Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

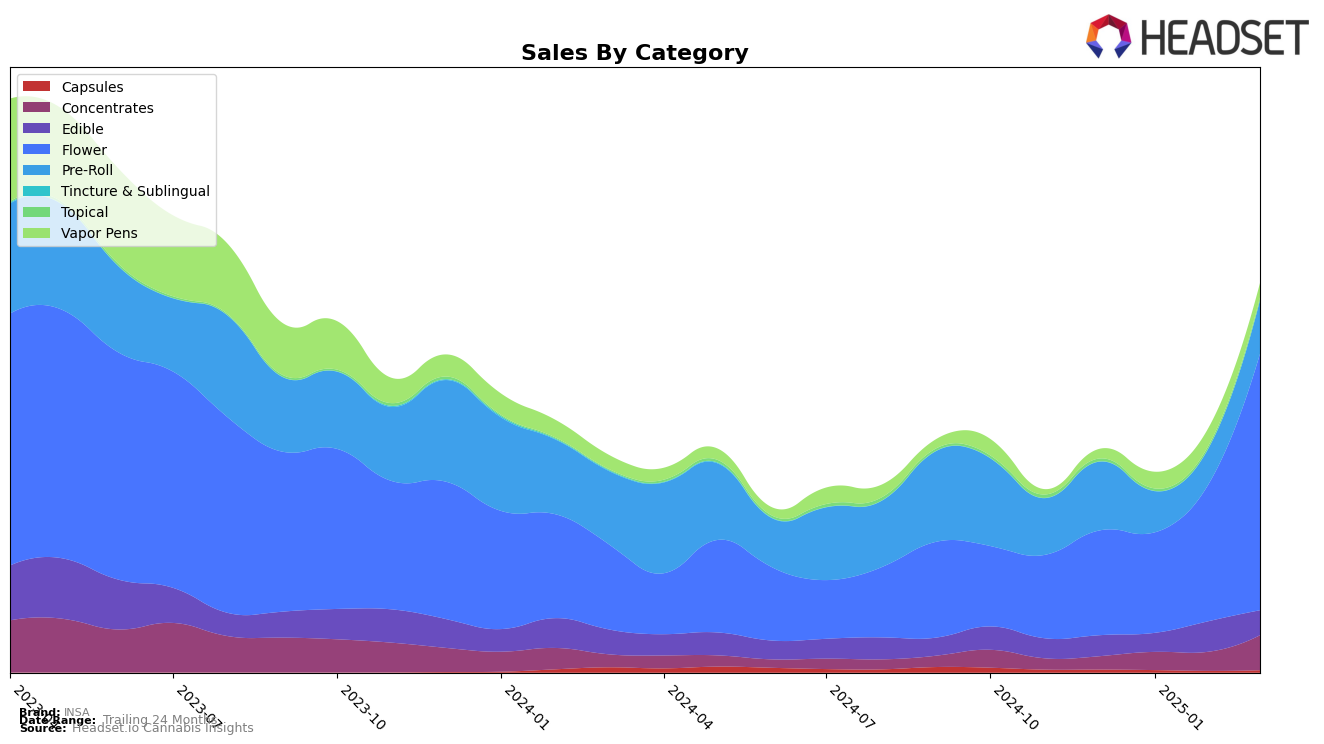

INSA has shown a notable performance trajectory in Massachusetts across various product categories. In the Concentrates category, INSA made a significant leap from the 32nd position in December 2024 to the 15th position by March 2025, indicating a strong upward trend in consumer preference or market presence. This positive momentum is also reflected in the Flower category, where INSA improved its ranking from 51st in December 2024 to 21st in March 2025. Such advancements suggest that INSA is gaining traction in these segments, potentially due to increased brand recognition or product offerings that resonate well with consumers in Massachusetts.

Conversely, INSA's performance in other categories presents a more mixed picture. For instance, in the Edible category, the brand managed to climb from 46th to 40th position by March 2025, which, while an improvement, still leaves them outside the top 30 brands in this category. In the Pre-Roll segment, INSA's ranking fluctuated, starting at 47th in December 2024, dropping to 60th in February 2025, and then recovering slightly to 51st by March 2025. This inconsistency might indicate challenges in maintaining a steady market position or could reflect a highly competitive segment. Moreover, in the Vapor Pens category, INSA did not break into the top 30, with rankings hovering around the 70s and 80s, suggesting a need for strategic adjustments to enhance their standing in this market.

Competitive Landscape

In the Massachusetts flower category, INSA has demonstrated a remarkable upward trajectory in brand ranking over the past few months, indicating a significant shift in its competitive positioning. Starting from a rank of 51 in December 2024, INSA has climbed to 21 by March 2025, showcasing a consistent improvement in market presence. This upward movement is particularly notable when compared to competitors like Old Pal and Shaka Cannabis Company, both of which have experienced fluctuations in their rankings, with Old Pal dropping to 20 and Shaka Cannabis Company to 19 by March 2025. Additionally, Cloud Cover (C3) has shown inconsistent performance, not maintaining a steady top 20 presence. Meanwhile, Wee-De has made a notable leap from being unranked in December 2024 to achieving a rank of 22 by March 2025. INSA's rise in rank is mirrored by a significant increase in sales, suggesting effective strategies in capturing market share and consumer interest in the competitive Massachusetts flower market.

Notable Products

In March 2025, the top-performing product for INSA was C.R.E.A.M Pre-Roll 0.5g, maintaining its consistent position at rank 1 since January, with sales reaching 1614 units. C.R.E.A.M Blunt 1g emerged as a new contender, securing the second spot with a notable sales figure of 1343 units. Peanut Butter Smooches Chocolate Bites 20-Pack 100mg, which held the second position in February, dropped to third place in March with sales of 988 units. Hollywood Hairband Pre-Roll 1g maintained a steady performance, ranking fourth for the second consecutive month. Apple Jax 14g made its debut in the rankings, achieving fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.