Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

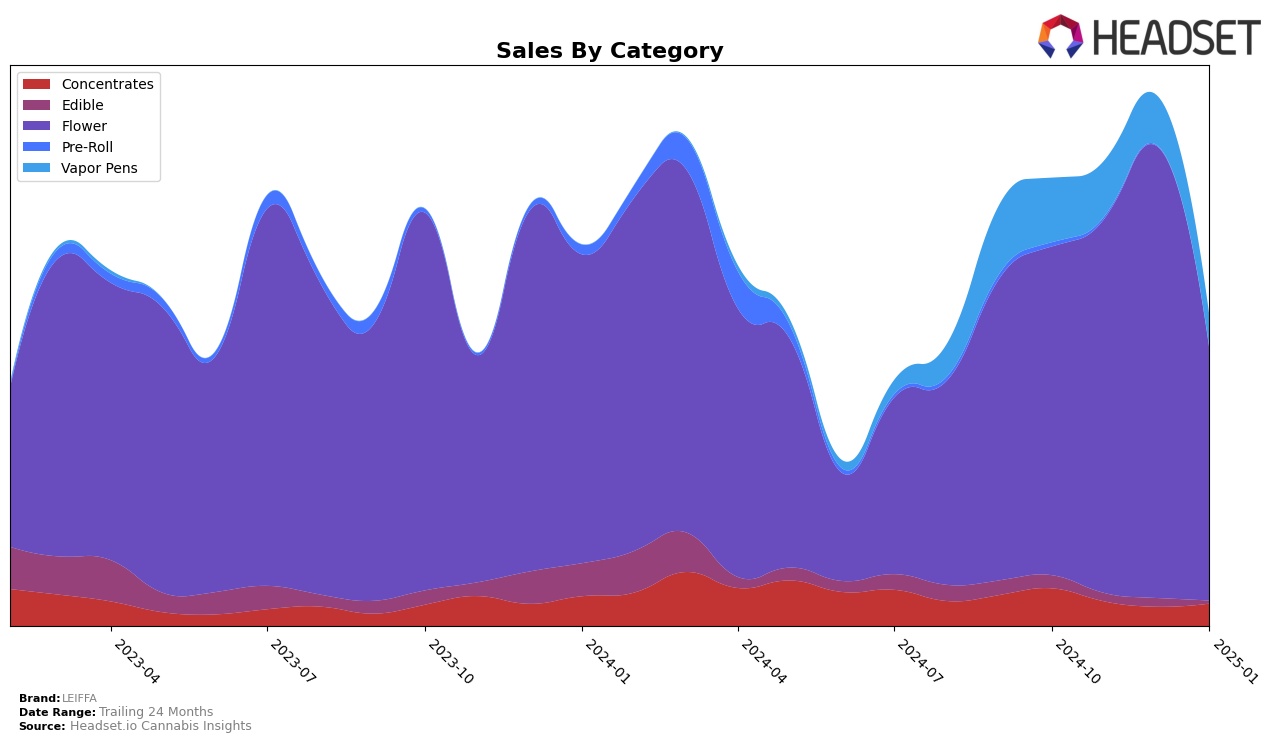

In the state of Colorado, LEIFFA has shown varied performance across different cannabis categories. The brand has experienced notable fluctuations in the Concentrates category, with rankings slipping from 46th in October 2024 to 53rd in December, before rebounding to 43rd in January 2025. This suggests some volatility but also a potential for recovery in this segment. In contrast, the Flower category has been a strong performer for LEIFFA, maintaining a consistent presence in the top 30, peaking at 14th in December 2024, highlighting a competitive edge in this category. However, it's worth noting that LEIFFA's presence in the Edible category was fleeting, as they were only ranked in October 2024 and did not make it into the top 30 in subsequent months, which may indicate a need for strategic adjustments in this segment.

The Vapor Pens category reflects a steady yet unremarkable performance for LEIFFA in Colorado, with a consistent ranking of 65th from November 2024 to January 2025. This stability, albeit outside the top 30, could imply a niche but stable market presence. The sales trend in the Flower category shows a significant peak in December 2024, followed by a drop in January 2025, which might suggest seasonal influences or promotional impacts that warrant further investigation. While LEIFFA did not achieve top 30 rankings in several months across multiple categories, the brand's ability to remain competitive in the Flower segment offers a promising avenue for growth and potential market leadership in the future.

Competitive Landscape

In the competitive landscape of the Colorado flower category, LEIFFA has shown a dynamic shift in rankings from October 2024 to January 2025. Initially ranked 22nd in October and November 2024, LEIFFA climbed to 14th place in December 2024, showcasing a significant improvement in market position. However, the brand experienced a slight decline to 24th in January 2025. This fluctuation in rank is noteworthy when compared to competitors like Silver Lake, which maintained a more stable presence, peaking at 13th in December 2024 and slightly dropping to 22nd in January 2025. Meanwhile, Bonsai Cultivation saw a more pronounced drop, falling out of the top 20 by December 2024. LEIFFA's sales trajectory mirrored its ranking changes, with a peak in December 2024, indicating a strong performance during that period. The brand's ability to climb the ranks amidst fluctuating competition highlights its potential for growth and resilience in the Colorado market.

Notable Products

In January 2025, Miracle Grow (Bulk) from LEIFFA emerged as the top-performing product, climbing from fourth place in December 2024 to first place, with impressive sales of 11,572 units. Gummies (Bulk) secured the second position, having dropped from the third spot in December. Hawaiian Plushers (Bulk) experienced a decline, moving from first in December to third in January. Chem Brulee (Bulk), which held the top spot in November, has now fallen to fourth place. Punch Breath (Bulk) entered the rankings for the first time in January, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.