Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

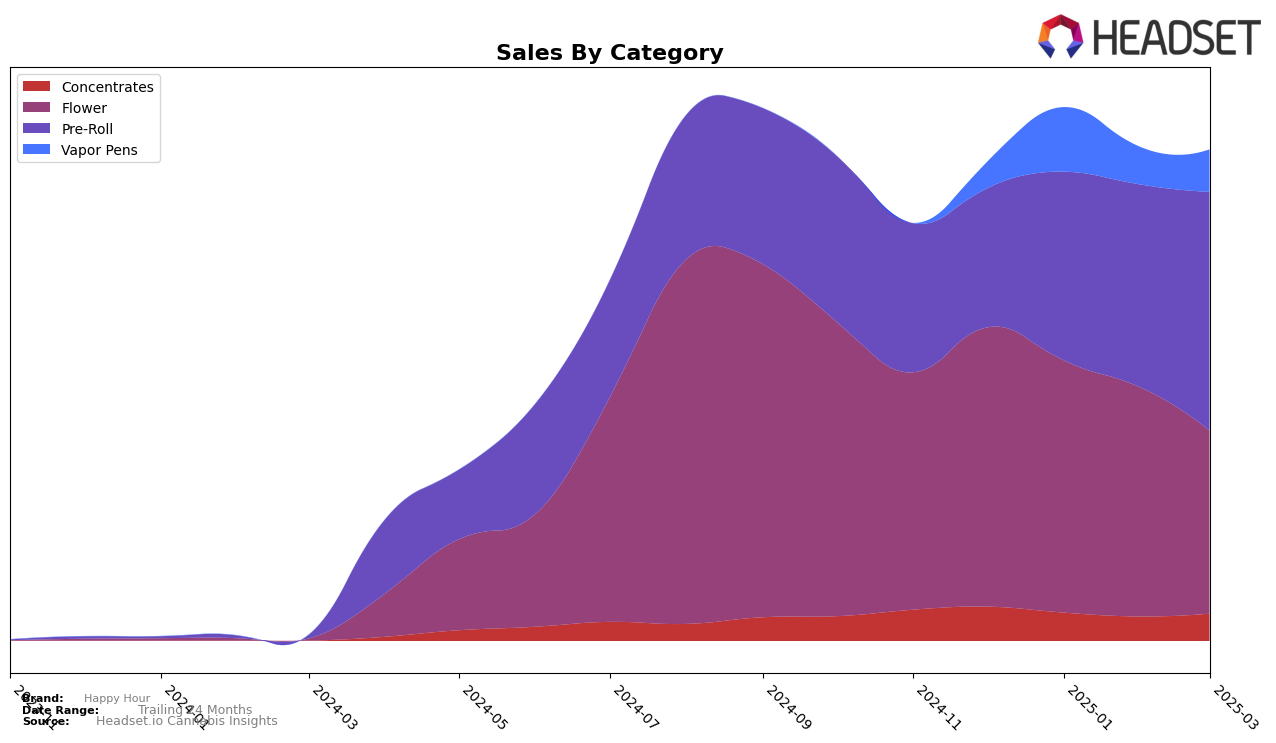

In the province of British Columbia, Happy Hour has shown varied performance across different cannabis categories. In the Concentrates category, the brand maintained a presence within the top 30, with rankings fluctuating between 24th and 27th position from December 2024 to March 2025. This consistency indicates a stable market presence despite a dip in sales during January and February. Meanwhile, in the Flower category, Happy Hour experienced a brief surge to 25th position in February 2025 before dropping back to 31st in March, highlighting a volatile performance in this segment. Notably, the brand's Pre-Roll category witnessed a significant improvement, climbing from 44th in December to 29th by February and maintaining that rank in March, suggesting a growing consumer interest in this product line.

On the other hand, Happy Hour's performance in the state of Massachusetts was less prominent, as the brand did not appear in the top 30 brands for any category beyond December 2024. Their initial rank of 72nd in the Flower category suggests limited market penetration, and the absence of subsequent rankings indicates a potential struggle to maintain a competitive edge in this state. This contrast between provinces and states highlights the brand's varying market strategies and consumer reception across different regions. The data suggests that while Happy Hour is gaining traction in certain categories in British Columbia, there is room for growth and improvement in Massachusetts.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Happy Hour has shown a promising upward trajectory in its rankings from December 2024 to March 2025. Initially ranked at 44th in December, Happy Hour improved to 29th by February and maintained this position in March, indicating a positive trend in market presence. This upward movement is noteworthy, especially when compared to competitors like BLKMKT, which started at a lower rank of 60th and climbed to 31st by March, and Jonny Chronic, which improved from 43rd to 30th in the same period. Meanwhile, Simply Bare and The Original Fraser Valley Weed Co. consistently maintained higher ranks, with Simply Bare fluctuating slightly but remaining in the top 30. The consistent sales growth of Happy Hour, culminating in March, suggests a strengthening brand position amidst intensifying competition, making it a brand to watch in the evolving Pre-Roll market of British Columbia.

Notable Products

In March 2025, Harmony Haze Pre-Roll (0.5g) maintained its position as the top-performing product for Happy Hour, with sales reaching 9,880 units. Nighttime Nirvana Pre-Roll (0.5g) held steady in second place, continuing its consistent performance from January and February. Sativa Pre-Roll 2-Pack (2g) remained in third place, showing stable sales figures across the months. Indica Pre-Roll 2-Pack (2g) experienced a decline in ranking since December 2024, dropping from first to fourth place by March 2025. Midday Mix - Gastro Pop Pre-Roll (0.5g) entered the rankings in February and held onto the fifth position in March, indicating a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.