Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

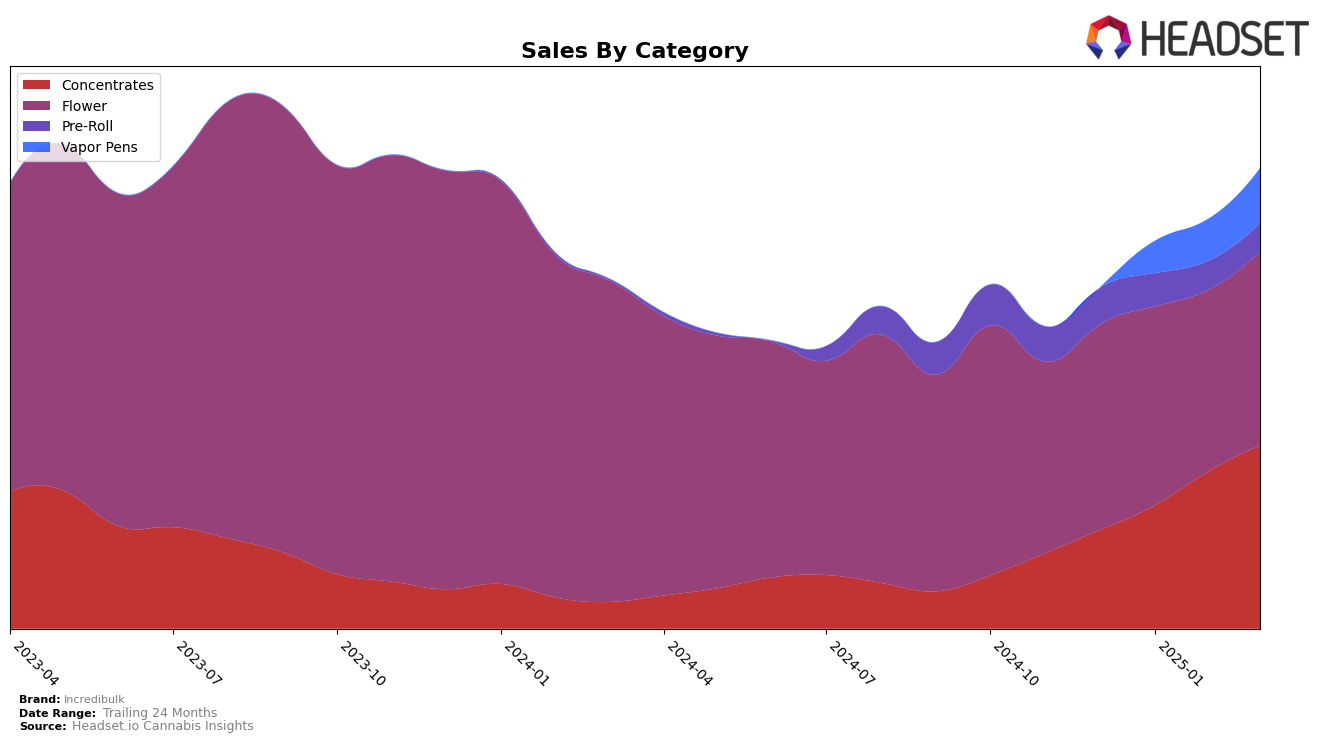

In the Washington market, Incredibulk has demonstrated a notable upward trajectory in the Concentrates category. From December 2024 to March 2025, the brand improved its rank from 48th to 24th. This significant climb into the top 30 brands suggests a strong market presence and growing consumer preference for their concentrates. The consistent increase in sales figures over these months further underscores this positive trend. However, the brand's absence from the top 30 in December highlights a previous struggle to capture market share, which they have since overcome.

Conversely, in the Flower category within Washington, Incredibulk's performance has been less dynamic. Ranking outside the top 30 throughout the observed period, their position improved slightly from 92nd to 80th from December 2024 to March 2025. Despite this modest rise, their sales figures reveal a fluctuating trend, indicating potential challenges in establishing a strong foothold in this category. This suggests that while Incredibulk is gaining traction in concentrates, they may need to reassess their strategy for flower products to achieve similar success.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Incredibulk has shown a promising upward trend in rankings from December 2024 to March 2025. Starting at rank 92 in December 2024, Incredibulk improved its position to rank 80 by March 2025. This positive trajectory contrasts with competitors like Dog House, which experienced a slight decline, moving from rank 81 to 79, and From the Soil, which fluctuated significantly, dropping out of the top 20 in February 2025. Meanwhile, Equinox Gardens maintained a relatively stable presence, improving from rank 73 to 66. Despite these shifts, Incredibulk's sales figures indicate a consistent performance, with a slight dip in February 2025 but recovering in March. This resilience in both rank and sales positions Incredibulk as a strong contender in the Washington Flower market, suggesting potential for further growth and market share capture.

Notable Products

In March 2025, Sour Blueberry Wax (1g) emerged as the top-performing product for Incredibulk, securing the number one rank in the Concentrates category with impressive sales of 1844 units. Trophy Wife Wax (1g) followed closely, maintaining a strong performance with a second-place ranking, although it dropped from its previous top spot in February. Zkittlez Distillate Cartridge (1g) climbed to third place in the Vapor Pens category, improving from fourth place in February, indicating a positive trend. Elmer's Glue Wax (1g) made its debut in the rankings at fourth place, showing potential within the Concentrates category. Zkittlez Wax (1g) saw a decline, moving from third to fifth place, reflecting a shift in consumer preference within the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.