Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

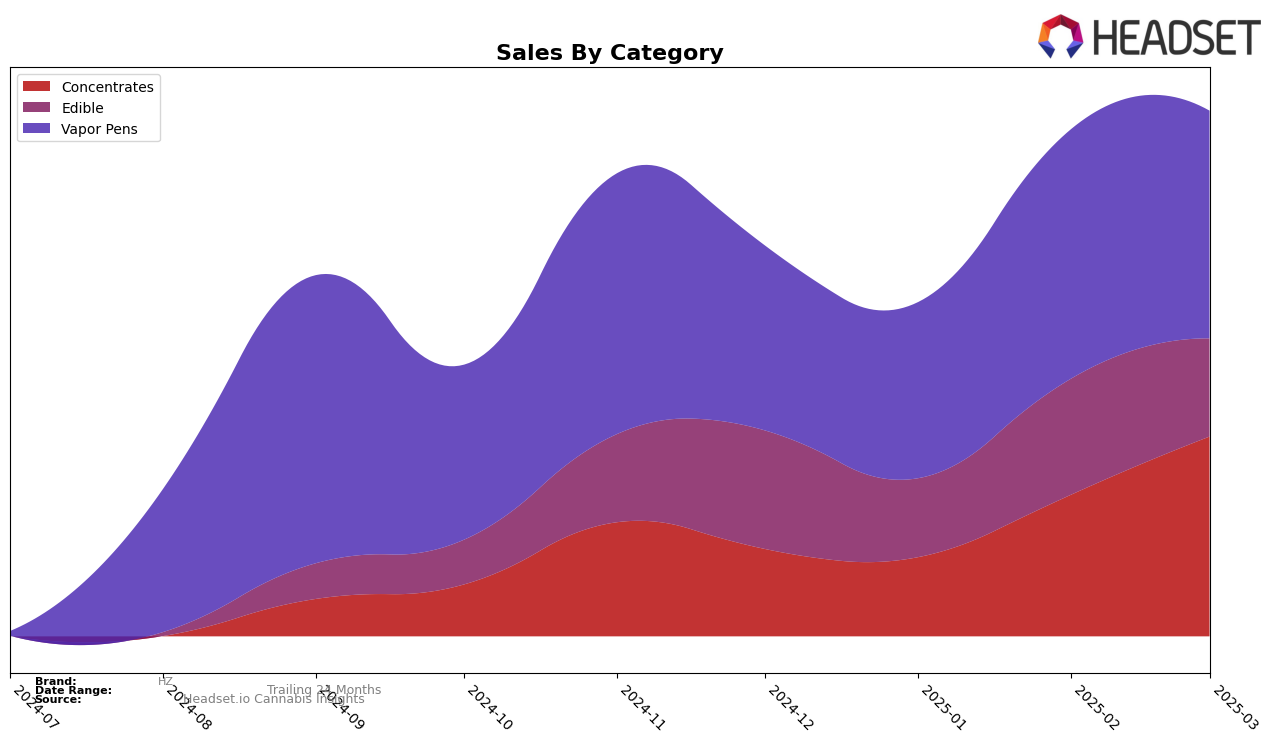

In the state of Ohio, HZ has shown notable performance in the Concentrates category. Over the span from December 2024 to March 2025, HZ improved its position from 23rd to 13th, indicating a significant upward trajectory in this category. This positive movement aligns with a substantial increase in sales, particularly from February to March 2025. In contrast, HZ's performance in the Vapor Pens category has been less consistent, with rankings fluctuating between 41st and 52nd. Despite this variability, the brand's sales figures in this category suggest a steady demand, albeit without a corresponding rise in rank.

Conversely, HZ's presence in the Edible category in Ohio has been relatively stagnant. The brand has maintained a consistent ranking at 42nd, aside from a brief dip to 47th in January 2025. This suggests that while HZ has a presence in the Edible category, it has not been able to break into the top 30, which could be seen as a missed opportunity for growth. The steady sales figures further reinforce this static position, indicating that while there is a consistent consumer base, the brand has not yet capitalized on expanding its market share in this segment.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Ohio, HZ has demonstrated a notable upward trend in its market position, climbing from a rank of 47 in December 2024 to 43 by March 2025. This progression is indicative of a strengthening brand presence, despite not breaking into the top 20 rankings. In contrast, Willie's Reserve experienced a decline, dropping from rank 31 in January 2025 to 48 by March, alongside a significant decrease in sales. Meanwhile, Old Pal maintained a relatively stable position, fluctuating slightly but remaining outside the top 30. Josh D saw a notable improvement from rank 62 in January to 40 in February, but its sales figures suggest volatility. Pure Ohio Wellness also showed a positive trajectory, improving its rank from 59 in January to 46 in March. HZ's consistent improvement in rank and sales amidst these fluctuations highlights its growing competitiveness in the Ohio market.

Notable Products

In March 2025, the top-performing product for HZ was Mai Cake Live Rosin Disposable, which climbed to the number one position in the Vapor Pens category, with a notable sales figure of 368 units. Cherry Dosidos Live Resin Disposable maintained its second-place rank from February, reflecting consistent performance. London Pound Cake Live Rosin Disposable moved up to third place, having previously been unranked in February. White Strawberry Live Rosin Badder entered the rankings in the Concentrates category at fourth place, while Boston Tea Party Live Rosin Badder dropped to fifth after being the top seller in January. These shifts highlight dynamic changes in consumer preferences within HZ's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.