Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

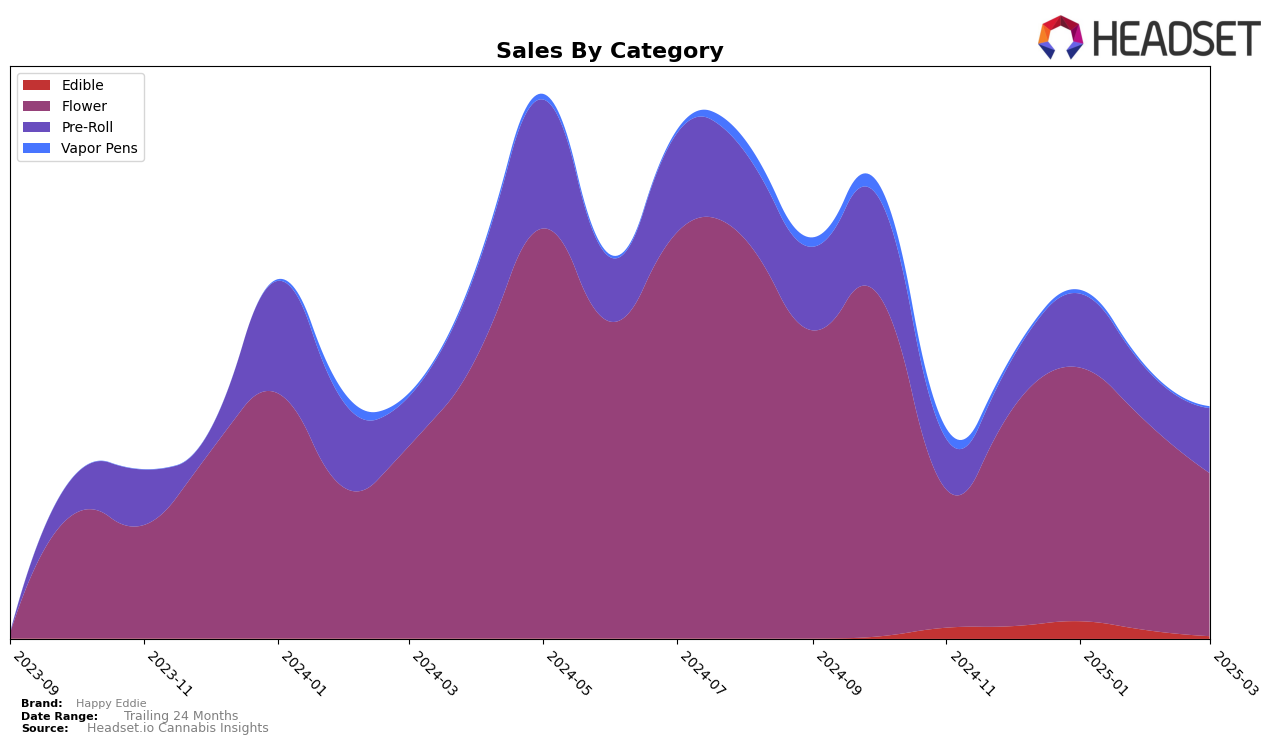

Happy Eddie's performance across categories in Maryland shows notable fluctuations. In the Edible category, Happy Eddie made a significant leap from being outside the top 30 in December 2024 to securing the 29th position by January 2025. This upward movement indicates a growing consumer interest in their edible products. However, the absence of rankings for February and March 2025 suggests that they fell out of the top 30, which could be a point of concern. Meanwhile, their Flower category experienced a decline, moving from 31st in February to 35th by March 2025, which might suggest increased competition or shifting consumer preferences.

In the Pre-Roll category, Happy Eddie has shown a more stable performance in Maryland. They improved their ranking from 30th in December 2024 to 24th in January 2025, which was followed by a slight drop to 29th in February but then a recovery to 27th in March 2025. This indicates a relatively steady demand for their pre-rolls despite minor fluctuations. The sales data corroborates these trends, with notable increases in January sales across categories, suggesting a strong start to the year. However, the brand's challenge will be to maintain or improve these positions in the coming months.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Happy Eddie has experienced notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 31 in December 2024, Happy Eddie climbed to 28 in January 2025, indicating a positive reception during the new year. However, by March 2025, the brand slipped to rank 35, suggesting increased competition or shifts in consumer preferences. Notably, Khalifa Kush and Belushi's Farm have shown similar fluctuations, with Khalifa Kush peaking at rank 28 in February 2025 and Belushi's Farm maintaining a relatively stable presence despite a slight decline. Meanwhile, Redemption and In House have shown upward trends, with Redemption improving its rank significantly from 44 in January to 34 in February, and In House making a debut in January at rank 40 and maintaining a competitive edge. These dynamics highlight the volatile nature of the market and underscore the need for strategic positioning by Happy Eddie to regain and sustain its competitive edge.

Notable Products

In March 2025, the top-performing product for Happy Eddie was Zen Wen Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one rank for the third consecutive month with notable sales of 3901 units. Mischief Pre-Roll 2-Pack (1g) climbed to the second position, improving from its fourth-place rank in the previous two months, with sales reaching 2118 units. Nigerian Silver (3.5g) in the Flower category secured the third spot, moving down from its second position in February. The CEO Pre-Roll 2-Pack (1g) dropped to fourth place, continuing its downward trend from second in January. Zen Wen (3.5g) made its first appearance in the top five, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.