Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

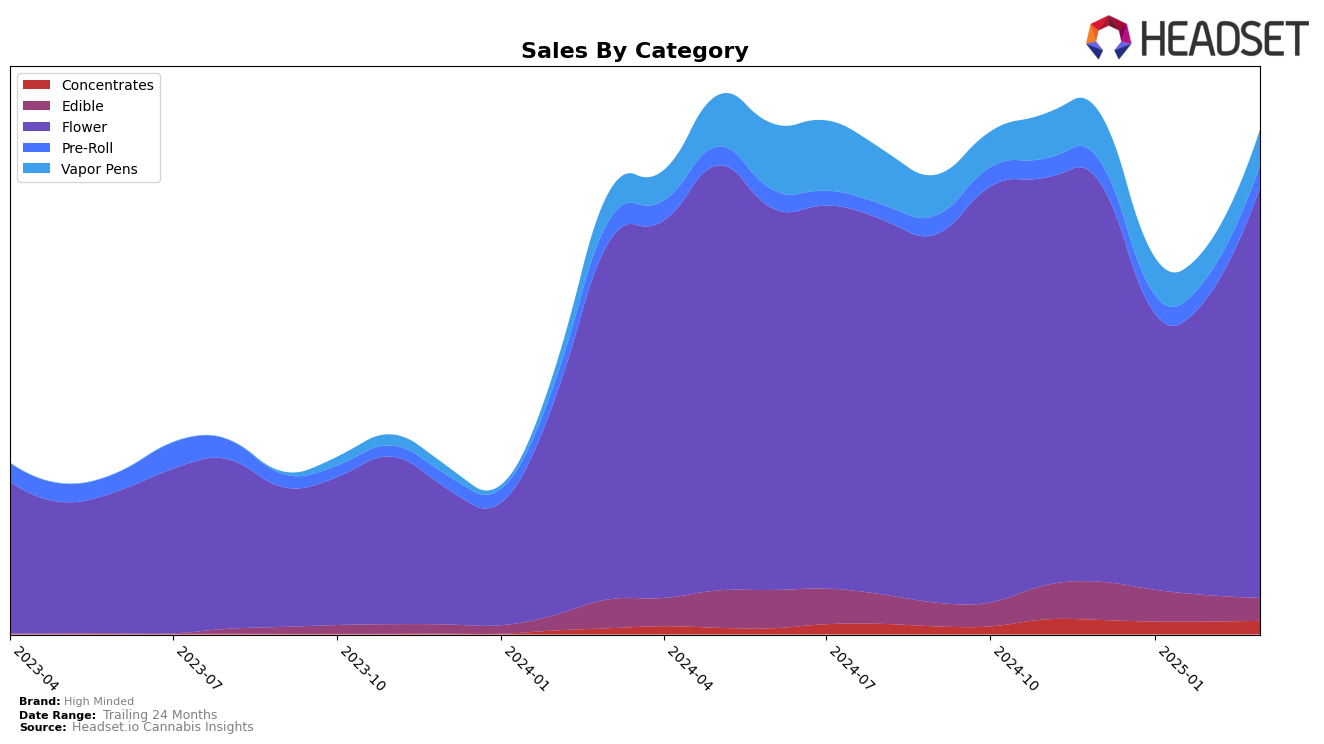

High Minded has demonstrated varied performance across different product categories in Michigan. In the Flower category, the brand has shown remarkable consistency, maintaining a top position with a brief dip to third place in January 2025 before reclaiming the number one spot by March 2025. This indicates a strong consumer preference and possibly effective marketing strategies in this category. In contrast, their performance in the Edible category has seen a gradual decline from 15th to 21st place over the four-month period. This downward trend suggests potential challenges in maintaining consumer interest or competition from other brands in the Edible market.

In the Concentrates and Vapor Pens categories, High Minded has experienced fluctuating rankings, indicating a competitive landscape in these segments. The brand moved from 22nd to 24th place in Concentrates, showing a slight recovery after a drop to 28th in February 2025. Similarly, in the Vapor Pens category, High Minded improved its position from 23rd to 20th by March 2025 after a dip in January. However, the Pre-Roll category presents a more challenging scenario, with the brand hovering around the bottom of the top 30, even dropping out of the rankings in January. This suggests that while High Minded holds a strong position in certain categories, there are areas where they face significant competition and potential for growth.

Competitive Landscape

In the competitive landscape of the Michigan flower category, High Minded has demonstrated resilience and strategic agility, reclaiming its top position by March 2025 after a brief dip in rank. Despite a challenging start to the year, where it fell from first to third place in January, High Minded's sales trajectory shows a robust recovery, culminating in a strong performance that outpaces competitors. Notably, Pro Gro and Society C have been formidable contenders, with Pro Gro reaching the top rank in February and Society C leading in January. However, High Minded's ability to rebound and secure the number one spot in March underscores its strong market presence and effective sales strategies, suggesting a promising outlook for sustained leadership in the Michigan flower market.

Notable Products

In March 2025, High Minded's top-performing product was Lemon Cherry Gelato (Bulk) in the Flower category, securing the first rank with sales reaching 14,012 units. Tropical Punch Gummies 20-Pack (200mg), previously holding the top spot for three consecutive months, dropped to second place. Cadillac Rainbow #7 (Bulk) entered the rankings at third place, showing a strong performance in the Flower category. Blue Raspberry Gummies 10-Pack (200mg) saw a decline, slipping to fourth place from its previous second position in January 2025. Strawberry Lemonade Gummies 20-Pack (200mg) rounded out the top five, making its debut in the rankings for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.