Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

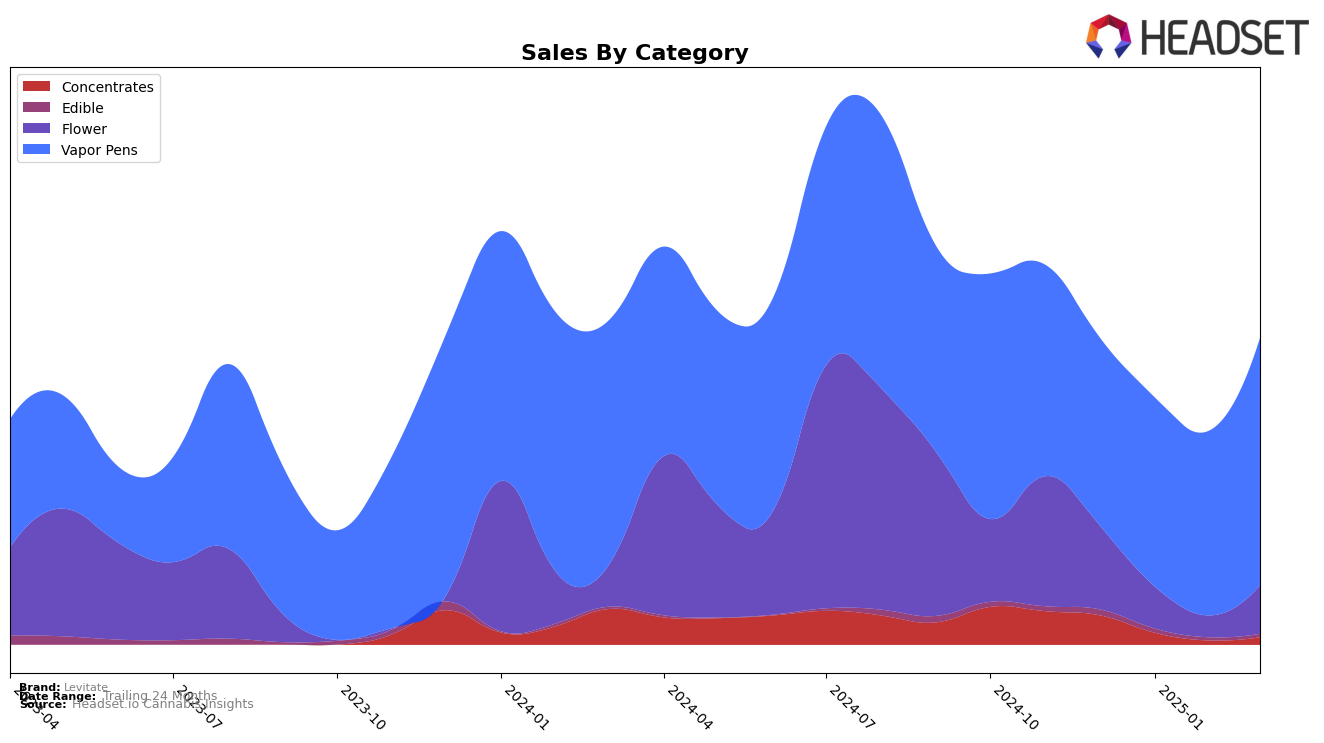

Levitate's performance across various cannabis categories in Michigan shows a mixed bag of results. In the Concentrates category, the brand saw a decline in rankings, starting from 44th place in December 2024 and dropping to 93rd by March 2025. This significant drop indicates a challenging market environment or increased competition in the Concentrates space. Similarly, in the Edible and Flower categories, Levitate did not make it into the top 30 rankings, suggesting that these categories might not be their strongest suit in Michigan. This could be seen as an area for potential improvement or reevaluation of strategy in these segments.

Conversely, Levitate has maintained a strong presence in the Vapor Pens category within Michigan. The brand consistently held the 18th spot from December 2024 through February 2025, before climbing to 13th place in March 2025. This upward movement in the rankings, coupled with the increase in sales from February to March, highlights Levitate's competitive edge and potential growth in the Vapor Pens category. It suggests a successful strategy or product offering that resonates well with consumers in this segment. This performance could serve as a blueprint for enhancing brand presence in other categories where Levitate currently lags.

Competitive Landscape

In the competitive landscape of Vapor Pens in Michigan, Levitate has shown a promising upward trajectory in rank and sales over the first quarter of 2025. Starting from a consistent 18th position in December 2024 through February 2025, Levitate made a notable leap to 13th place by March 2025. This improvement is indicative of a positive sales trend, as evidenced by the increase in sales from $637,172 in February to $850,750 in March. In contrast, Rove experienced a decline, dropping from 8th place in December 2024 to 12th in March 2025, with sales decreasing steadily over the same period. Meanwhile, Dragonfly Cannabis showed a strong performance, climbing from 19th in December to 11th in March, closely matching Levitate's rank by the end of the period. Ozone and Sauce Essentials maintained relatively stable positions, with minor fluctuations in rank. Levitate's significant rise in rank and sales suggests a growing consumer preference and effective market strategies, positioning it as a strong contender in the Michigan Vapor Pens market.

Notable Products

In March 2025, the top-performing product from Levitate was the Blue Dream Distillate Cartridge (1g) in the Vapor Pens category, which jumped from the fifth position in February to first place with sales reaching $11,465. The Raspberry Lemonade Distillate Cartridge (1g) maintained its second-place ranking from February, showing consistent performance with sales of $11,033. Purple Punch Distillate Cartridge (1g) moved up one spot to third place, indicating a steady increase in popularity. Maui Wowie Distillate Cartridge (1g), previously the top performer, fell to fourth place, showing a notable decline in sales from earlier months. Lastly, Grape Soda Distillate Cartridge (1g) entered the rankings in fifth place, marking its debut in the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.