Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

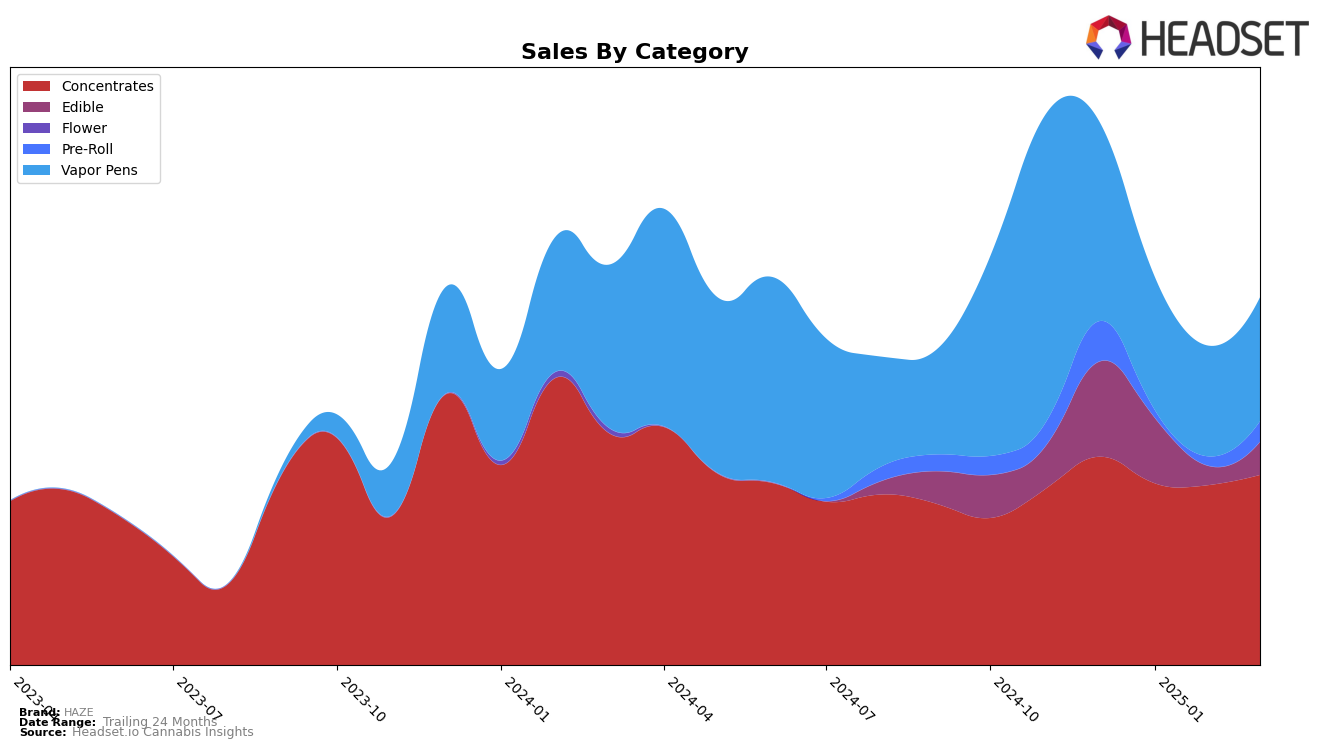

In the state of Massachusetts, HAZE has shown consistent performance in the Concentrates category, maintaining a steady rank of 6th place in December 2024 and March 2025, with a slight dip to 7th in January and February 2025. This indicates a strong foothold in the Concentrates market, with sales showing a positive trend from $157,113 in December 2024 to $164,727 by March 2025. However, in the Vapor Pens category, HAZE is struggling to break into the top 90, languishing in the low 90s throughout the observed months. This suggests a potential area for growth or reevaluation of strategy to improve their standing in this competitive segment.

Meanwhile, in New Jersey, HAZE's performance is more varied across different categories. In the Concentrates category, HAZE started at 11th place in December 2024 but experienced a slight decline, ranking 14th in January and February 2025, before improving to 12th in March 2025. This reflects some volatility but also the potential to regain a stronger position. In contrast, the Edible category presents a more challenging scenario, with HAZE dropping out of the top 30 in February 2025, indicating a significant decline in market presence. Moreover, the Pre-Roll category saw HAZE not ranking in January 2025, which highlights a gap in maintaining consistent visibility and sales in this segment. The Vapor Pens category also shows a downward trend, with ranks slipping from 24th in December 2024 to 30th by March 2025, suggesting the need for strategic adjustments to reverse this trajectory.

Competitive Landscape

In the Massachusetts concentrates market, HAZE has maintained a stable presence, consistently ranking between 6th and 7th from December 2024 to March 2025. This stability is notable given the fluctuations among its competitors. For instance, Local Roots has shown a significant upward trend, climbing from 17th to 8th place, which indicates a strong growth trajectory that could pose a future threat to HAZE's market position. Meanwhile, Crispy Commission Concentrates has experienced a decline, dropping from 2nd to 4th place, suggesting potential vulnerabilities that HAZE could capitalize on. Rave has shown impressive growth, moving from 7th to 5th place, with sales surpassing HAZE in recent months, indicating a competitive edge. Conversely, Cultivators Classic has seen a decline in rank, from 3rd to 7th, which might provide HAZE an opportunity to strengthen its position if it can leverage its consistent sales performance effectively.

Notable Products

In March 2025, NY Sour Diesel Live Badder (1g) emerged as the top-performing product for HAZE, climbing to the number one rank in the Concentrates category with impressive sales of 1,246 units. Purple Haze Wax (1g) followed closely, securing the second position, showing a slight dip in sales from February. Haze x Mudd Brothers - Sundae Sherbert Live Resin Cartridge (0.5g) maintained a strong presence, ranking third despite a decrease from its January peak. Fried Ice Cream Live Badder (1g) debuted in the rankings at the fourth position, marking its entry into the competitive market. Meanwhile, Haze x Mudd Brothers - Tahoe Cream Live Resin Disposable (0.5g) rounded out the top five, indicating steady performance since its introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.