Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

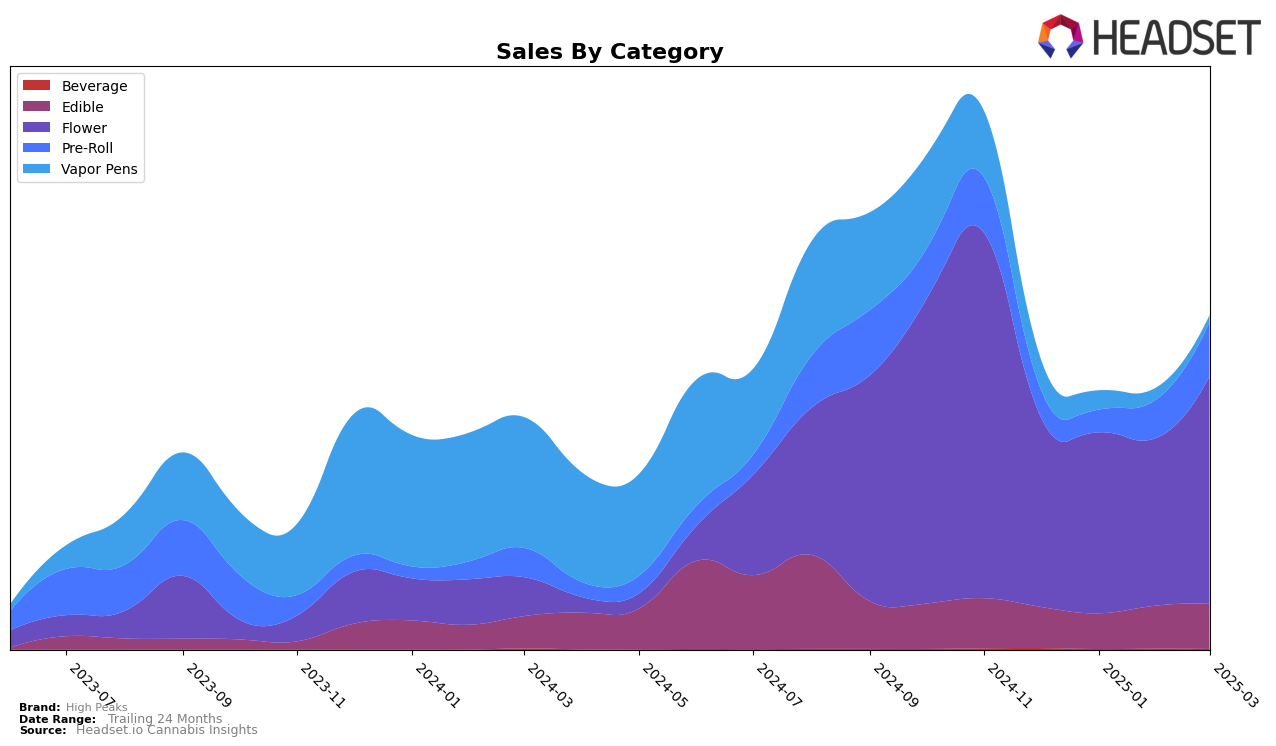

High Peaks has shown a varied performance across different product categories in New York. In the Edible category, the brand has consistently ranked outside the top 30, holding steady at 39th position in both December 2024 and January 2025, before slipping to 40th by March 2025. Despite this, there was a noticeable uptick in sales from February to March 2025, indicating a potential positive trend. Meanwhile, in the Flower category, High Peaks experienced a significant improvement in its ranking, climbing from 47th in February 2025 to 42nd in March 2025, alongside a substantial increase in sales, suggesting a strengthening presence in this competitive category.

The Pre-Roll category presents an interesting dynamic for High Peaks in New York. Although the brand was not ranked in January 2025, it managed to re-enter the top 100 by February, reaching 86th place and improving further to 76th by March 2025. This upward movement coincided with a marked increase in sales, which could indicate growing consumer interest. Conversely, in the Vapor Pens category, High Peaks saw a decline in rankings from 77th in December 2024 to 86th in January 2025, and it did not make the top 30 in subsequent months, which may suggest challenges in maintaining competitive momentum in this segment.

Competitive Landscape

In the competitive landscape of the New York Flower category, High Peaks has shown a consistent presence, maintaining a rank in the mid-40s from December 2024 to March 2025. Despite a slight dip in sales in January and February, High Peaks rebounded in March with a notable increase, suggesting resilience and potential for growth. In contrast, Old Pal and CAM have experienced more volatile ranking changes, with Old Pal dropping to 44th in March after climbing to 31st in February, and CAM showing a significant improvement from 56th in February to 43rd in March. Meanwhile, Good Green has maintained a more stable position, consistently ranking in the 30s, which may indicate a steady consumer base. Pura, despite a strong start in December, saw a decline in January and February but managed to recover to 41st in March. These dynamics highlight High Peaks' potential to capitalize on its stable performance amidst competitors' fluctuating ranks, positioning it as a reliable choice for consumers in the New York Flower market.

Notable Products

In March 2025, the top-performing product from High Peaks was Mayday Pre-Roll 2-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank from the previous month with sales reaching 1215 units. Larry's Cookies (3.5g) in the Flower category climbed to the second position, showcasing a notable debut this month. Orangutan Cookies (3.5g), also in the Flower category, improved its position to third from fifth in February 2025. Bees Knees Pre-Roll 2-Pack (1.5g) secured the fourth spot, showing strong performance despite not being ranked in the previous months. The CBD/THC/CBN 4:2:1 Goodnight Guava Gummies 25-Pack (200mg CBD, 100mg THC, 50mg CBN) slipped to fifth place from third, with sales of 460 units in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.