Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

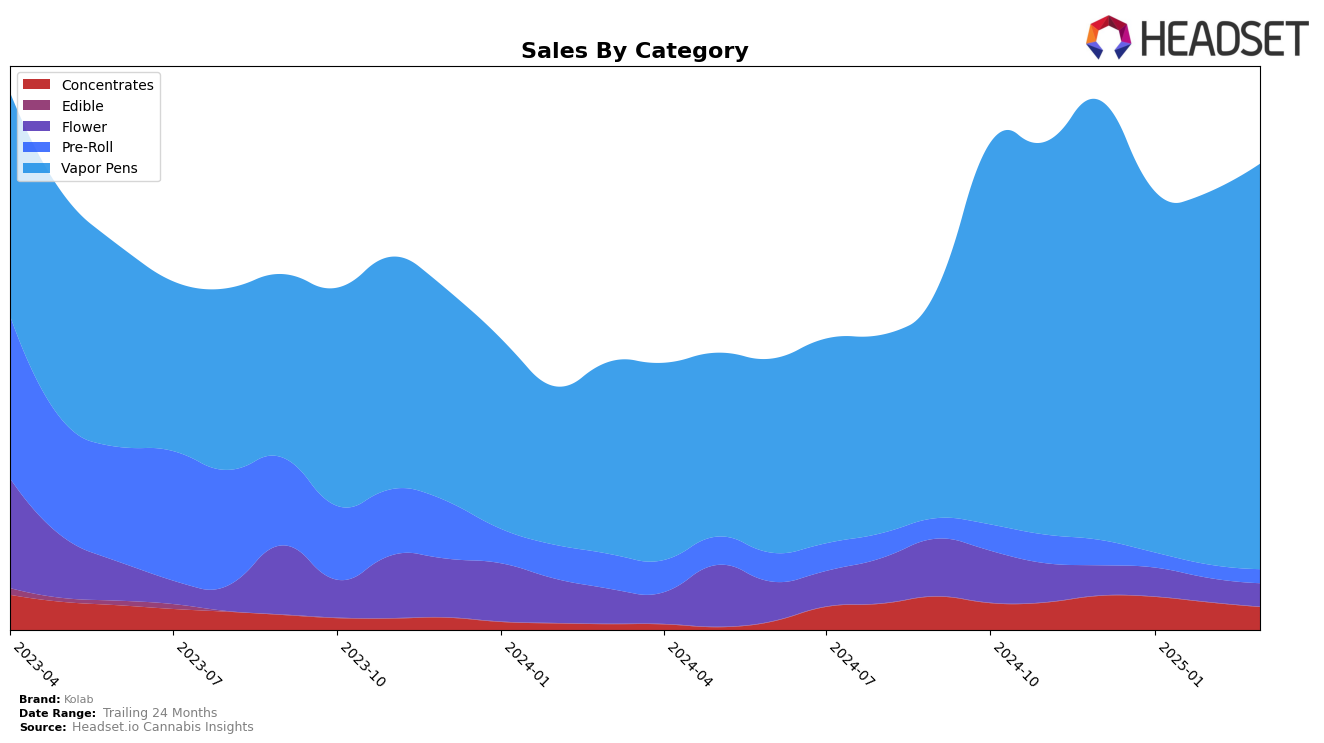

Kolab's performance in the vapor pens category has shown notable trends across different provinces. In Alberta, Kolab maintained a strong presence, consistently ranking between 7th and 8th position over the months from December 2024 to March 2025. This stability is reflected in their sales figures, which, despite some fluctuations, remained robust. In British Columbia, Kolab exhibited a positive trajectory, improving its ranking from 16th to 12th place by March 2025. This upward movement suggests a growing consumer preference for Kolab's vapor pens in the region.

Conversely, Kolab's performance in the concentrates category presents a mixed picture. In Ontario, the brand struggled to maintain a top 30 position by March 2025, slipping from 27th in December 2024 to 31st. This decline indicates challenges in capturing market share in Ontario's concentrates segment. In Alberta, however, Kolab showed improvement, rising from 23rd to 20th place by January 2025, although it did not maintain this momentum in the subsequent months. This suggests that while Kolab is making strides in certain areas, there are still opportunities for growth and improvement in others.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Kolab has shown resilience with a consistent rank of 7th or 8th from December 2024 to March 2025. Despite facing strong competition, Kolab managed to maintain its position, with a slight improvement in March 2025, moving back to 7th place. Competitors like Back Forty / Back 40 Cannabis consistently held a higher rank at 4th place until March 2025, when they dropped to 6th, indicating a potential opportunity for Kolab to climb higher. Meanwhile, XPLOR demonstrated significant growth, moving from 9th in December 2024 to 5th by February 2025, suggesting a rising threat. DEBUNK also fluctuated, peaking at 6th in January and February 2025 before dropping to 8th in March, which could provide Kolab with a chance to solidify its standing. Overall, Kolab's stable performance amidst fluctuating competitors highlights its potential to leverage market dynamics for improved sales and ranking.

Notable Products

In March 2025, the top-performing product from Kolab was the White Grape Liquid Diamonds Disposable (1g) in the Vapor Pens category, maintaining its first-place ranking since December 2024, with sales figures reaching 9,567 units. The Golden Papaya Liquid Diamonds Disposable (1g) also held steady in second place, consistently performing well over the months. A notable climber was the Yuzu Honey Diamonds Distillate Cartridge (1g), which rose from fifth place in February to third place in March, showing a significant increase in sales. The Pure Liquid Diamonds Disposable (1g) experienced a slight drop, moving from third to fourth place. Lastly, the Guava OG Diamonds FSE Cartridge (1g) entered the rankings in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.