Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

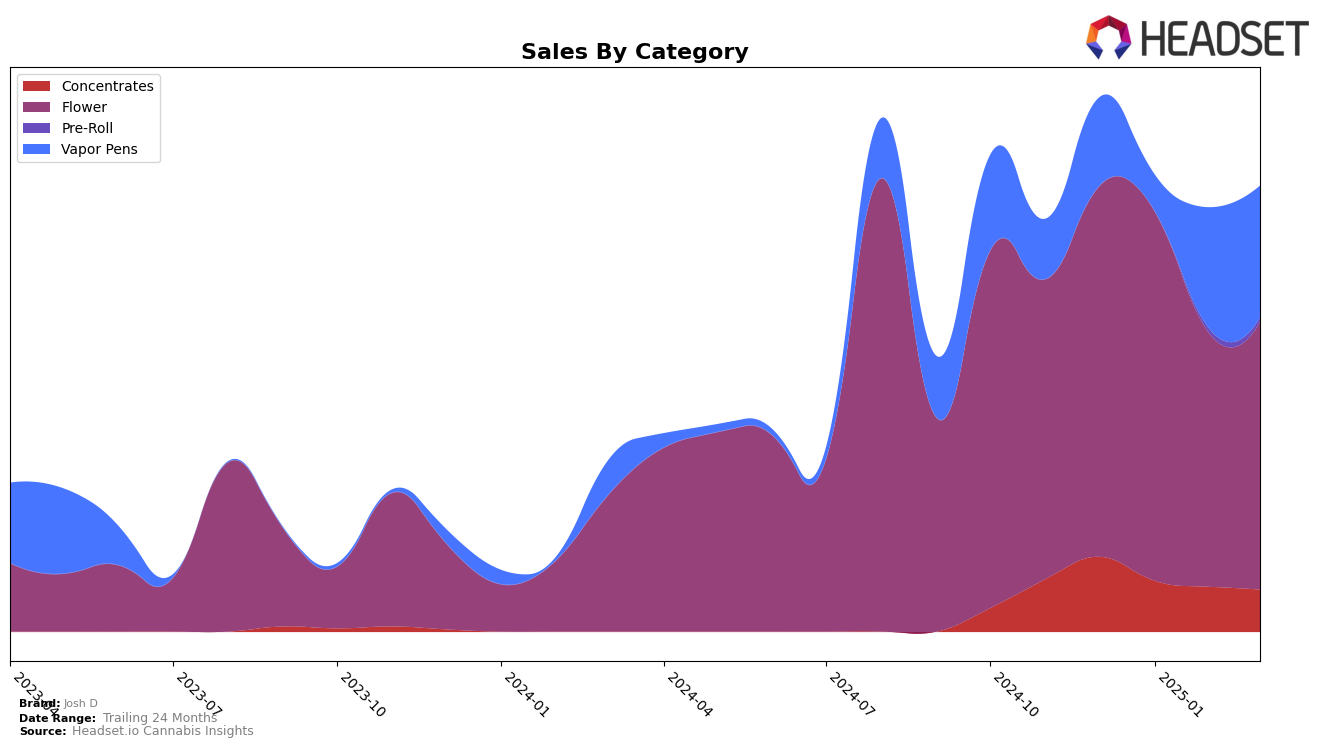

In the state of Ohio, Josh D has shown varying performance across different cannabis categories. In the Concentrates category, Josh D maintained a steady presence within the top 30, ranking 16th in both December 2024 and January 2025, before dropping to 21st and 22nd in the subsequent months. This downward trend in rankings suggests a potential challenge in maintaining market share in Concentrates. In contrast, the Flower category saw Josh D consistently outside the top 30, with rankings of 34th in December 2024 and March 2025. This indicates a struggle to gain a significant foothold in the Flower market in Ohio, as the brand has not managed to break into the top 30 in this category.

For Vapor Pens in Ohio, Josh D experienced a more dynamic performance. The brand was ranked 46th in December 2024, dropped to 62nd in January 2025, but then improved to 40th in both February and March 2025. This fluctuation highlights a potential recovery or strategic shift that allowed Josh D to regain some ground in the Vapor Pens category. The sales data for Vapor Pens also reflect this positive movement, with a notable increase from January to March 2025, suggesting that the brand may be gaining traction among consumers in this segment. However, the overall sales figures and rankings indicate that while there are areas of growth, Josh D still faces challenges in securing a dominant position across categories in the Ohio market.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Josh D has experienced notable fluctuations in its market position, which could impact its strategic decisions moving forward. From December 2024 to March 2025, Josh D's rank shifted from 34th to 37th, indicating a slight decline in its competitive standing. This downward trend is juxtaposed with the performance of competitors like Superflux, which improved its rank from 42nd in January 2025 to 35th by March 2025, suggesting a growing market presence. Meanwhile, Firelands Scientific saw its rank drop from 30th in December 2024 to 39th in March 2025, reflecting a more significant decline than Josh D. Additionally, Wellspring Fields made a notable entry into the top 50, climbing to 36th in March 2025. These dynamics suggest that while Josh D faces challenges in maintaining its rank, there are opportunities to strategize against competitors who are either declining or just entering the competitive field.

Notable Products

In March 2025, the top-performing product from Josh D was the Motorbreath Full Spectrum Cartridge (1g) in the Vapor Pens category, which ascended to the number one rank with sales of 1302 units. This product showed significant improvement, climbing from the second rank in February 2025. The Bobby Shaloha (Bulk) in the Flower category made a notable debut, securing the second position with 1195 units sold. Ojos Rojos (3.5g), also in the Flower category, ranked third, while the Motorbreath Full Spectrum Luster Pod (1g) maintained a steady fourth position. Wyld Lyfe (3.5g) rounded out the top five, indicating a strong presence of Flower category products among the top ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.