Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

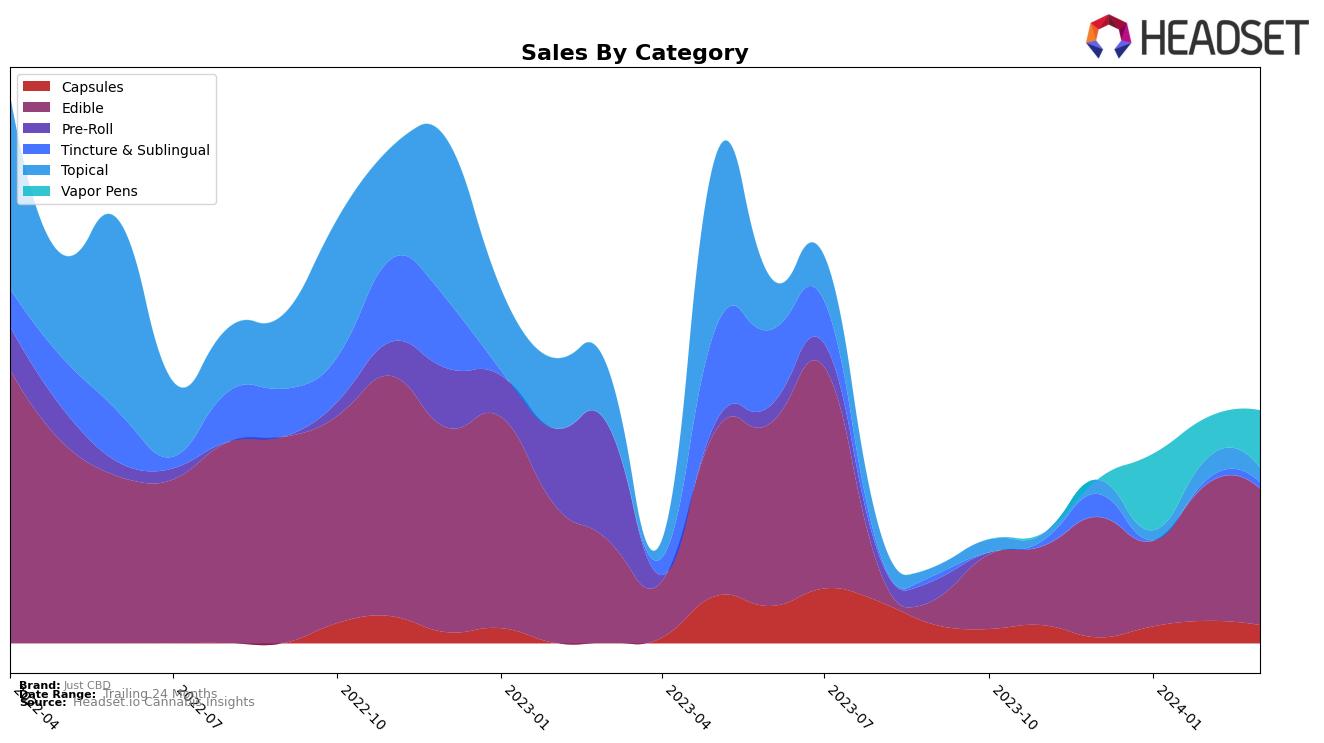

In the dynamic landscape of the cannabis market, Just CBD has shown noteworthy performance across different categories and states, with a particularly interesting trajectory in Nevada. In Nevada, Just CBD has made significant strides in the Capsules category, moving from the 7th position in December 2023 to the 5th by March 2024. This upward trend is mirrored in their sales figures, which saw a substantial increase from December's 270 units to 833 units in March. However, their performance in the Tincture & Sublingual and Topical categories tells a different story. Notably, the brand dropped out of the top 30 in the Tincture & Sublingual category in January 2024, only to reappear in the 21st position in February and improve to 17th by March, indicating a potential recovery phase. Conversely, in the Topical category, Just CBD displayed a more stable, albeit slightly fluctuating, presence within the top 20 ranks from December 2023 to March 2024.

On the other hand, Michigan presents a contrasting picture for Just CBD, particularly in the Edible category where the brand did not rank in the top 30 from December 2023 through March 2024. This absence in the rankings could signal a challenge for Just CBD in penetrating the Edible market within Michigan, or possibly indicate a strategic withdrawal or reallocation of resources to more profitable categories or states. Despite this, the reported sales figure for March in the Edible category, although not accompanied by a ranking, suggests some level of activity or residual interest in their products. Such disparities in performance across categories and states underscore the complex and ever-evolving nature of the cannabis market, where brand visibility and consumer preferences can shift rapidly, influencing a brand's strategy and focus.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Michigan, Just CBD has shown a notable presence, although its rank in March 2024 indicates challenges in maintaining a top position among its competitors. Notably, Tree House CBD and CBD Living have demonstrated stronger sales and rankings over the same period, with Tree House CBD showing an upward trend in sales from December 2023 to January 2024, despite not being ranked in the top 20 for February and March. CBD Living, on the other hand, has maintained its presence in the rankings from December 2023 through March 2024, albeit with fluctuating sales figures. Newcomers like Drops and Harbor Farmz have also entered the rankings in February and March 2024, respectively, indicating a dynamic and competitive market. Just CBD's entry into the top 20 in March 2024, alongside these competitors, suggests a challenging environment, with the need to closely monitor both established and emerging brands to maintain or improve its market position in Michigan's edible cannabis category.

Notable Products

In March 2024, Just CBD's top-performing product was the CBD Peach Ringz Gummies (500mg CBD) within the Edible category, maintaining its number one rank since December 2023 with sales reaching 190 units. The second-ranked product was the CBD Sweet Cherry Bath Bombs (150mg CBD) from the Topical category, which also held its position steadily from December 2023, showcasing a significant sales figure increase over the months. A notable mover in the rankings was the Northern Lights Live Resin Full Spectrum CBD Cartridge (2g) from the Vapor Pens category, which jumped from the fourth position in February to the third in March, indicating a growing interest in vapor products. The CBD Full Spectrum Soft Gel 30-Pack (750mg CBD) in the Capsules category slightly fell to the fourth rank in March after being in the third position in February, reflecting competitive shifts within the product lineup. These shifts indicate a dynamic market, with consumer preferences slightly leaning towards vapor pens in recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.