Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

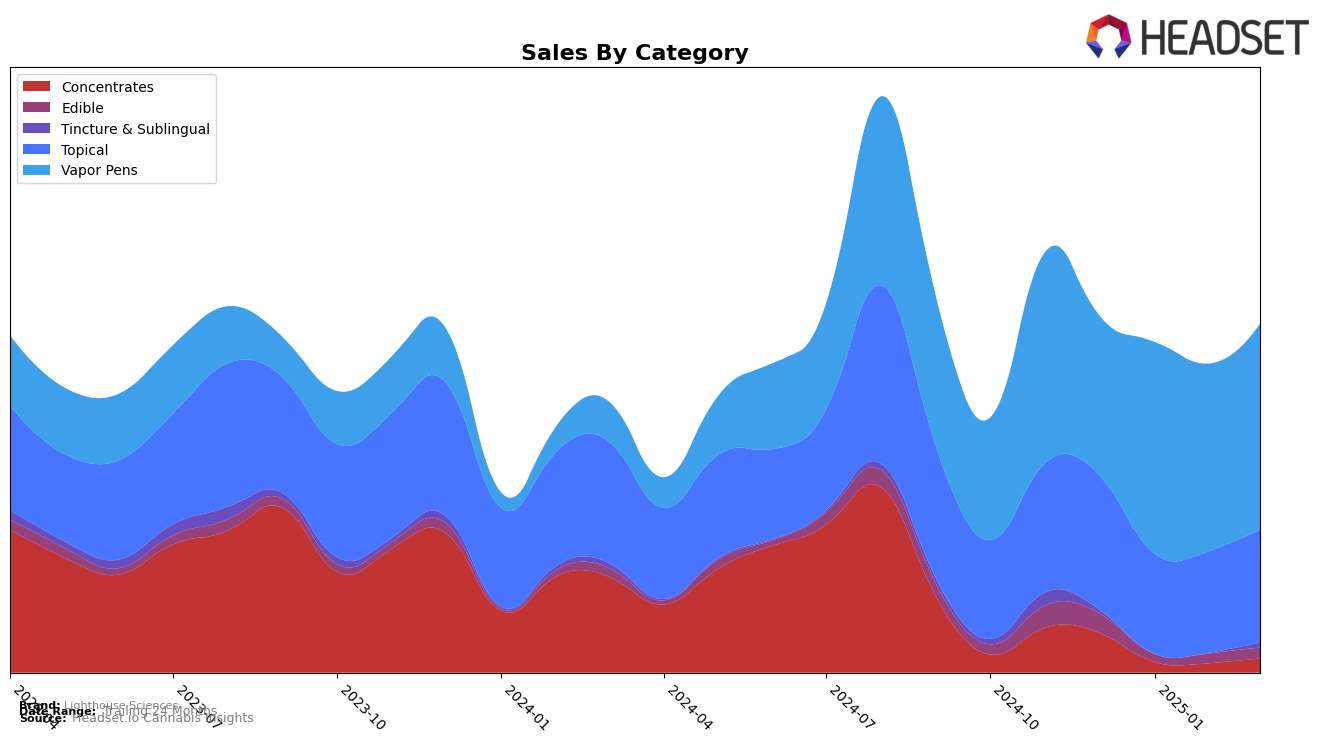

Lighthouse Sciences has shown a varied performance across different product categories in Ohio. In the Concentrates category, the brand saw a decline, dropping from the 17th position in December 2024 to not being ranked in the top 30 in January and February 2025, before reappearing at the 26th position in March 2025. This fluctuation indicates a potential volatility in this category, which may be attributed to either market competition or shifts in consumer preferences. Meanwhile, in the Edible category, Lighthouse Sciences did not make it into the top 30 rankings at all, which could be seen as a negative indicator of their market presence in this segment.

In contrast, Lighthouse Sciences maintained a stronghold in the Topical category, consistently holding the number one spot from December 2024 through March 2025. This dominance suggests a robust product offering or strong brand loyalty among consumers in this category. The Vapor Pens category also saw relatively stable performance, with the brand improving slightly from the 30th position in December 2024 to the 28th in January 2025, and then maintaining a steady presence at 29th in February and March 2025. This stability, coupled with an observed increase in sales from January to March, points to a steady demand for their vapor products in the Ohio market.

Competitive Landscape

In the competitive landscape of the vapor pens category in Ohio, Lighthouse Sciences has shown a steady performance from December 2024 to March 2025, maintaining a consistent rank around the 28th to 30th positions. Notably, Lighthouse Sciences improved its rank from 30th in December 2024 to 28th in January 2025, reflecting a positive response to their market strategies during this period. In contrast, Verano and Standard Farms have consistently ranked outside the top 25, indicating a less competitive stance in comparison. Meanwhile, Galenas made a significant jump from 44th in February to 28th in March, suggesting a potential threat to Lighthouse Sciences if this upward trend continues. Despite these shifts, Lighthouse Sciences' sales figures have shown resilience, particularly from January to March 2025, where they experienced a noticeable increase, suggesting effective customer retention and brand loyalty in a competitive market.

Notable Products

In March 2025, Lighthouse Sciences' top-performing product was the CBD/THC 6:1 MJ Muscles & Joint Balm (3000mg CBD, 500mg THC, 2oz) in the Topical category, maintaining its first-place rank for four consecutive months with March sales of 1248 units. The Peanut Butter Cookies Breath x Alien Cookies Live Resin Diamond Cartridge (1g) emerged as the second-ranked product in the Vapor Pens category. Pineapple Upside Down Cake x Pink Lemonade Live Resin Diamonds Disposable (1g) secured the third position, followed closely by Pineapple Upside Down Cake x Blue Dream Live Resin Diamond Disposable (1g) in fourth. The CBD/THC 6:1 MJ Muscles & Joint Balm (1500mg CBD, 250mg THC, 1oz) experienced a slight drop, moving from second in February to fifth in March. These shifts highlight a strong performance in the Vapor Pens category, while the leading balm maintained its dominance despite some fluctuations in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.