Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

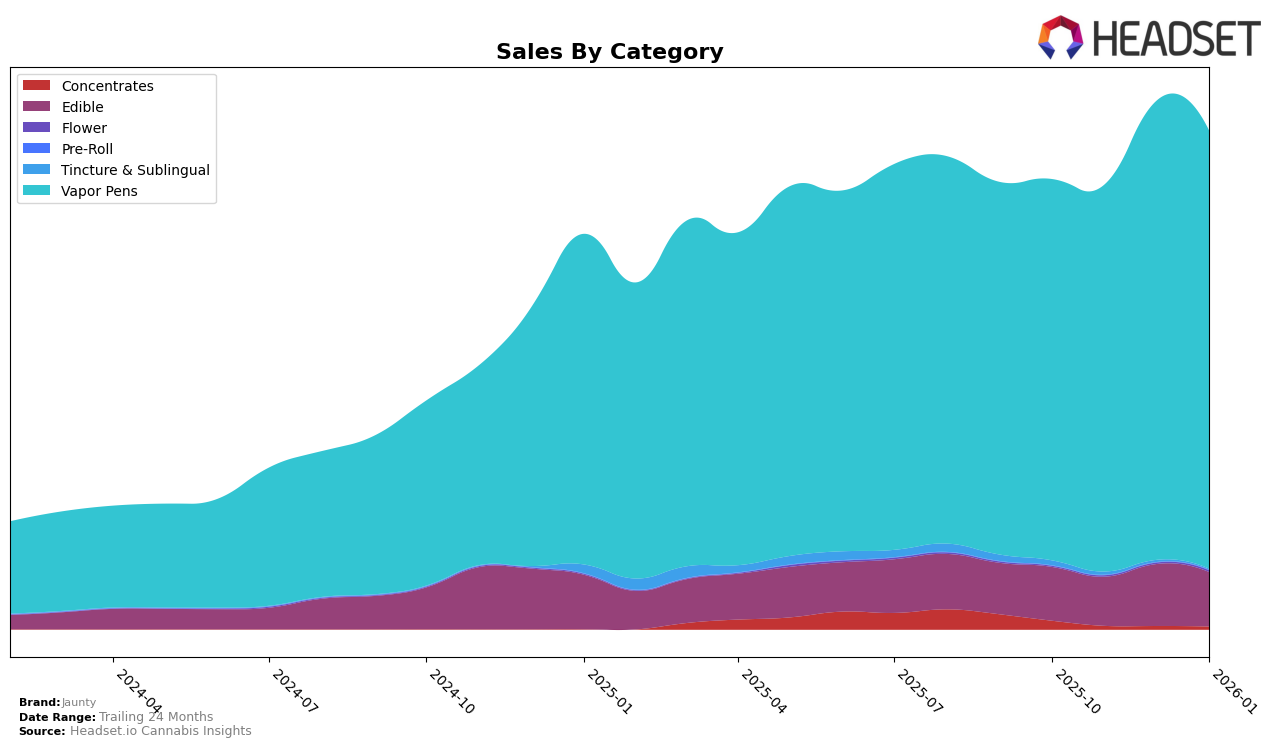

Jaunty has shown a consistent performance in the New York market, particularly in the Vapor Pens category where it has maintained its top position from October 2025 through January 2026. This stability is a testament to their strong market presence and consumer preference in this segment. On the other hand, in the Edible category, Jaunty has fluctuated slightly, ranking 9th in October and November 2025, dropping to 10th in December 2025, and then recovering to 9th in January 2026. This indicates a competitive landscape in the Edible category, where maintaining a steady rank can be challenging.

In terms of sales performance, Jaunty's Vapor Pens have seen a notable increase in sales from October to December 2025, with a slight dip in January 2026. This suggests a strong holiday season boost, which is typical for many consumer goods, including cannabis products. In contrast, the Edible category experienced a sales peak in December 2025, which could be attributed to seasonal demand, followed by a decrease in January 2026. The absence of Jaunty from the top 30 brands in any other state or province could be seen as a limitation in their geographical reach, which may present opportunities for expansion or indicate a focused strategy on specific markets like New York.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Jaunty has consistently maintained its top position from October 2025 through January 2026. This unwavering leadership is notable, especially given the strong presence of competitors like Ayrloom and Fernway, which have held the second and third ranks, respectively, throughout the same period. While Ayrloom and Fernway have shown fluctuations in sales, Jaunty's sales have demonstrated a robust upward trend, particularly peaking in December 2025 before a slight decline in January 2026. This consistent top ranking and sales growth highlight Jaunty's strong brand loyalty and market penetration, making it a formidable leader in the New York vapor pen market.

Notable Products

In January 2026, the top-performing product from Jaunty was the Classic - Sour Diesel Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank for four consecutive months with sales reaching 8,305 units. The Classic - Pineapple Express Oil Cartridge (1g) continued to hold the second position, despite a slight decrease in sales compared to December 2025. The Palms - Blue Dream Distillate Disposable (1.5g) remained steady in third place, showing consistent demand. The CBN/THC 1:1 Dreamberry Gummies 10-Pack rose to fourth place, improving from its fifth position in December. The Classic- Blueberry Kush Distillate Cartridge (1g) experienced a slight decline in rank, moving from fourth to fifth place, reflecting a competitive market for Vapor Pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.