Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

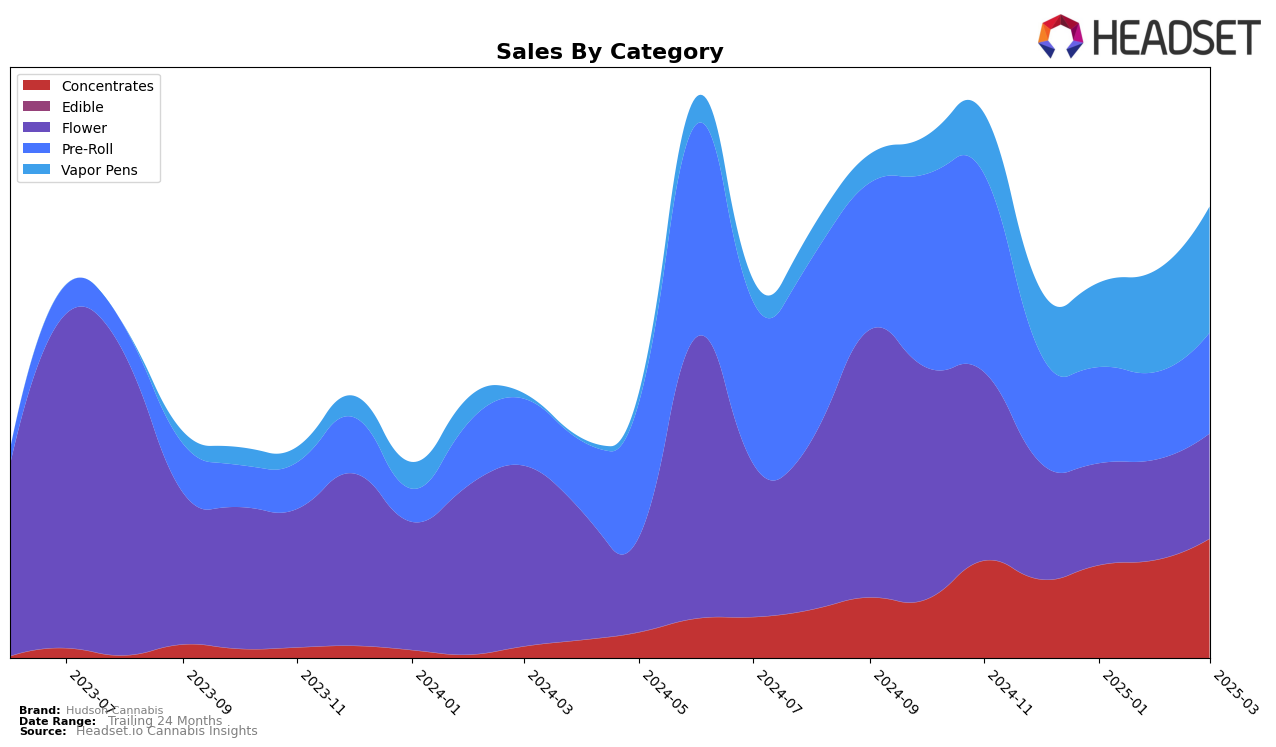

Hudson Cannabis has demonstrated a strong presence in the New York market, particularly in the Concentrates category where it has consistently maintained a top 5 position, climbing from fourth to third place by March 2025. This upward movement is indicative of a significant increase in sales, which reached $298,868 in March. Such performance highlights the brand's growing influence and competitiveness in this segment. The Vapor Pens category also shows promising signs of growth, with Hudson Cannabis improving its ranking from 36th in December 2024 to 28th by March 2025, reflecting an upward trend in sales volume over the same period.

In contrast, the Flower category presents a challenge for Hudson Cannabis, as it slipped from 25th place in December 2024 to 31st by March 2025, indicating a struggle to maintain its position within the top 30 brands. This decline suggests potential areas for improvement or strategic adjustments to regain market share. Meanwhile, the Pre-Roll category has seen fluctuating rankings, with a slight recovery from 19th place in February to 18th in March 2025. This mixed performance across categories provides a nuanced view of Hudson Cannabis's market dynamics and highlights areas of strength and potential growth opportunities in New York.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Hudson Cannabis has shown a promising upward trajectory in its rankings over the first quarter of 2025. Starting from a rank of 36 in December 2024, Hudson Cannabis climbed to 28 by March 2025, indicating a consistent improvement in market presence. This upward movement is particularly notable when compared to competitors like Jetty Extracts, which saw fluctuations and a slight decline from 21 to 27, and CRU Cannabis, which experienced a mixed trend, ending at 29. Meanwhile, Olio showed a steady climb but remained behind Hudson Cannabis in March. The sales growth for Hudson Cannabis also reflects this positive trend, with a significant increase from December to March, suggesting a strengthening brand appeal and customer base. In contrast, Hashtag Honey experienced volatility, with a drop in January but recovering to a rank of 26 by March. Overall, Hudson Cannabis's consistent rank improvement and sales growth position it as a rising contender in the New York vapor pen market.

Notable Products

In March 2025, the top-performing product for Hudson Cannabis was 87 Lime Pop Pre-Roll (0.5g) in the Pre-Roll category, maintaining its position as the best-seller from February with a sales figure of 4,411 units. Grape Dosi Pre-Roll (0.5g) followed as the second best-seller, showing a notable entry into the rankings for the first time. Farmers Blend Pre-Ground (7g) in the Flower category secured the third spot, while Farmer's Blend RSO Applicator (1g) in Concentrates and Grape Dosi (3.5g) in Flower ranked fourth and fifth, respectively. This marks a significant reshuffle from previous months, with several products making their debut in the top five. Overall, the Pre-Roll category showed strong performance, dominating the top two positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.