Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

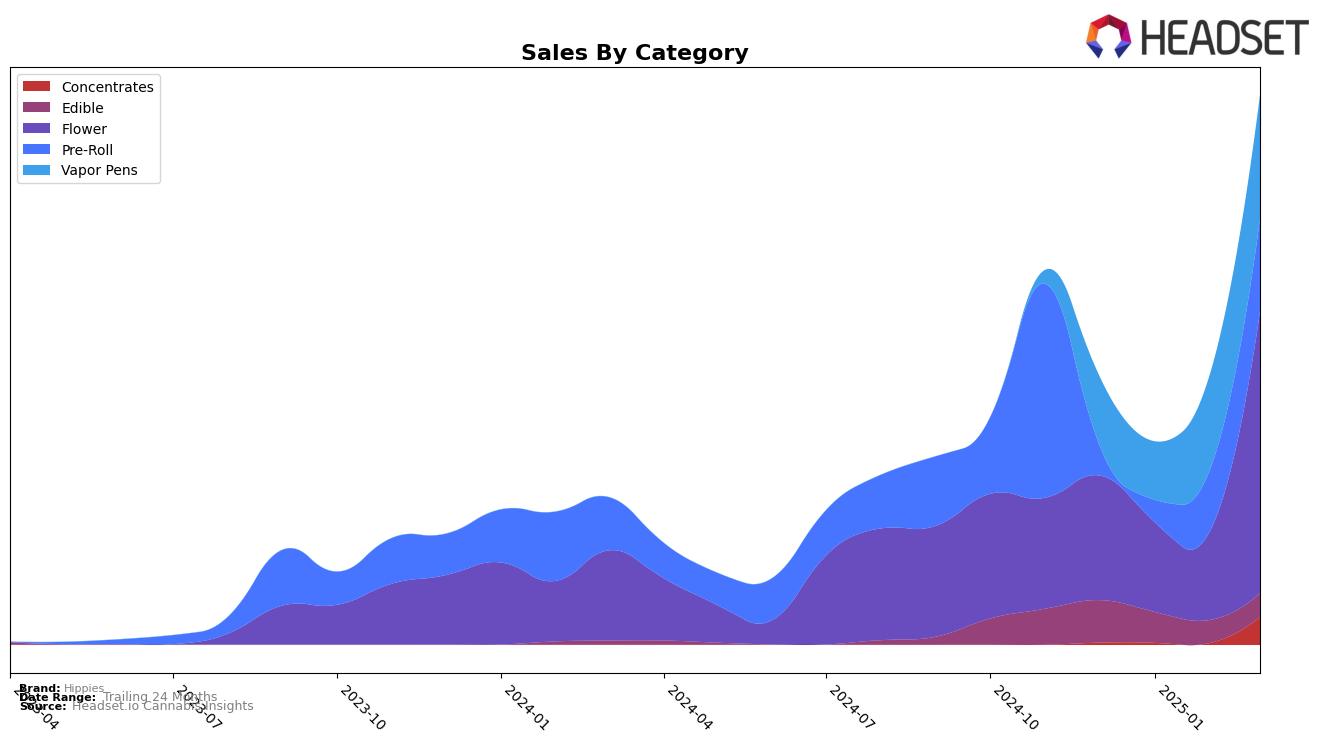

Hippies has shown a varied performance across different categories and states, with notable movements in their rankings. In Michigan, Hippies' presence in the Edible category did not make it to the top 30 brands as of March 2025, indicating potential room for growth or challenges in that market. In contrast, Nevada has been a more dynamic market for Hippies, particularly in the Concentrates category, where they achieved a notable 18th place ranking in March 2025. This suggests a strong foothold in that category, potentially driven by unique product offerings or competitive pricing strategies.

In Nevada, Hippies has demonstrated impressive upward mobility in the Flower and Pre-Roll categories. The Flower category saw a significant leap from 45th place in February 2025 to 17th place in March 2025, highlighting a surge in popularity or effective market strategies. Similarly, the Pre-Roll category experienced a jump from 24th to 16th place over the same period, suggesting increased consumer interest or successful promotional efforts. Meanwhile, the Edible category in Nevada saw a slight fluctuation, maintaining a presence within the top 30 but with minor shifts between 24th and 27th place from December 2024 to March 2025. These variations across categories and states underscore the brand's competitive positioning and potential growth areas.

Competitive Landscape

In the Nevada flower category, Hippies has shown a remarkable turnaround in its market position from December 2024 to March 2025. Initially ranked 42nd in December, Hippies was not in the top 20 brands, indicating a struggle in market presence. However, by March 2025, it surged to 17th place, reflecting a significant improvement in both rank and sales performance. This upward trajectory is particularly notable when compared to competitors like Polaris MMJ and Prime Cannabis, which also experienced fluctuations in their rankings, but not as dramatically as Hippies. Grassroots maintained a relatively stable position, consistently ranking within the top 20, while Firestar saw a dip in February but recovered slightly by March. The significant increase in sales for Hippies in March, compared to previous months, suggests a successful strategic shift or market response, positioning it as a rising competitor in the Nevada flower market.

Notable Products

In March 2025, Gorilla Tts Pre-Roll (1g) emerged as the top-performing product for Hippies, securing the first rank with substantial sales of 1864 units. Ape S#!t (3.5g) followed closely in second place, marking its entry into the rankings this month. Fridaze Pre-Roll (1g), which held the second position in February, moved down to third place in March. Frosted Oreoz Pre-Roll (1g) maintained its fourth position from the previous month, demonstrating consistent sales performance. WiFi Sherbet Pre-Roll (1g) entered the rankings at the fifth position, indicating a rise in popularity compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.