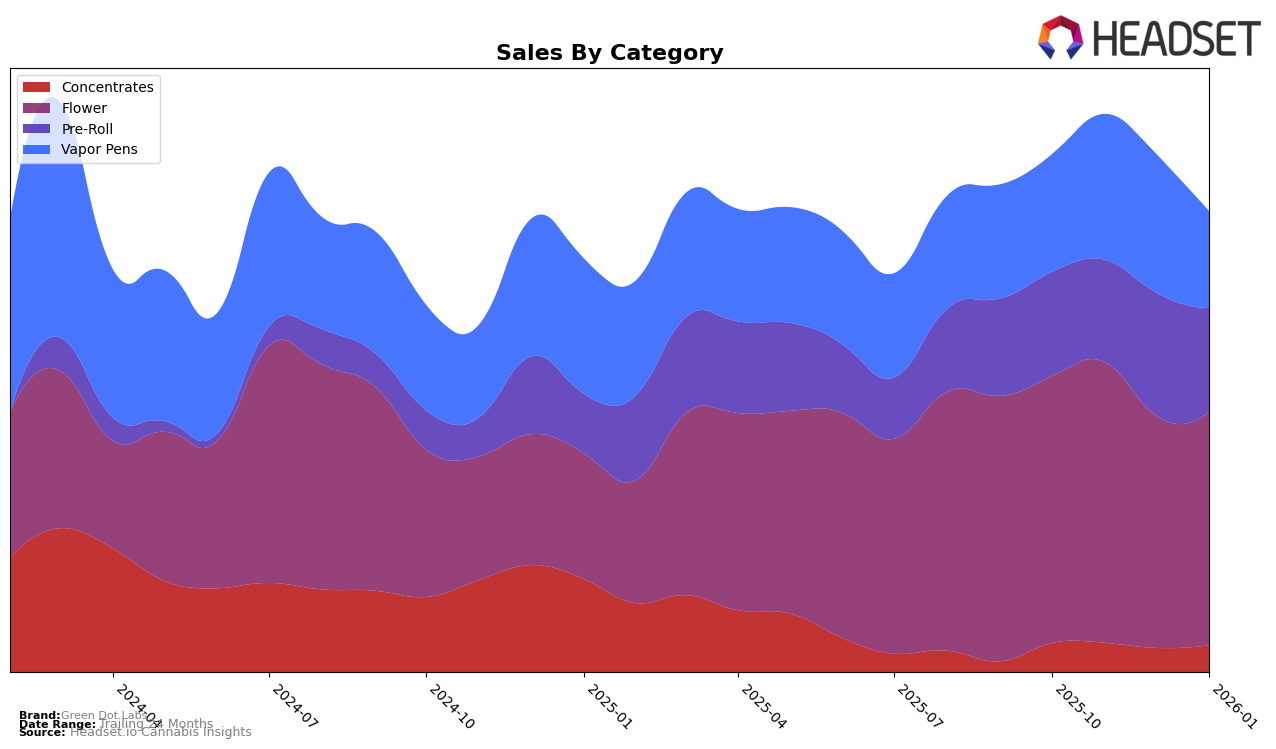

Green Dot Labs has shown a dynamic performance across different categories and states over the past few months. In Colorado, the brand has maintained a strong presence, particularly in the Pre-Roll category, where it ascended to the top position by January 2026. This reflects a consistent demand for their products in this category. However, in the Vapor Pens category, there's been a slight decline in ranking from 6th in October 2025 to 8th by January 2026, suggesting potential challenges or increased competition in this segment. In the Flower category, Green Dot Labs has shown resilience, maintaining a top 4 position consistently, which indicates a solid consumer base and product appeal in this market.

In contrast, Arizona presents a different scenario for Green Dot Labs. The brand has not made it to the top 30 in the Pre-Roll category for several months, which could be a cause for concern or an opportunity for growth in this market. In the Flower category, however, there's been a gradual improvement in their ranking from 45th in October 2025 to 39th by January 2026, despite fluctuations in sales figures. This upward movement might suggest strategic adjustments or an increasing acceptance of their products among consumers in Arizona. The data indicates that while Green Dot Labs has a strong foothold in Colorado, there is room for growth and improvement in Arizona, particularly in the Pre-Roll and Flower categories.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Green Dot Labs has consistently maintained a strong presence, ranking 4th in October and November 2025, improving to 3rd in December 2025, before settling back to 4th in January 2026. This fluctuation in rank highlights the dynamic nature of the market and the competitive pressure from brands like Triple Seven (777), which swapped positions with Green Dot Labs between December and January. Despite this, Green Dot Labs has demonstrated resilience with relatively stable sales figures, even as Good Chemistry Nurseries consistently held the 2nd position with significantly higher sales. Meanwhile, 710 Labs and LIT (CO) have shown more volatility in their rankings, indicating potential opportunities for Green Dot Labs to capitalize on any market shifts. Overall, Green Dot Labs' ability to maintain a top 5 position amidst fierce competition underscores its strong brand presence and customer loyalty in the Colorado flower market.

Notable Products

In January 2026, the top-performing product from Green Dot Labs was the Black Label - A5 Wagyu Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 3,186 units. The Dali Pre-Roll (1g) moved up to the second position from its previous third rank in December 2025. Garlic Banger Pre-Roll (1g) secured the third spot, making its first appearance in the top rankings. The Thunderdome Pre-Roll (1g) dropped from second place in November 2025 to fourth in January 2026. Lastly, the Kashmir Pre-Roll (1g) entered the rankings at fifth place, indicating a positive sales trajectory.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.