Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

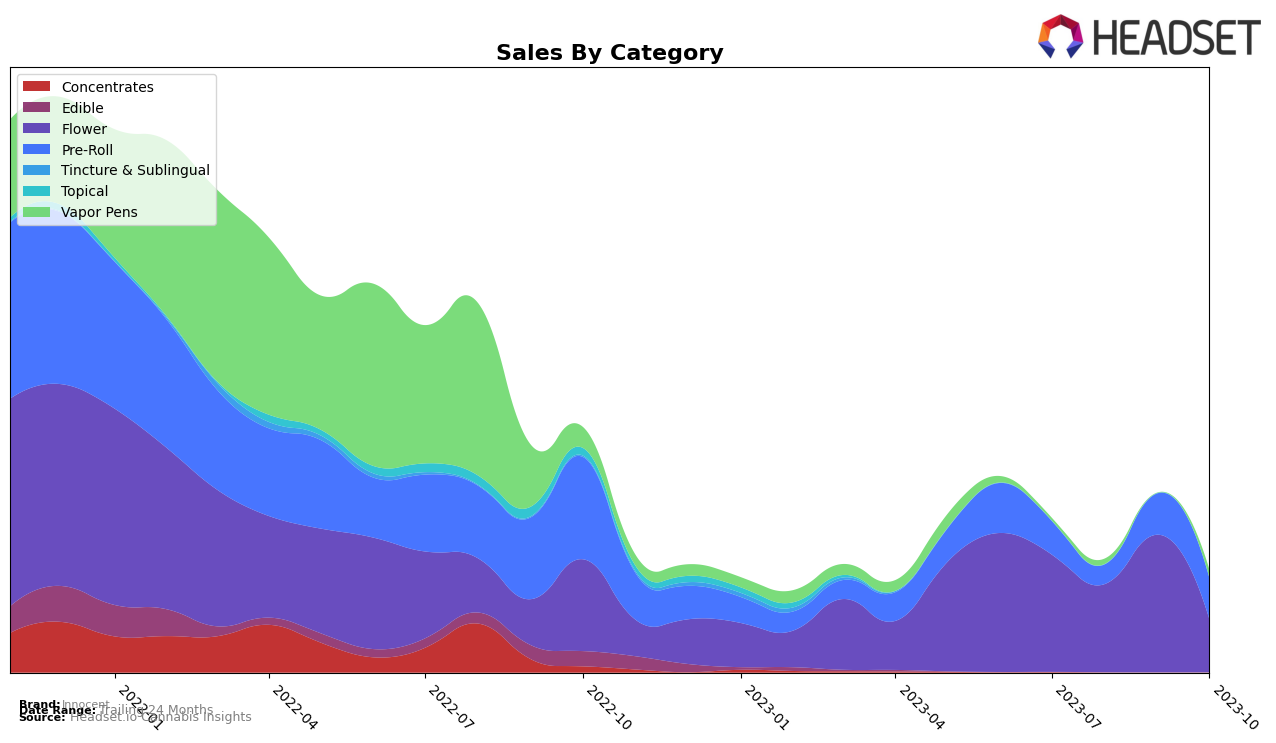

Let's delve into the performance of the cannabis brand Innocent in Illinois across various categories. In the Concentrates and Edible categories, Innocent has consistently ranked outside the top 20 brands from July to August 2023, indicating a potential area for growth. The Flower category, on the other hand, showed a promising upward trend, with Innocent climbing from the 26th position in August to the 19th in September, before falling back to 34th in October. This suggests a fluctuating market position within this category.

Innocent's performance in the Pre-Roll category is noteworthy. Despite a slight dip in August, the brand rebounded impressively, improving its rank from 27th to 15th in September, and further to 13th in October. This shows a positive momentum for Innocent in this category. The Vapor Pens category, however, presents a more challenging picture. Innocent's ranking fluctuated between the 40th and 51st positions from July to October 2023, indicating a need for improved strategies to enhance its market position in this category. A single sales figure worth mentioning is the significant increase in Flower sales from August to September, hinting at a potential surge in demand during this period.

Competitive Landscape

In the Illinois Flower category, Innocent has experienced a notable fluctuation in rank over the period from July to October 2023. Starting at a strong 23rd position in July, Innocent rose to 19th in September, only to fall significantly to 34th in October. This suggests a volatile market position relative to competitors. For instance, Island and Legacy Cannabis (IL) have shown similar fluctuations, while Kaviar and Crops have maintained more consistent, albeit lower, ranks. Sales trends for Innocent seem to mirror its rank changes, with a peak in September followed by a significant drop in October. This suggests that Innocent's market position is sensitive to changes in sales, which could be influenced by a variety of factors such as pricing, marketing efforts, and consumer preferences.

Notable Products

In October 2023, the top-performing product for Innocent was the Northern Lights Haze Pre-Roll (0.7g) with sales of 5920 units. This product maintained its number one rank from the previous month. The second best seller was the Margalope Pre-Roll (0.7g), moving up in rankings from the previous month. The Margalope Pre-Roll 5-Pack (2.5g) also improved its performance, ranking third in October from its previous fifth position in August. The Northern Lights Haze (3.5g) dropped to fourth place from its first-place position in July and August, while the Sis DMV Pre-Roll (0.7g) entered the top five for the first time in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.