Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

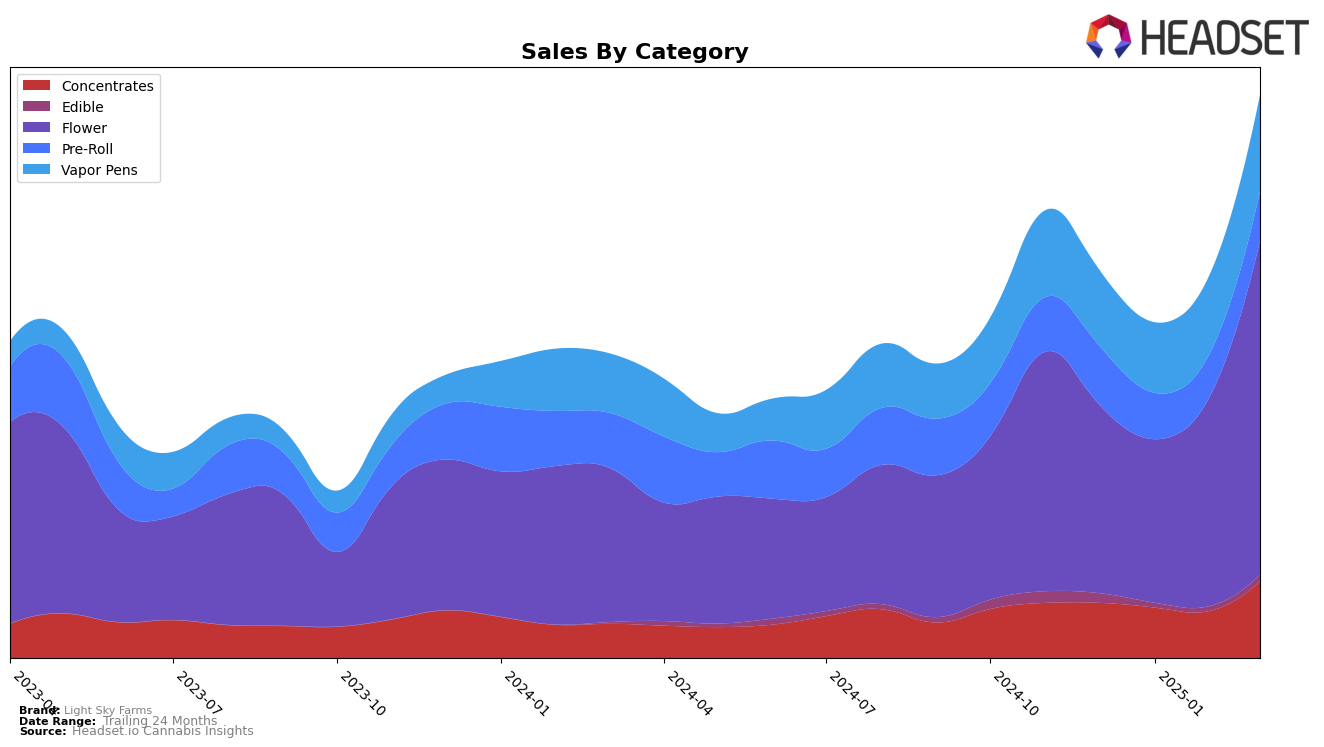

Light Sky Farms has shown a dynamic performance across various product categories in Michigan. In the Concentrates category, the brand made a significant leap from a rank of 34 in February 2025 to 22 in March 2025, indicating a robust upward trend. Despite a temporary dip in sales from December 2024 to February 2025, March saw a strong recovery with sales reaching over $200,000. The Flower category also experienced positive momentum, with Light Sky Farms climbing from the 68th position in January to 32nd by March. This advancement suggests a growing consumer preference for their flower products, aligning with the substantial increase in sales observed during this period.

On the other hand, Light Sky Farms' presence in the Edible category was less prominent, as they did not rank in the top 30 in the months following December 2024, where they held the 82nd position. This absence from the top ranks could indicate a need for strategic adjustments to capture more of the edible market. In the Vapor Pens category, the brand displayed steady improvement, moving from 47th place in December 2024 to 39th by March 2025, supported by a consistent rise in sales. Meanwhile, the Pre-Roll category saw relatively stable rankings, maintaining a position in the 60s range, which suggests a consistent but unremarkable performance in this segment. Overall, Light Sky Farms exhibits strong potential in certain categories while facing challenges in others, highlighting areas for potential growth and strategic focus.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Light Sky Farms has demonstrated a notable upward trajectory in recent months. Starting from a rank of 60 in December 2024, Light Sky Farms improved its position significantly to rank 32 by March 2025. This upward movement is indicative of a strong performance, particularly when compared to competitors like Peninsula Cannabis and Garcia Hand Picked, both of which have struggled to maintain consistent rankings within the top 40. Meanwhile, Grown Rogue and Carbon have experienced fluctuations, with Carbon showing a slight decline from a rank of 24 in January to 30 in March. Light Sky Farms' rise in rank is accompanied by a significant increase in sales, suggesting a growing consumer preference and market presence. This trend positions Light Sky Farms as a formidable competitor in the Michigan flower market, highlighting its potential to capture further market share from its rivals.

Notable Products

In March 2025, Light Sky Farms saw its top-performing product as Death Star x Jedi Breath #8 (1g) in the Flower category, which achieved the number one rank with notable sales of 5,152 units. Following closely, MAC (1g) also in the Flower category secured the second rank. Death Star x Jedi Breath #8 Small (1g) came in third, marking its first appearance in the top rankings. Titty Sprinkles Pre-Roll (1g) dropped to fourth position from second in January, despite consistent sales. The Paradise Pop Live Resin Ceramic Cartridge (0.5g) maintained a steady presence, ranking fifth, showing slight improvement from its previous fourth position in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.