Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

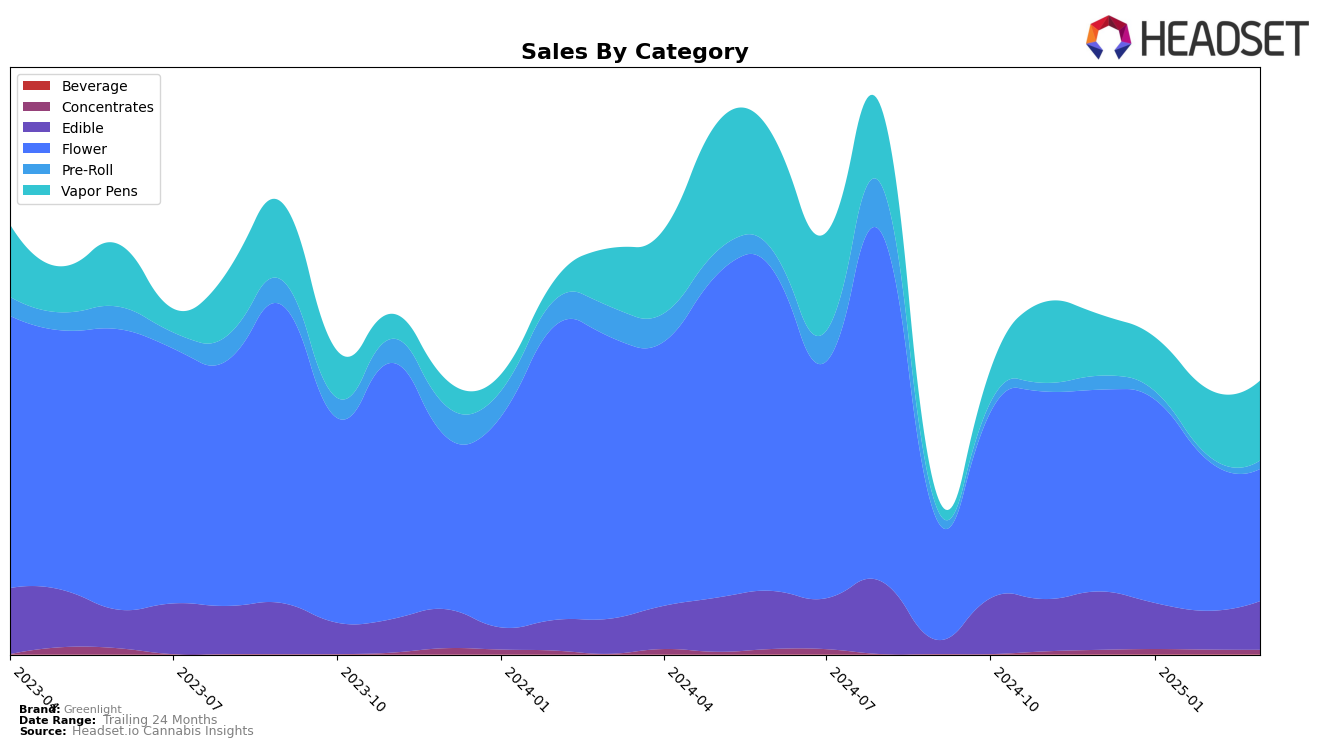

Greenlight's performance across various product categories in Missouri reveals some interesting trends. In the Edible category, the brand experienced fluctuations in its rankings, moving from 11th in December 2024 to 16th in January 2025, then improving slightly to 15th in February, and further to 13th in March. Despite these ranking changes, sales figures show a decline during the first two months of 2025, but a recovery in March. Conversely, in the Flower category, Greenlight's rankings saw a gradual decline from 11th in December to 13th in March, with sales reflecting a significant drop from January to March. This suggests a potential challenge in maintaining market share in the Flower category despite a strong start to the year.

The Pre-Roll category presented a more challenging landscape for Greenlight in Missouri. Ranking 29th in December, the brand fell out of the top 30 in February, indicating difficulties in sustaining a competitive position. However, Greenlight's performance in the Vapor Pens category was more promising, with a consistent improvement in rankings from 23rd in December to 18th in March, alongside a notable upward trend in sales during the same period. This indicates a strengthening position in the Vapor Pens market, suggesting that Greenlight's strategy in this category may be more effective. The diverse performance across categories highlights the varying competitive dynamics Greenlight faces within the Missouri cannabis market.

Competitive Landscape

In the Missouri flower category, Greenlight has experienced notable fluctuations in its ranking and sales over the past few months. Starting from December 2024, Greenlight was ranked 11th, improving to 10th in January 2025, but then slipping to 12th and 13th in February and March, respectively. This downward trend in rank is mirrored by a decrease in sales, particularly from January to March. Meanwhile, competitors such as Elevate (Elevate Missouri) and Rooted (MO) have shown resilience, with Rooted (MO) climbing from 19th in December to 11th by March, indicating a strong upward trajectory. Buoyant Bob also demonstrated competitive strength, peaking at 10th in February before a slight decline. These dynamics suggest that while Greenlight remains a key player, it faces stiff competition from brands that are gaining traction in the Missouri market, necessitating strategic adjustments to maintain its market position.

Notable Products

In March 2025, the top-performing product for Greenlight was the Sativa Strawberry Gummies 10-Pack (100mg) in the Edible category, which rose to the number one spot with notable sales of 5485 units. Silver - Cookies n Cream (3.5g) in the Flower category climbed to second place, showing a consistent performance from its fourth position in January. The Granddaddy Purple Distillate Cartridge (1g) entered the rankings at third place for Vapor Pens, indicating a new preference trend. Chem Driver Pre-Roll (1g) held the fourth position, maintaining its presence in the Pre-Roll category. Jack Herer Distillate Cartridge (1g) debuted in the rankings at fifth place, showcasing a growing interest in Vapor Pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.