Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

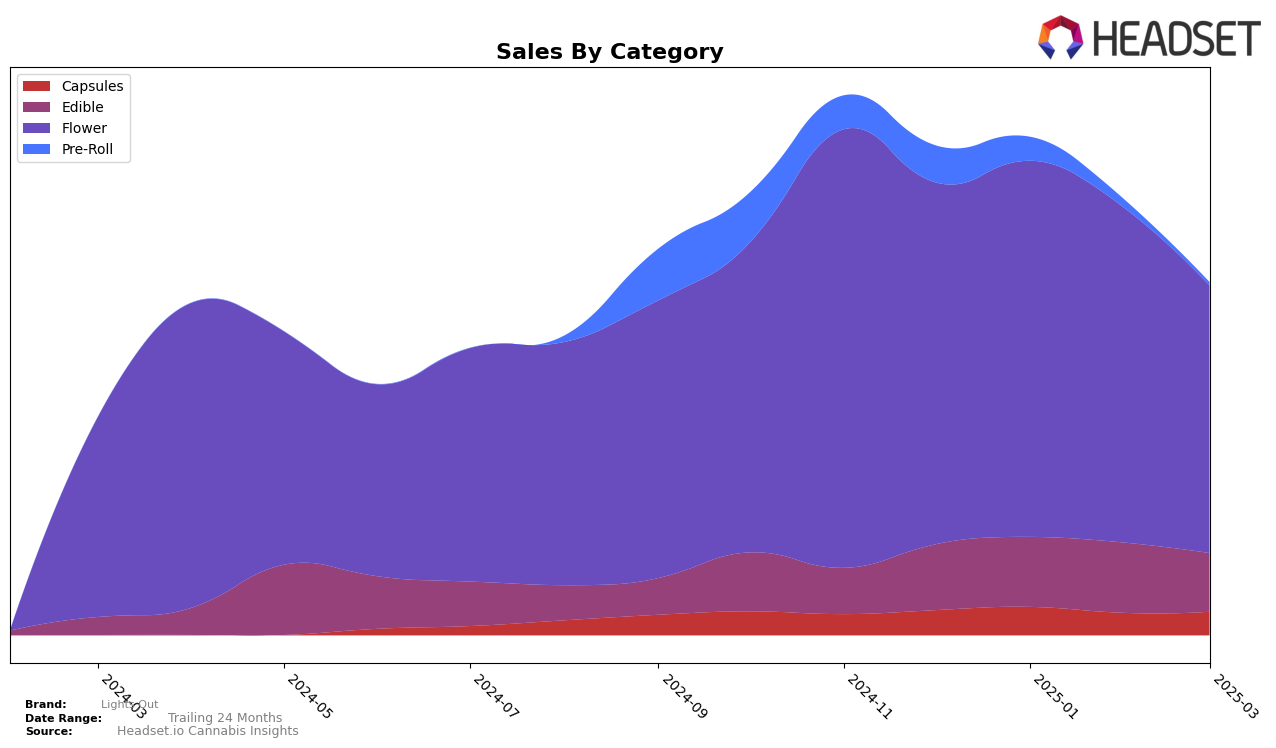

In the state of California, Lights Out has shown varying performance across different product categories. In the Capsules category, Lights Out maintained a steady position, ranking 13th in both December 2024 and January 2025, before slightly improving to 12th in February and March 2025. This stability suggests a consistent demand for their capsules. However, in the Edible category, Lights Out did not break into the top 30, with rankings hovering around the mid-30s, indicating a need for strategic adjustments to improve their market presence. The Flower category saw a downward trend, with the brand dropping from 49th in December 2024 to 66th by March 2025, reflecting a potential shift in consumer preferences or increased competition.

While Lights Out's performance in the Capsules category in California remains commendable, the brand faces challenges in the Edible and Flower categories. Not being in the top 30 for Edibles suggests that competitors are capturing more consumer attention in this segment. The declining rankings in the Flower category could be a result of various factors, including market saturation or evolving consumer tastes. Despite this, the brand's sales figures provide a glimpse of resilience, with Capsules showing a slight sales increase from December to January, though sales dipped in February before a modest rise in March. This fluctuation underscores the complexities of maintaining a strong market position amid changing dynamics.

Competitive Landscape

In the competitive landscape of the California flower category, Lights Out has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked at 49th in December, Lights Out saw a slight decline to 50th in January, followed by a more pronounced drop to 57th in February, and further to 66th in March. This downward trend in rank suggests increasing competitive pressure from brands like Lolo, which maintained a stronger position, consistently ranking between 40th and 52nd during the same period. Despite Lights Out's initial sales growth from December to January, the subsequent decline in sales aligns with its drop in rank, indicating potential challenges in maintaining market share. Meanwhile, competitors such as Autumn Brands and Pure Beauty have shown more stable performance, with Autumn Brands improving its rank from 69th in January to 60th in March, which could be a factor in Lights Out's decreasing visibility and sales in the market.

Notable Products

In March 2025, the top-performing product for Lights Out was Saturn OG (3.5g) in the Flower category, maintaining its consistent rank of 1st place from December 2024 through March 2025, despite a decrease in sales to 3,085 units. The THC/CBN/CBD 1:1:1 Wildberry Deep Sleep Gummies 10-Pack in the Edible category climbed to 2nd place, showing resilience with sales figures closely matching February 2025. Indica Watermelon Live Rosin Gummies 10-Pack remained in 3rd place for March 2025, following similar rankings in January and February. Pink Acai (3.5g), another Flower product, fell to 4th place in March, down from its 2nd place standing in January and February. Lastly, Sativa Strawberry Live Rosin Gummies 10-Pack held steady at 5th place, showing a consistent decline in sales since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.