Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

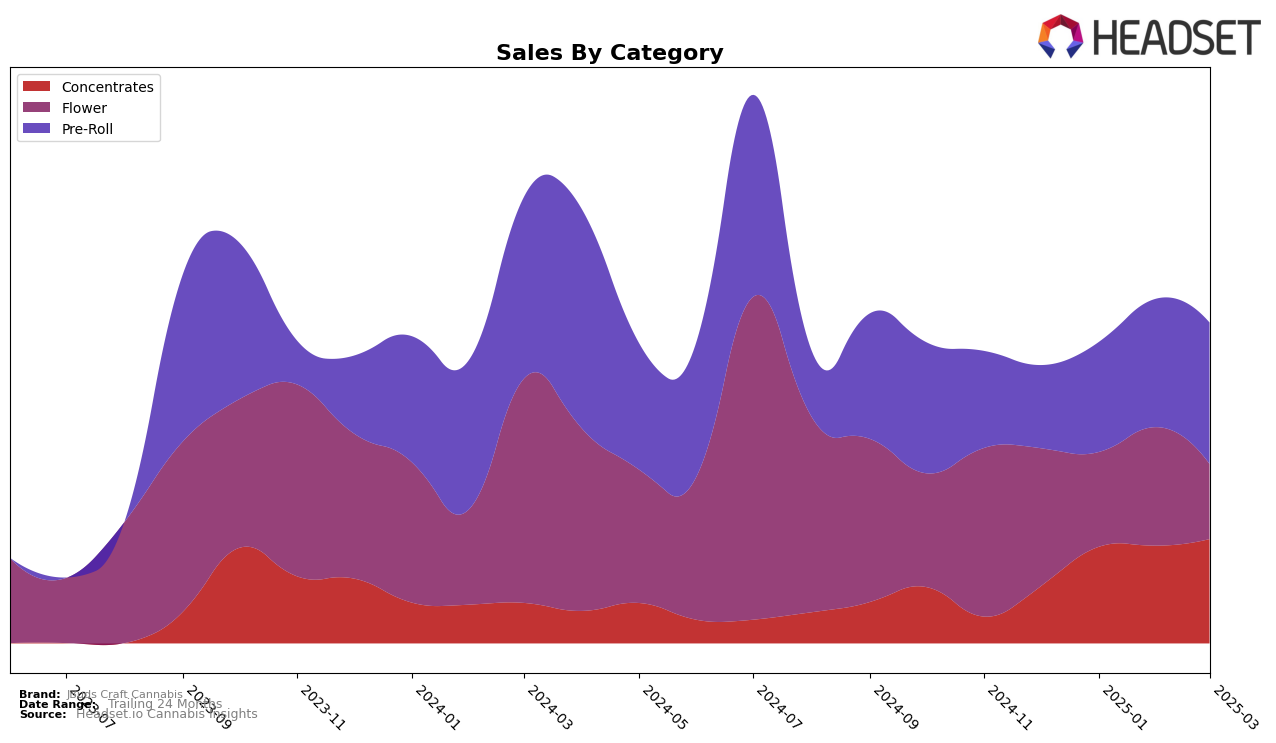

JBuds Craft Cannabis has shown a promising upward trend in the Concentrates category in British Columbia, advancing from a rank of 36 in December 2024 to 23 by March 2025. This significant climb indicates a growing consumer preference for their products in this category. In contrast, their performance in the Flower category has been less consistent, with rankings fluctuating between 83 and 97 over the same period. Despite these fluctuations, the Flower category still recorded notable sales figures, suggesting a stable customer base that continues to support JBuds despite the competitive market.

The Pre-Roll category presents a different picture, where JBuds Craft Cannabis has only recently entered the top 30 rankings, securing positions of 88 and 90 in February and March 2025, respectively. This entry into the rankings is a positive development, indicating that their Pre-Roll products are gaining traction among consumers. The absence of a ranking in December and January suggests that this category has been a recent focus for JBuds, and their efforts are beginning to bear fruit. This could be a category to watch in the coming months, as continued improvement could further strengthen JBuds' market presence in British Columbia.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, JBuds Craft Cannabis has shown notable progress in recent months. Starting from a position outside the top 20 in December 2024 and January 2025, JBuds Craft Cannabis made a significant leap to secure the 88th rank in February 2025, maintaining a strong presence with a slight dip to the 90th rank in March 2025. This upward trend in ranking is indicative of a positive reception in the market, contrasting with competitors like Solei, which saw fluctuating ranks from 84th to 87th over the same period, and Hiway, which experienced a downward trend from 88th to 96th. Meanwhile, Divvy and Parcel also faced inconsistent rankings, with Divvy missing from the top 20 in February and Parcel dropping to 100th in March. JBuds Craft Cannabis's consistent sales growth, particularly in February and March, suggests a strengthening market position and increasing consumer preference, setting it apart from its competitors in the region.

Notable Products

In March 2025, the top-performing product from JBuds Craft Cannabis was Genetic Funk Pre-Roll 3-Pack (1.5g), which climbed to the number one spot with an impressive sales figure of 914 units, a significant increase from its fourth rank in February. Dilli-Bar Shatter (1g) maintained a strong position at rank two, showing consistent performance over the past months. Peach Supreme Pre-Roll 3-Pack (1.5g), which held the top spot in February, dropped to third place, indicating a slight decrease in its relative popularity. Quantum Kiwi Pre-Roll 3-Pack (1.5g) held steady in fourth place, showing a slight dip in sales compared to the previous month. Peach Supreme (7g), although ranking fifth, saw a notable decline in sales, reflecting a decrease in demand since it last appeared in the rankings in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.