Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Herbal Dispatch Craft has shown varied performance across different categories and provinces, with notable movements in British Columbia. In the Concentrates category, the brand did not make it into the top 30 rankings from September to December 2025, indicating a potential area for improvement or increased competition. However, the Flower category saw some activity, with the brand entering the rankings in October 2025 at 77th place and dropping to 97th by November. This downward trend might suggest challenges in maintaining market share or growing competition in the Flower category.

Despite not being ranked in the top 30 for Concentrates, Herbal Dispatch Craft's sales in this category reached $13,703 in December 2025, which could hint at a niche market presence or loyal customer base that isn't large enough to break into the top rankings. The Flower category, while seeing a decline in rank, still maintained a steady sales figure of $21,989 in November 2025. This indicates that while the brand's rank dropped, it still retains a solid foothold in the market, suggesting potential for growth if strategic adjustments are made. The fluctuations in these rankings highlight the dynamic nature of the cannabis market in British Columbia and the importance of continuous market analysis and adaptation.

Competitive Landscape

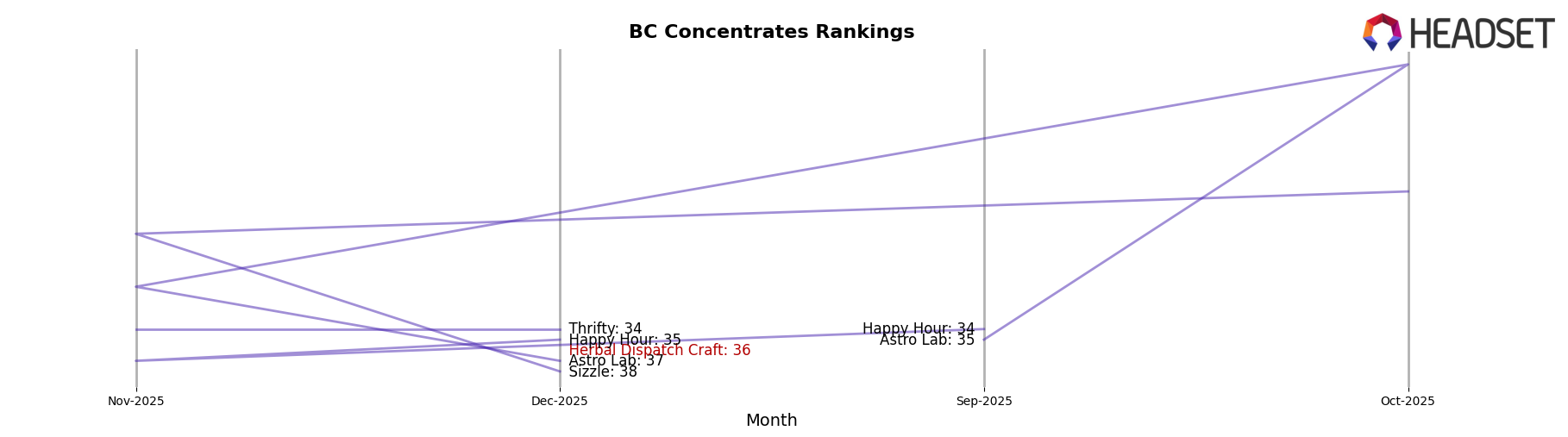

In the competitive landscape of the concentrates category in British Columbia, Herbal Dispatch Craft has shown a notable presence, although it only appeared in the top 20 brands in December 2025, ranking 36th. This indicates a potential for growth, especially when compared to competitors like Astro Lab, which saw a significant fluctuation in rank, peaking at 9th in October before dropping to 37th in December. Meanwhile, Sizzle experienced a decline from 21st in October to 38th in December, suggesting a volatile market environment. Happy Hour maintained a more stable presence, ranking 35th in December. These dynamics highlight the competitive pressures Herbal Dispatch Craft faces, yet also underscore opportunities for strategic positioning and market share expansion in a fluctuating market.

Notable Products

In December 2025, the top-performing product for Herbal Dispatch Craft was Premium Live Hash Rosin RSO (1g), which climbed to the number one rank with impressive sales of 231 units. RSO Phoenix Tears Live Hash Rosin (1g) maintained its strong performance, holding steady at the second rank. Purple Nuken (28g) saw a significant drop, moving from first place in previous months to third in December. The CBD/THC 1:1 Relief Cream (125mg CBD, 125mg THC, 50ml) remained consistent, staying in fourth place as it did in November. Notably, Cake City Hash Rosin (1g), which had appeared in the rankings in September, did not feature in the top ranks for December.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.