Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

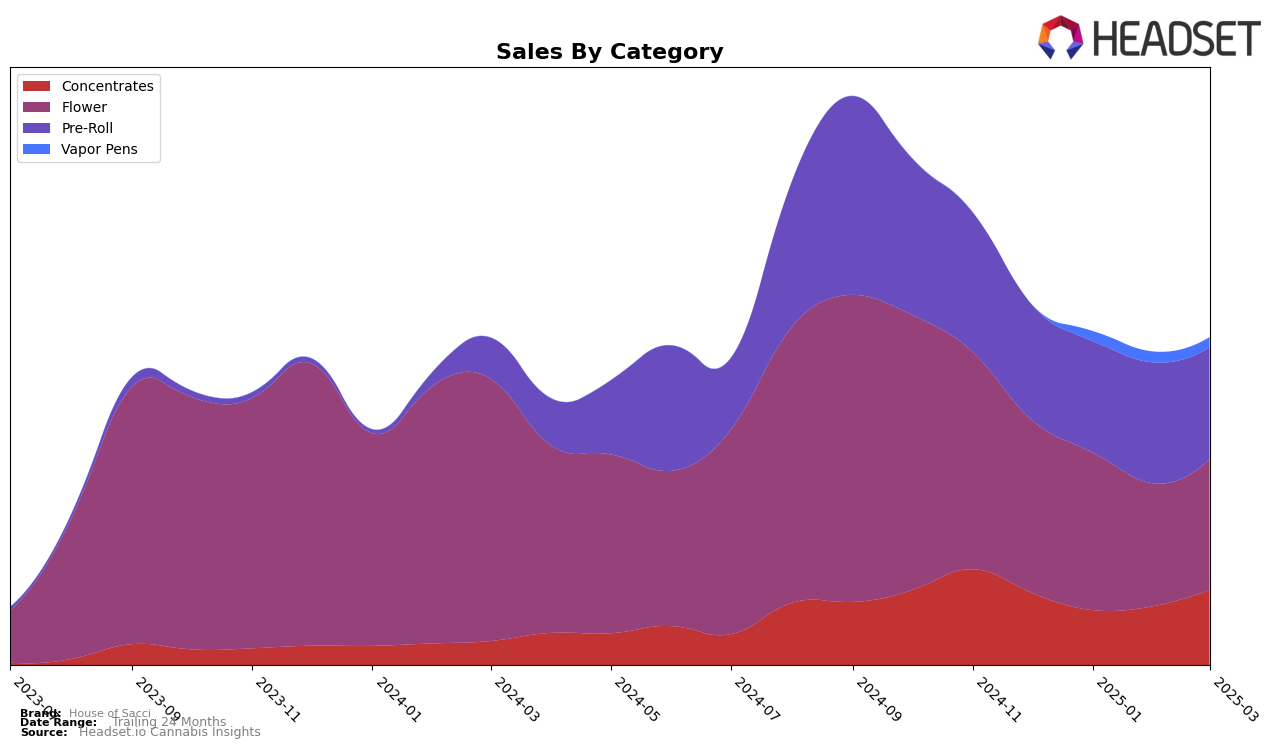

House of Sacci has shown a dynamic performance in the New York market, particularly within the Concentrates category. Over the first quarter of 2025, the brand has maintained a strong presence, never dropping below the 13th rank and achieving an 11th place ranking by March. This upward trend is indicative of a resilient market strategy, especially considering the brand's ability to bounce back in sales from a dip in January to impressive figures by March. In contrast, the Flower category has seen a decline in ranks, slipping from 39th in December to 53rd by March, suggesting potential challenges in maintaining competitiveness or a shift in consumer preferences. The absence of House of Sacci from the top 30 in this category could be seen as a setback, indicating room for strategic adjustments.

The Pre-Roll category presents a mixed bag for House of Sacci in New York, as they hovered around the 38th to 42nd rank without breaking into the top 30. This consistency, while not stellar, suggests a stable niche presence. On the other hand, the Vapor Pens category highlights a significant gap in the brand's market penetration, as they were not ranked in the top 30 until February, when they appeared at 91st. This late entry into the rankings could imply either a late product launch or a slow adoption rate, offering an opportunity for growth if addressed strategically. The data suggests that while House of Sacci is performing well in certain areas, there are specific categories where further efforts could enhance their market position.

Competitive Landscape

In the competitive landscape of the New York flower category, House of Sacci has experienced a notable decline in both rank and sales over the past few months. Starting from a rank of 39 in December 2024, it slipped to 53 by March 2025, indicating a downward trend. This decline is mirrored in its sales, which decreased from $168,152 in December to $127,295 in March. In comparison, Bison Botanics also experienced a drop in rank from 28 to 45, but maintained higher sales figures, ending March with $166,214. Meanwhile, UMAMII showed an upward trajectory, climbing from a rank of 76 in December to 48 in March, with a corresponding increase in sales from $66,658 to $147,011. Etain also saw a rank decline from 34 to 56, with sales dropping from $207,431 to $119,093, yet still managed to stay ahead of House of Sacci. These dynamics suggest that while House of Sacci faces challenges, competitors like UMAMII are capitalizing on market opportunities, potentially impacting House of Sacci's market share and necessitating strategic adjustments to regain competitive positioning.

Notable Products

In March 2025, House of Sacci's top-performing product was the Watermelon Z Pre-Roll 7-Pack (3.5g), maintaining its consistent first-place ranking from previous months, despite a slight decrease in sales to 733 units. The Indica Blonde Hash (1g) emerged as a strong contender, securing the second rank, a notable entry as it was not ranked in prior months. Devil's Drip (3.5g) improved its position from fourth in February to third in March, with sales increasing to 487 units. The Indica Brown Hash (1g) experienced a drop from second to fourth place, although its sales remained relatively stable. Lastly, the Banana Jealousy Pre-Roll 7-Pack (3.5g) slipped to fifth place, marking a slight decline from its third position in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.