Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

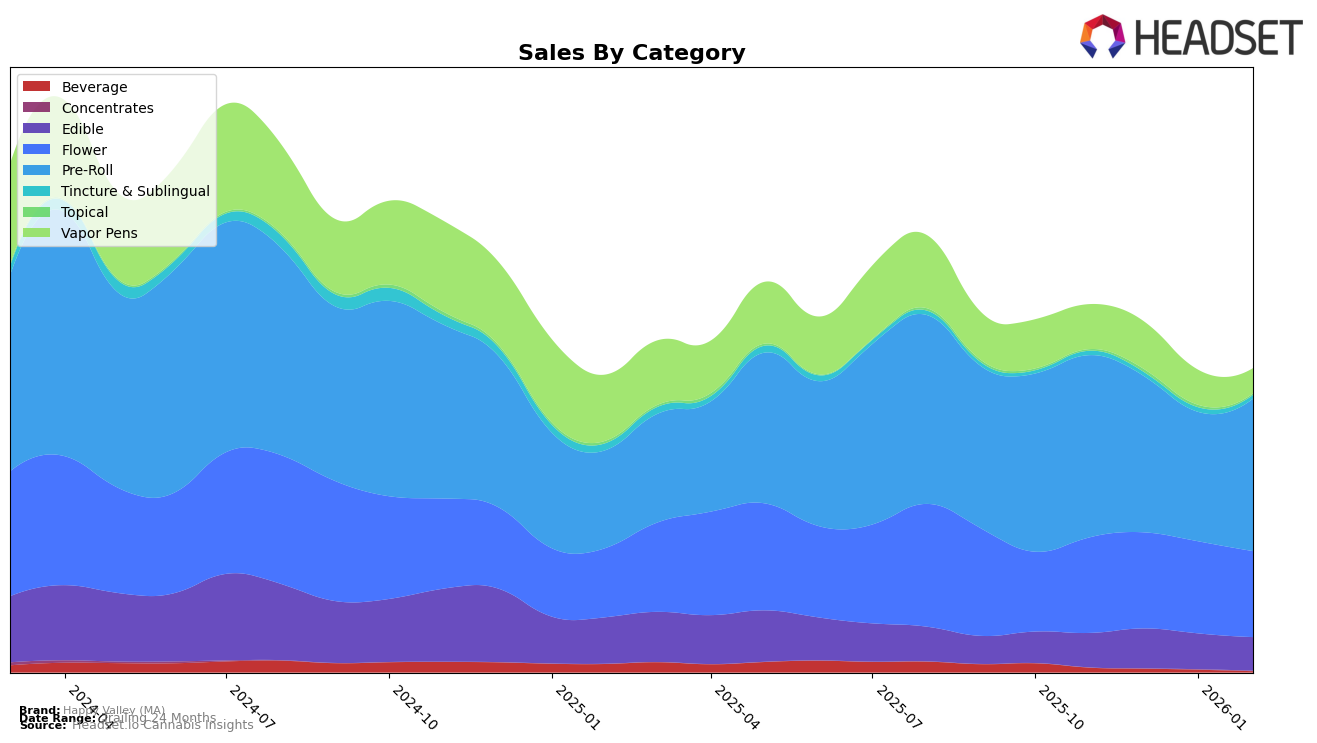

Happy Valley (MA) has shown a steady presence in the Massachusetts cannabis market, particularly in the Edible category, maintaining its rank at 23rd from December 2025 through February 2026. Despite a minor dip in sales from December to February, the brand has managed to hold its position, indicating a consistent consumer base. However, the Flower category tells a different story, where Happy Valley has not been able to break into the top 30 rankings, suggesting a more competitive landscape or potential areas for product improvement. The Pre-Roll category, on the other hand, is a strong point, with Happy Valley climbing back to 6th position in February 2026 after a brief decline, showcasing resilience and possibly effective marketing strategies or product offerings that resonate well with consumers.

The Vapor Pens category presents both challenges and opportunities for Happy Valley in Massachusetts. The brand's rank fell from 38th in December 2025 to 50th by February 2026, accompanied by a notable decrease in sales. This trend might indicate growing competition or shifting consumer preferences that the brand needs to address. It is clear that while Happy Valley has strongholds in certain categories, there are others where they are either absent from the top rankings or experiencing declining performance. This mixed performance across categories suggests that while the brand has established itself well in some areas, there remains room for strategic adjustments to improve its standing across the board.

Competitive Landscape

In the Massachusetts Pre-Roll market, Happy Valley (MA) has experienced notable fluctuations in its ranking over the past few months, reflecting a dynamic competitive landscape. Starting from a rank of 6th in November 2025, Happy Valley (MA) saw a decline to 9th in December and further down to 11th in January 2026, before rebounding back to 6th in February. This volatility contrasts with the more stable performance of competitors like Nature's Heritage, which consistently maintained a top 4 position. Meanwhile, No.9 Sunflower Collection experienced a downward trend, dropping from 3rd to 7th place over the same period. Simpler Daze showed an upward trajectory, improving from 9th to 5th place, suggesting a potential challenge to Happy Valley (MA)'s position. These shifts indicate a highly competitive environment where maintaining or improving rank requires strategic adjustments, especially as sales figures for Happy Valley (MA) show a recovery in February after previous declines.

Notable Products

In February 2026, Super Lemon Haze Pre-Roll (1g) maintained its top position as the best-selling product for Happy Valley (MA), continuing its streak from previous months with sales of 4957 units. Banana Jealousy Pre-Roll (1g) held steady at the second spot, showing consistent performance. Dirty Taxi Pre-Roll (1g) saw a notable rise, moving up to third place from fifth in January 2026. Super Lemon Haze (3.5g) experienced a slight decline, dropping to fourth from third place, while White Wedding Pre-Roll (1g) rounded out the top five, maintaining its position from January. These rankings reflect a strong preference for pre-rolls among consumers, with only one flower product making the top five list.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.