Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

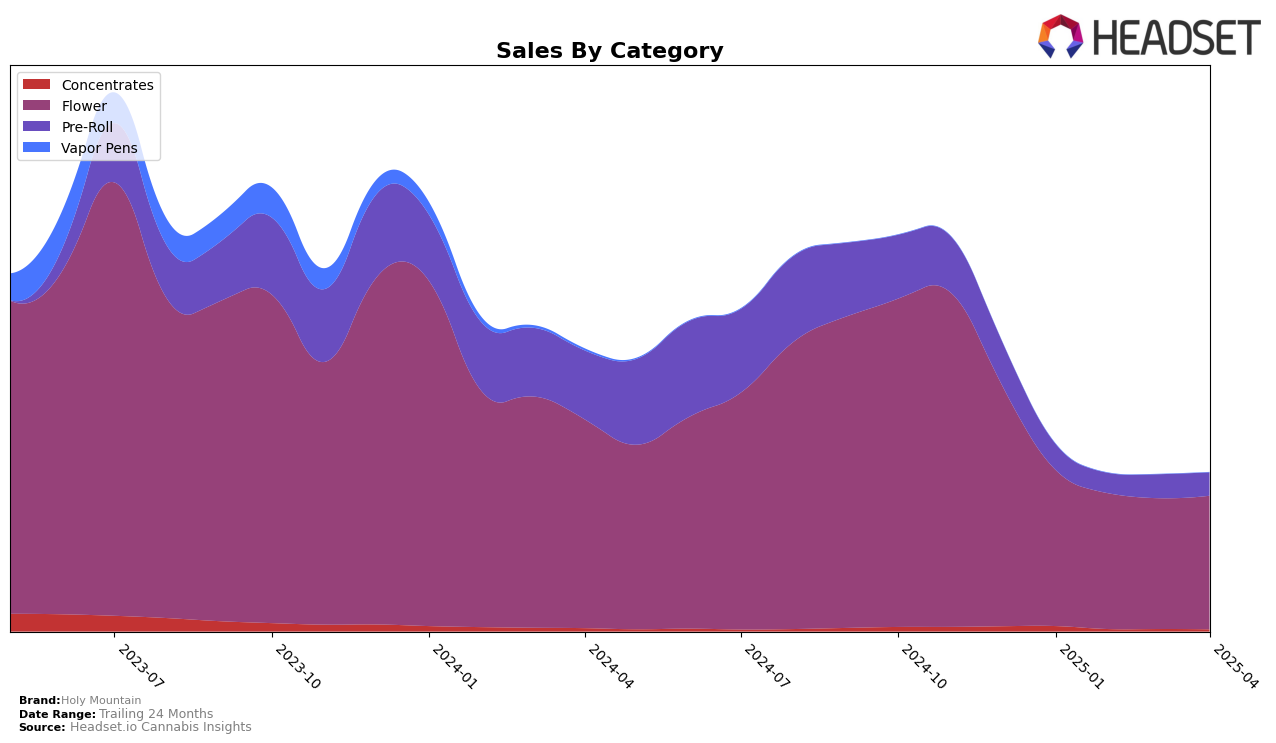

Holy Mountain's performance across different categories and provinces offers intriguing insights into its market presence. In Alberta, the brand's presence in the Concentrates category was notable in January 2025, ranking at 31, but it did not maintain a top 30 position in subsequent months, which indicates a potential area for growth or a shift in consumer preferences. In the Flower category, Holy Mountain showed a slight improvement from 64th to 63rd place between January and February, but it did not maintain a top 30 ranking, suggesting that while there is some movement, the brand may need to strategize to gain a stronger foothold. Interestingly, in Saskatchewan, Holy Mountain appeared in the Flower category rankings in January, but not in the following months, highlighting a potential decline in market presence or competition challenges.

In the Ontario market, Holy Mountain demonstrated a more consistent performance in the Flower category, maintaining a top 30 position throughout the first four months of 2025, with a slight fluctuation between 22nd and 23rd place. This consistency suggests a stable consumer base or effective market strategies in this category. However, the brand faced challenges in the Pre-Roll category, where it consistently ranked outside the top 30, with rankings fluctuating between 80th and 98th place. This indicates a potential area for improvement or a need for differentiation to capture consumer interest in the Pre-Roll segment. Overall, Holy Mountain's performance varies across categories and provinces, with certain areas showing promise and others highlighting opportunities for strategic adjustments.

Competitive Landscape

In the competitive landscape of the flower category in Ontario, Holy Mountain has maintained a consistent presence, ranking 23rd in January, February, and April 2025, with a slight improvement to 22nd in March 2025. This stability in rank suggests a steady performance amidst fluctuating market conditions. Notably, 1964 Supply Co showed a decline, dropping out of the top 20 by April 2025, which may present an opportunity for Holy Mountain to capture some of their market share. Meanwhile, Jonny Chronic and Carmel have seen improvements in their rankings, indicating competitive pressure that Holy Mountain must navigate. Despite these challenges, Holy Mountain's sales figures have shown resilience, with a notable uptick in March and April 2025, suggesting effective strategies in customer retention and product appeal. This competitive analysis highlights the importance for Holy Mountain to leverage its stable market position and capitalize on the shifting dynamics of its competitors to enhance its market share in Ontario's flower category.

Notable Products

In April 2025, the top-performing product from Holy Mountain was Purple Punch-Out (3.5g) in the Flower category, maintaining its first-place ranking with sales of 3786. Following closely, Purple Punch-Out (28g) also held steady in the second position. The Holy Smokes - Purple Punch Out!! Pre-Roll 10-Pack (4g) retained its third-place rank, showing consistent performance from March. Holy Smokes - GMO Tropical Reign Pre-Roll 10-Pack (4g) remained in fourth place, while Dynamic Duos - Purple Punch-Out + Ultra Jean-G (28g) continued to rank fifth as it did in March. Overall, the rankings of these products have shown remarkable stability over the months, with no changes in their positions from March to April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.