Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

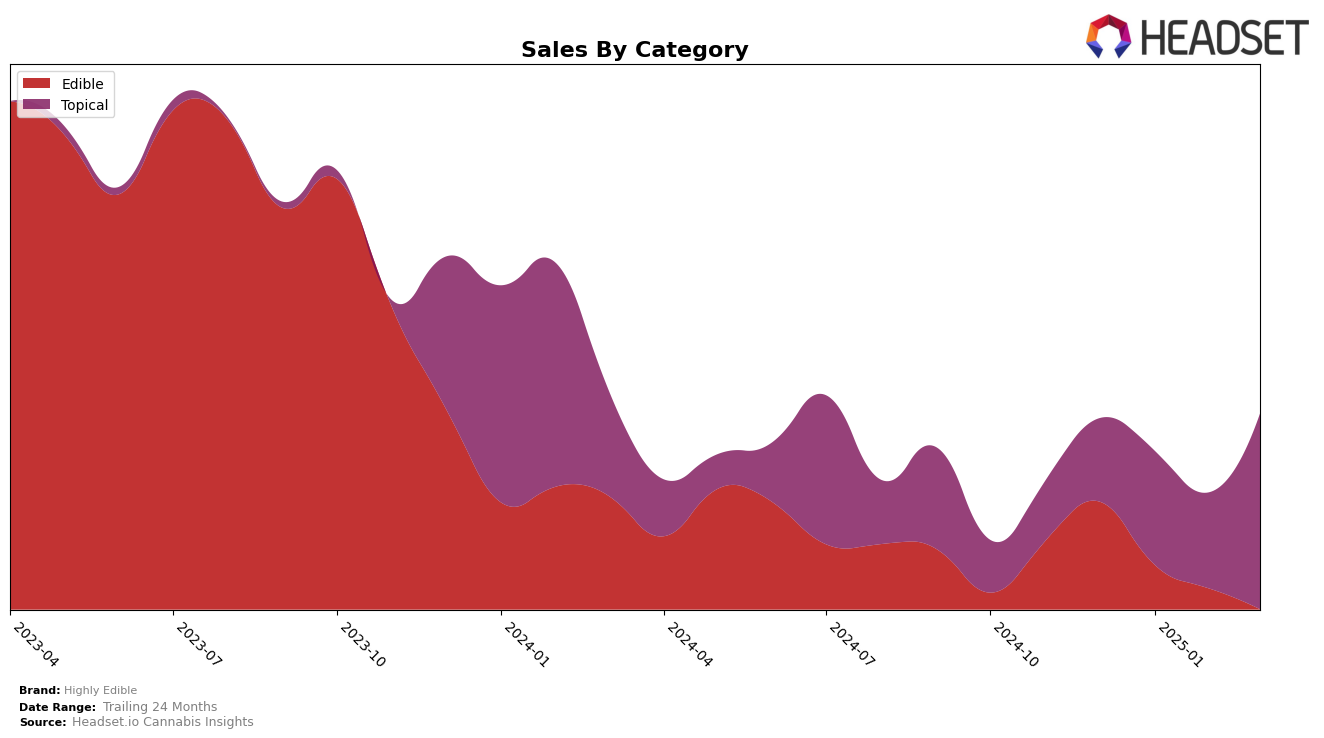

Highly Edible has demonstrated a notable performance in the Colorado market, particularly in the Topical category. The brand maintained a consistent rank of 7th place from December 2024 to February 2025, before climbing to 6th place in March 2025. This upward movement in March is significant, as it coincides with a substantial increase in sales, more than doubling from February to March. Such a trend suggests a growing consumer interest or possibly effective marketing strategies that have bolstered their position in the market.

In contrast, Highly Edible's presence in the Nevada Edible category shows a different trajectory. The brand was ranked 20th in December 2024, slipping to 30th in January 2025, and then fell out of the top 30 rankings in subsequent months. This decline in rank, coupled with the absence of sales data for February and March, indicates challenges in maintaining market presence or competitiveness in Nevada. The brand's performance in Nevada suggests a need for strategic adjustments to regain its foothold in the Edible category.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Colorado, Highly Edible has shown a promising upward trajectory in terms of rank and sales. From December 2024 to March 2025, Highly Edible maintained a steady rank of 7th place before climbing to 6th in March 2025, indicating a positive trend in market presence. This improvement is particularly notable when compared to competitors such as My Brother's Flower, which slipped from 6th to 7th place over the same period. Meanwhile, NectarBee consistently ranked lower, maintaining 8th or 9th place, suggesting that Highly Edible is outperforming some of its peers. Despite not surpassing top contenders like Nordic Goddess and Care Division, which held steady in the 4th and 5th positions respectively, Highly Edible's sales growth from $24,137 in December 2024 to $56,060 in March 2025 highlights its potential to continue climbing the ranks in the coming months.

Notable Products

In March 2025, Highly Edible's CBD/THC 1:1 Nordic Goddess Body Balm maintained its top position in the Topical category, exhibiting a significant sales increase to 800 units. The Sativa Assorted Sour Pucks 10-Pack, an Edible product, improved its rank to second place from third in the previous two months, despite a decrease in sales figures. The Hybrid Sweet Pucks, another Edible, did not have sufficient data for March, but previously held the fourth spot in January. Indica Assorted Sweet Pucks 10-Pack, which ranked fifth in December, did not feature in the rankings in March. Meanwhile, Indica Sour Pucks, which was second in January, was not ranked in March, indicating a shift in consumer preferences or availability.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.