Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

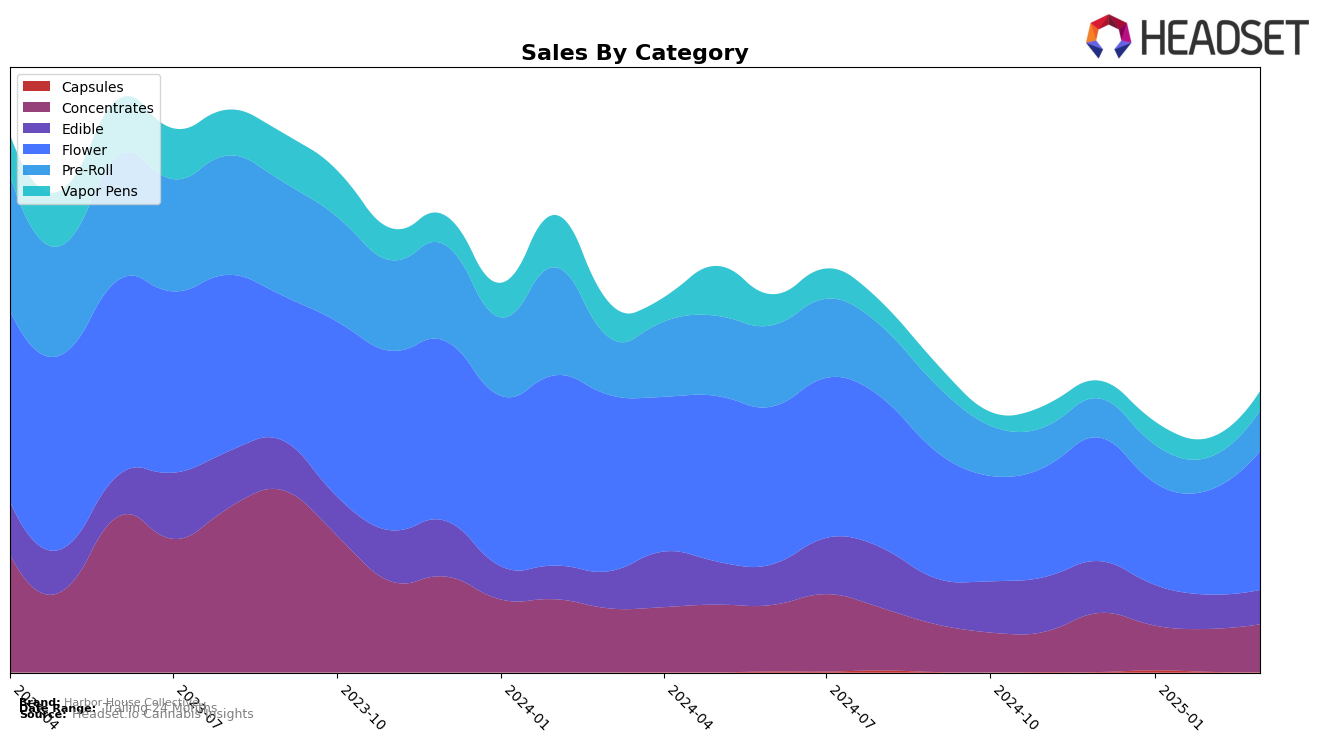

Harbor House Collective has shown varied performance across different product categories in Massachusetts. In the Concentrates category, the brand maintained a consistent presence in the top 15 with rankings hovering around the 10th position from January to March 2025, despite a noticeable dip in sales in January. This steadiness in ranking indicates a strong foothold in the Concentrates market. In contrast, their performance in the Edible category has been less stable, slipping out of the top 30 by March 2025, which might suggest a need for strategic adjustments to regain market share in this segment.

The Flower category has been a bright spot for Harbor House Collective, with a notable improvement in March 2025, climbing back to the 40th position after a decline in the previous months. This upward trend could be indicative of successful product offerings or marketing strategies. However, the Pre-Roll and Vapor Pens categories present a mixed picture. While the Pre-Roll rankings remained relatively stable, they did not break into the top 50, suggesting room for growth. Meanwhile, the Vapor Pens category saw a slight improvement in rankings, but not enough to enter the top 60, pointing towards potential challenges or opportunities for innovation in this area.

Competitive Landscape

In the Massachusetts flower category, Harbor House Collective has shown a dynamic shift in its competitive positioning from December 2024 to March 2025. Initially ranked 42nd in December, it experienced a slight decline in January and February, dropping to 46th and 49th, respectively. However, by March, Harbor House Collective rebounded to 40th place, indicating a positive trend in its market presence. This improvement in rank coincides with a notable increase in sales, surpassing competitors like Happy Valley and Simpler Daze, which saw a decline in their sales figures and rankings. Meanwhile, Tower Three and Trees Co. (TC) have maintained stronger positions, though Harbor House Collective's recent sales surge suggests a potential for further upward movement. This competitive landscape highlights the volatility and opportunities within the Massachusetts flower market, emphasizing the importance of strategic positioning and market responsiveness.

Notable Products

In March 2025, the top-performing product for Harbor House Collective was Motorbreath Pre-Roll (0.5g) in the Pre-Roll category, securing the number one rank with sales reaching 1087 units. Following closely was Sour Blue Raspberry Rosin Gummies 20-Pack (100mg) in the Edible category, which ranked second, having slipped from its top position in December 2024 and February 2025. Kosher Kush (3.5g) in the Flower category climbed to third place, showing a steady improvement from its fourth-place ranking in December 2024 and January 2025. Kosher Kush x Albarino Pre-Roll (0.5g) debuted in the rankings at fourth place. Lastly, Motorbreath (3.5g) in the Flower category entered the list at fifth place, rounding out the top five products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.