Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

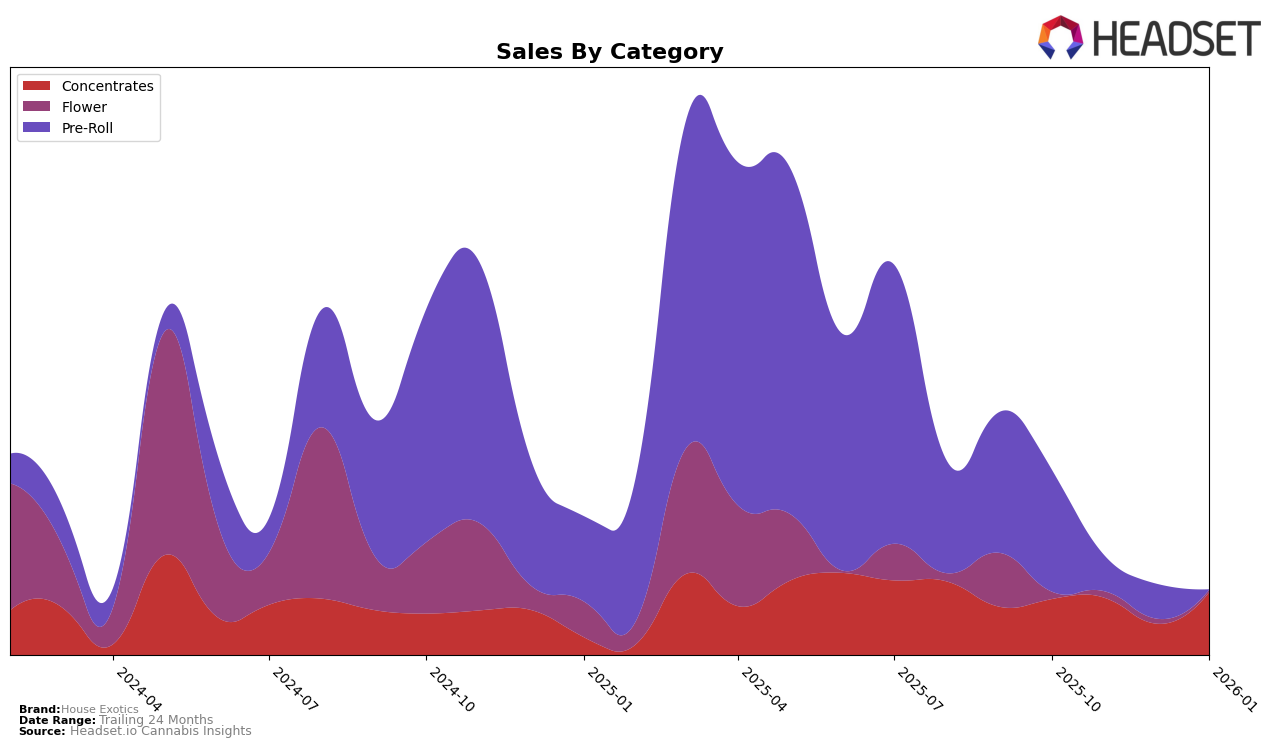

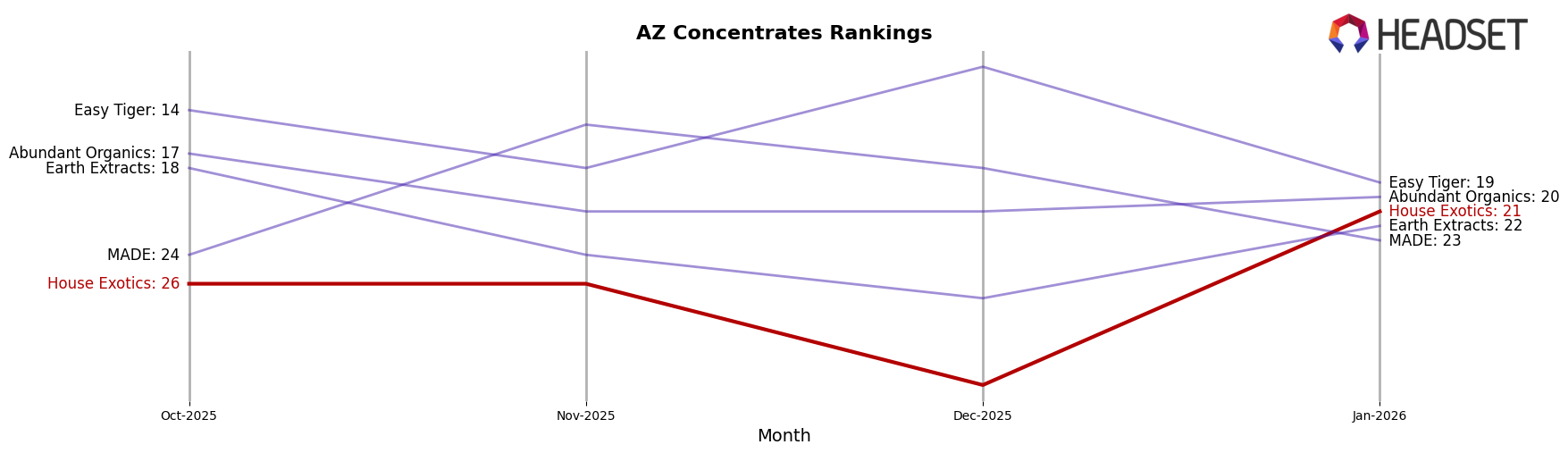

House Exotics has demonstrated varied performance across different product categories and states. In the Concentrates category in Arizona, House Exotics showed a promising trend. From October 2025 to January 2026, the brand's ranking improved from 26th to 21st, indicating a positive reception in the market. Despite a dip in December, where they fell to 33rd place, the brand's January sales of $42,796 suggest a strong recovery and potential for continued growth. This upward trajectory in the Concentrates category is a key highlight of the brand's performance in Arizona.

Conversely, in the Pre-Roll category in Arizona, House Exotics faced challenges maintaining a top position. The brand started off at 32nd in October 2025 but dropped out of the top 30 by January 2026. This indicates a struggle in capturing and retaining market share within this category. The decline in rank, from 32nd to beyond the top 57 by December, could be a signal of increasing competition or changing consumer preferences in the pre-roll sector. This contrast in performance between the two categories within the same state highlights the dynamic nature of market demands and the importance of strategic positioning for House Exotics.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, House Exotics has shown a notable improvement in its market position over recent months. After starting at a rank of 26 in October 2025, House Exotics maintained this position in November, but experienced a decline in December, falling to rank 33. However, by January 2026, the brand rebounded significantly, climbing to rank 21. This upward trajectory is particularly significant when compared to competitors like Abundant Organics, which fluctuated around the 20th position, and Earth Extracts, which also saw a decline in rank over the same period. Meanwhile, MADE experienced a more stable performance, maintaining a higher rank than House Exotics for most months, while Easy Tiger consistently outperformed House Exotics, particularly in December with a peak rank of 11. The sales trends suggest that House Exotics' recent strategic adjustments may be paying off, as evidenced by their improved rank and sales figures in January 2026, positioning them for potential growth in the competitive Arizona concentrates market.

Notable Products

In January 2026, House Exotics saw Modified Banana Live Hash Rosin (1g) reclaim its top position in the concentrates category, achieving the highest sales figure of $1,211. VVP OG Cured Badder (1g) made a notable entry, securing the second spot in the same category. Apricot Macmosa #3 (3.5g) maintained its consistency in the flower category, holding the third position for the second consecutive month. Valley Verde Pineapple OG Live Hash Rosin (1g) dropped to fourth place from its previous second position in November 2025. OG Kush x Big Moon Hashish Infused Pre-Roll 4-Pack (3g) debuted in the rankings at fifth place, suggesting a growing interest in pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.