Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

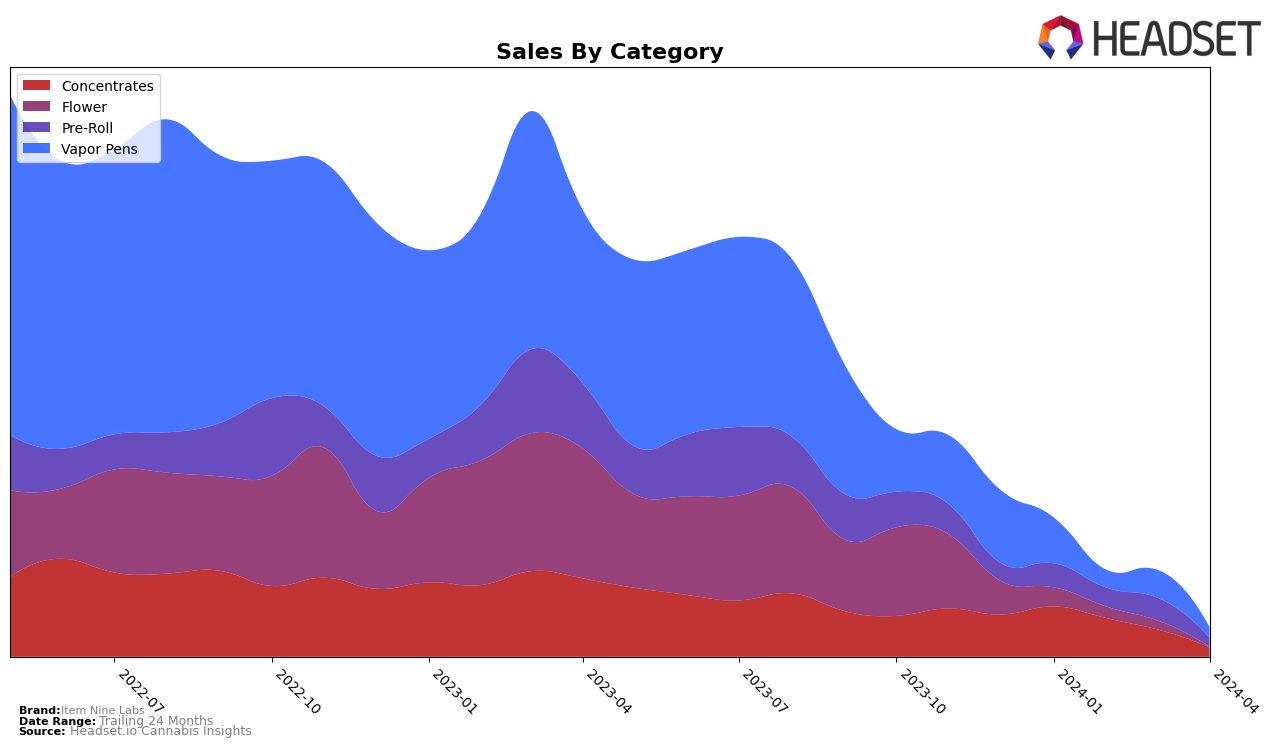

In Arizona, Item Nine Labs has shown a diverse presence across multiple cannabis product categories, indicating a broad market strategy. The brand's performance in the Concentrates category began strongly at the 10th rank in January 2024, maintaining the same position in February but then experienced a notable decline, dropping to 26th by April 2024. This downward trend, especially with a significant sales drop from $189,393 in January to $35,349 in April, suggests a critical need for strategic adjustments to regain market position. Conversely, the Pre-Roll category tells a different story; despite fluctuations, Item Nine Labs managed to stay within the top 30 brands, starting at 24th in January and slightly dipping to 41st by April, showing resilience but also room for improvement in maintaining their market share.

Moreover, the brand's venture into the Flower and Vapor Pens categories in Arizona highlights its ambition to capture a wider audience. However, the performance in these categories indicates challenges; notably, the brand did not rank in the top 30 for Flower in April 2024, after already trailing at 54th in March. This absence signifies a potential area of concern or a strategic withdrawal from the category. The Vapor Pens category saw a somewhat volatile performance, with a peak rank of 17th in January but a fall to 39th by April, reflecting fluctuating consumer interest or competitive pressures. These movements across categories and over time underscore the dynamic nature of consumer preferences and the competitive landscape in Arizona's cannabis market, suggesting that Item Nine Labs may need to pivot or enhance its strategies to bolster its standing and capitalize on market opportunities.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Arizona, Item Nine Labs has experienced notable fluctuations in its market position from January to April 2024. Initially ranking 17th in January, it saw a significant drop to 34th in February, a slight improvement to 29th in March, and then a further decline to 39th in April. This trend suggests a challenging period for Item Nine Labs, especially when compared to its competitors. For instance, Venom Extracts maintained a more stable position, hovering around the 26th to 30th ranks during the same period, indicating a steadier performance. Similarly, WTF Extracts showed resilience by improving its rank from 30th in January to 32nd in April, despite a temporary dip. On the other hand, Gen X entered the rankings in April at 52nd, suggesting a late but emerging presence in the market. Balance, despite fluctuating ranks, ended slightly above Item Nine Labs in April, positioned at 41st. These dynamics highlight the competitive pressures and the need for strategic adjustments for Item Nine Labs to improve its market standing and sales trajectory in the evolving Arizona Vapor Pens market.

Notable Products

In April 2024, the top-performing product from Item Nine Labs was the GMO Cookies x Z Cube Infused Pre-Roll (1g) in the Pre-Roll category, securing the first place with notable sales of 521 units. Following closely, the Z Cube Live Resin Disposable (1g) from the Vapor Pens category ranked second, showcasing a significant rise from its previous fifth position in March. The third spot was taken by Fruity Grape Pie Live Resin Disposable (1g) in the Concentrates category, which dropped one rank from its second place in March. Tres Leches Live Resin Disposable (1g), also in the Vapor Pens category, maintained its fourth position from March to April. Lastly, the Tres Leches x Slap and Tickle Infused Pre-Roll (1g) entered the rankings in April, landing in the fifth spot, marking its debut in the sales chart for the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.